1/ ICYMI Friday, we published a new issue of Yields of the Week in The Edge Newsletter...

Here are the top highlights for yield farmers across:

+ Stablecoins

+ BTC yields

+ ETH yields

+ @pendle_fi yields

+ Looping yields

2/ According to @vaultsfyi, the top real yields (unboosted, no leverage) for stablecoins were...

3/ We uncovered up a bonus yield for a gold-pegged stablecoin @Paxos $PAXG and @tethergold $XAUt, but this one does require looping up to 3.33x (70% LTV).

Depending on your size, this @0xfluid strat is killer.

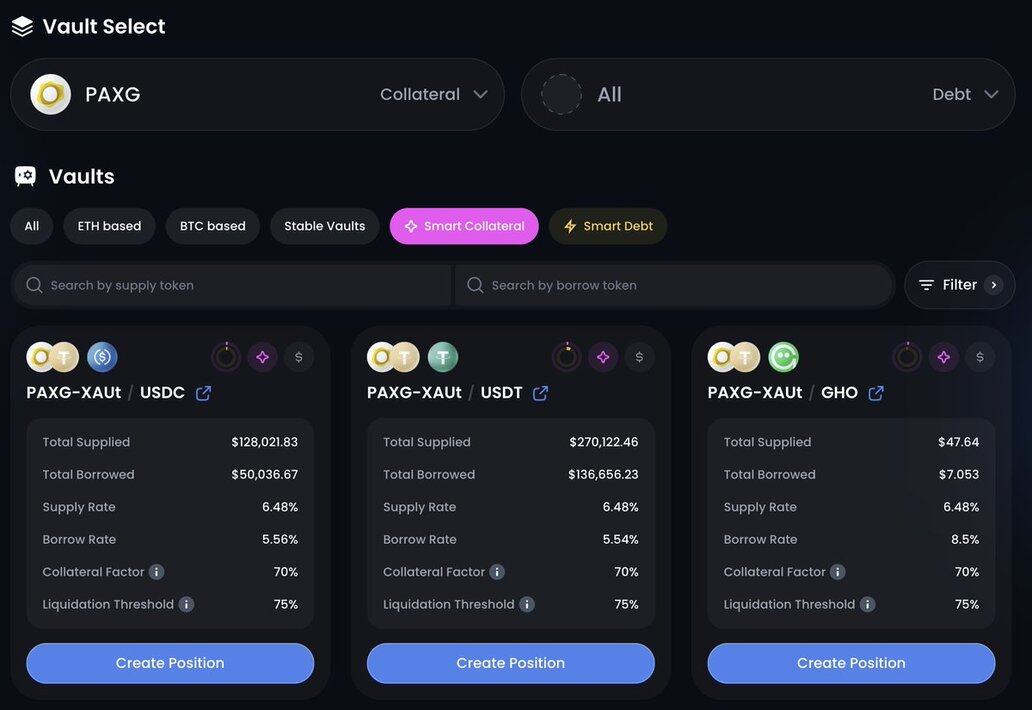

If you want onchain exposure to gold-backed stablecoins like @Paxos $PAXG or $XAUt (by @tethergold) with up to 4x leverage, there are Smart Collateral vaults on @0xfluid.

+ Vault owners hold an LP as collateral (PAXG-XAUt)

+ They can borrow up to 70% LTV (75% LLTV)

+ Loans are denominated in USDC, USDT, or GHO

+ And they can get leverage by using the Leverage recipe on Fluid (borrow, buy more collateral, deposit, borrow etc)

Plus, these vaults earn trading fees in PAXG+XAUt when trades are routed through Fluid DEX for PAXG<>XAUt.

4/ For top ETH yields (unboosted, no leverage) we have a number easy yields to earn, each with a minimum of $10M TVL.

5/ A bonus ETH-denominated yield we uncovered on @_WOOFi is for @Mantle_Official lenders who supply cmETH at 10.19% APR (boosted with WMNT) and mETH at 6.15% APR (boosted with WMNT).

👉

6/ For top BTC yields (unboosted, no leverage), @Dolomite_io WBTC lending on the @arbitrum is the standout yield, which is closer to 4.1 APY% if you account for the oDOLO rewards.

🌔 BONUS: I would highlight @MoonwellDeFi cbBTC vault maintained a min of 1-2% APY with $WELL rewards.

7/ Another bonus yield related to BTC but denominated in stablecoins is the Stability Pool for UBTC-backed @felixprotocol CDPs on @HyperliquidX. This also applies for the Stability Pool backing HYPE-backed CDPs on Felix.

So one can deposit feUSD into the Stability Pool which earns greater returns from i) borrower interest, ii) protocol fees, iii) liquidation incentives, and iv) future Felix incentives.

8/ IMO, @Nomaticcap is one of the few pros out there trading YTs on @pendle_fi and he's excited about new pools launched for sBOLD and ysyBOLD.

Read more in the newsletter on why these YTs look interesting to him...

9/ We also offer up a few competitive yields for those keen to earn fixed yields with PTs related to BTC or ETH.

10/ Lastly, we uncovered a staggering looping yield (61%) using @pendle_fi @infinifilabs PT-iUSD as collateral while borrowing against it on @MorphoLabs for a lesser borrowing rate.

Since Friday, the spread between the fixed PT yield and the borrowing rate has shrunk as the borrowing rate jumped from 5.8% to 10.17%. (see chart)

This looped yield is a great example of finding a higher PT yield to lock in as collateral vs a lesser borrowing rate to loop with on Morpho.

We need the borrowing rate on Morpho to come down or the PT yield to go up before I would enter this this week but here's the original tweet and a good reminder our Edge Newsletter subscribers saw this idea sooner in their inbox!

11/ One last yield I nearly skipped... 👀

Aside from @maplefinance's flagship SyrupUSDC earning 6.5% APY native APY and 14.88% max looped 5x on @KaminoFinance... 📈

Maple now offers a BTC yield (5.3%) for lenders 🟠

If you're on Maple or interested 👇

@maplefinance @KaminoFinance Reminder: All these insights are FREE if you subscribe with an email to The Edge Newsletter at:

👉👈

@maplefinance @KaminoFinance 👋 Please give us a follow below and share this thread and links to YOTW with your friends!

@edge_pod

@Nomaticcap

@DeFi_Dad

20.73 k

0

El contenido al que estás accediendo se ofrece por terceros. A menos que se indique lo contrario, OKX no es autor de la información y no reclama ningún derecho de autor sobre los materiales. El contenido solo se proporciona con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo enlazado para más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. Los holdings de activos digitales, incluidos stablecoins y NFT, suponen un alto nivel de riesgo y pueden fluctuar mucho. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti según tu situación financiera.