I continue to hold the belief that on-chain activity is principally governed by the tokens themselves. Tokens own the end user – and downstream of this – the only moat for blockchains today is token issuance

In a world where the most-used apps across every chain are indistinguishable (spot DEXs, perps DEXs, money markets) users don't have a relationship with apps – they have a relationship with tokens

I don't use Ethereum because I like Uniswap or Aave. I use Ethereum simply because I want to trade tokens that are tradable on Ethereum. And as soon as there are tokens that I want to trade on Solana or BSC, I'll use Solana or BSC. It's that simple

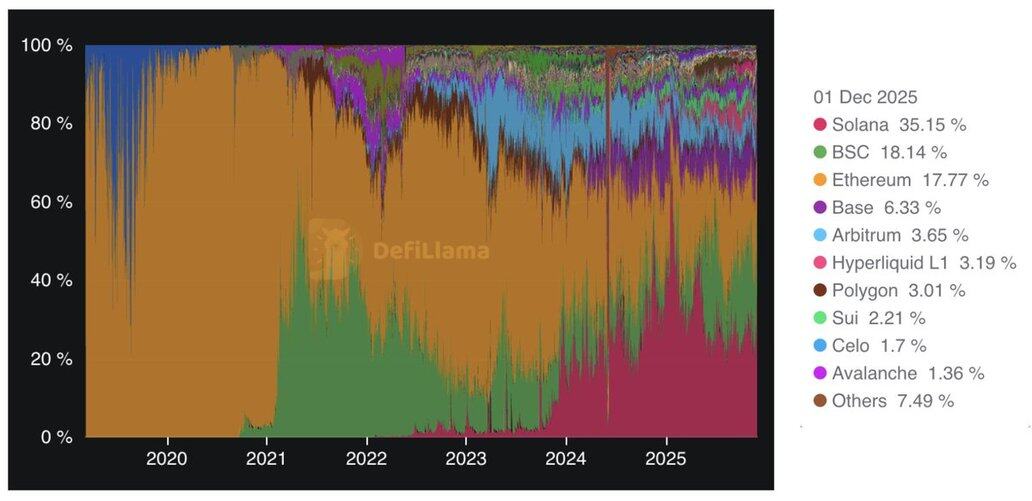

This is the only framework that perfectly explains the entire arc of blockchain market share:

- How did BSC gain 60% market share in 2021? It fostered an ecosystem of tokens people wanted to farm and trade

- How did Solana get up to 70% market share this cycle? It established itself as the canonical chain where memecoins are issued

- How does Ethereum mainnet still do ~20% of all spot volume despite being slow and expensive? It was the original chain where tokens were issued and intuitively this has some inertia

Interestingly, the fact that CEX volumes consistently trump DEX volumes is yet another supporting data point. CEXs provide an abstracted UX for simply trading tokens irrespective of chain

This is not to reduce blockchains to merely infrastructure for trading and speculation (although this is neither good nor bad in my view). I remain confident that non-speculative use cases will eventually prevail (stablecoin payment volumes are already eating into speculative volumes)

However, ignoring what ultimately drives user behavior today – and downstream of this – what is the true source of defensibility for blockchains results in a flawed mental model

Blockchains are asset ledgers. Intuitively, the moat is being the asset ledger where everyone wants to issue their assets

whats the most objective measure of "moat"?

imo it's fees/revenue. everything else is a vanity metric.

if ur business has durable moats and operates in a growing space, it should earn more revenue over time.

conversely, if it doesn't have moats, either it loses market share to competitors, or it maintains market share by engaging in price wars. both situations lead to flat or lower fees over time.

(note that just because a business has no moat doesn't mean it's not valuable. it just means that it passes value to customers rather than keeping it for itself. in fact, this is true for the vast majority of businesses in the world.)

1,13K

4

De inhoud op deze pagina wordt geleverd door derden. Tenzij anders vermeld, is OKX niet de auteur van het (de) geciteerde artikel(en) en claimt geen auteursrecht op de materialen. De inhoud is alleen bedoeld voor informatieve doeleinden en vertegenwoordigt niet de standpunten van OKX. Het is niet bedoeld als een goedkeuring van welke aard dan ook en mag niet worden beschouwd als beleggingsadvies of een uitnodiging tot het kopen of verkopen van digitale bezittingen. Voor zover generatieve AI wordt gebruikt om samenvattingen of andere informatie te verstrekken, kan deze door AI gegenereerde inhoud onnauwkeurig of inconsistent zijn. Lees het gelinkte artikel voor meer details en informatie. OKX is niet verantwoordelijk voor inhoud gehost op sites van een derde partij. Het bezitten van digitale activa, waaronder stablecoins en NFT's, brengt een hoge mate van risico met zich mee en de waarde van deze activa kan sterk fluctueren. Overweeg zorgvuldig of de handel in of het bezit van digitale activa geschikt voor je is in het licht van je financiële situatie.