Tokenized Real-World Assets Up 65% As Smart Money Pours In

The tokenization of real-world assets (RWAs) is quietly becoming one of the biggest stories in crypto.

According to a new DeFiLlama’s X post on July 3, the RWA total value locked (TVL) across major protocols reached $12.83 billion. This is up from $7.75 billion at the start of the year. And a 65% rise in just six months.

The top protocols in tokenized real-world assets now include BlackRock BUIDL, Ethena USDt, and Ondo Finance, based on total value locked (TVL).

BlackRock’s BUIDL leads with $2.83 billion spread across six chains. Ethena’s synthetic cash protocol follows at $1.46 billion, while Ondo trails closely with $1.39 billion, bolstered by its tokenized U.S. Treasury product OUSG, and newer short-duration bond offerings.

Franklin Templeton also ranks in the top six with $753.8 million, making it one of the largest traditional finance players to tokenize a money market fund on-chain.

Its Benji platform allows qualified buyers to hold shares of its FOBXX (Franklin OnChain U.S. Government Money Fund) natively as blockchain tokens.

Other notable names include Paxos Gold and Tether Gold, which continue to dominate tokenized gold. OpenEden, Centrifuge, and Maple Finance round out the leaderboard, targeting private credit and DeFi-native fixed income.

Despite lower TVL, protocols like Superstate, Goldfinch, and Anemoy Capital are seeing gradual institutional adoption, particularly from climate and emerging market-focused allocators.

What Are Institutions Really Buying?

The bulk of RWA inflows remains in tokenized Treasury products. According to DeFiLlama data, Ondo Finance accounts for over 35% of total RWA TVL, largely driven by its OUSG tokenized bond product.

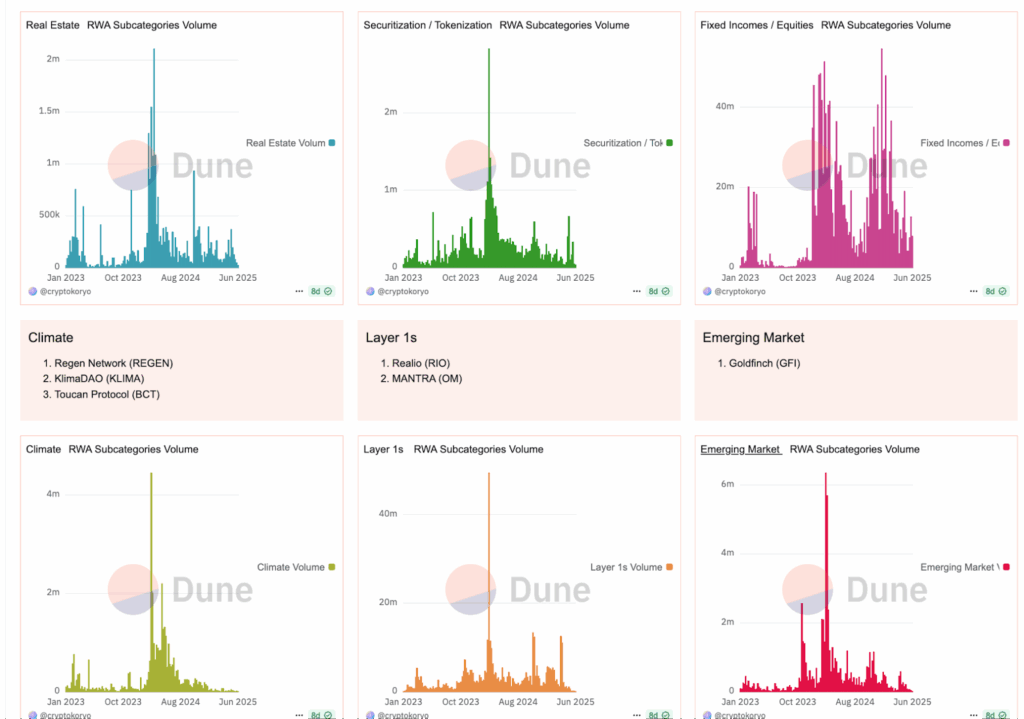

But real estate tokenization is quietly gaining ground too, with several platforms using fractional ownership models to tokenize property stakes, often focused on emerging markets.

There’s also rising activity around climate-linked assets, including carbon credits, which are being onboarded via protocols such as Toucan and Flowcarbon.

This trend puts a price tag on the regulatory-compliant yield products on-chain. That’s the bet institutional traders seem to be making.

Plus, if crypto hiring trends are any indicator, legal jobs have steadily risen, giving more credibility to these products.

Who’s Behind This Growth?

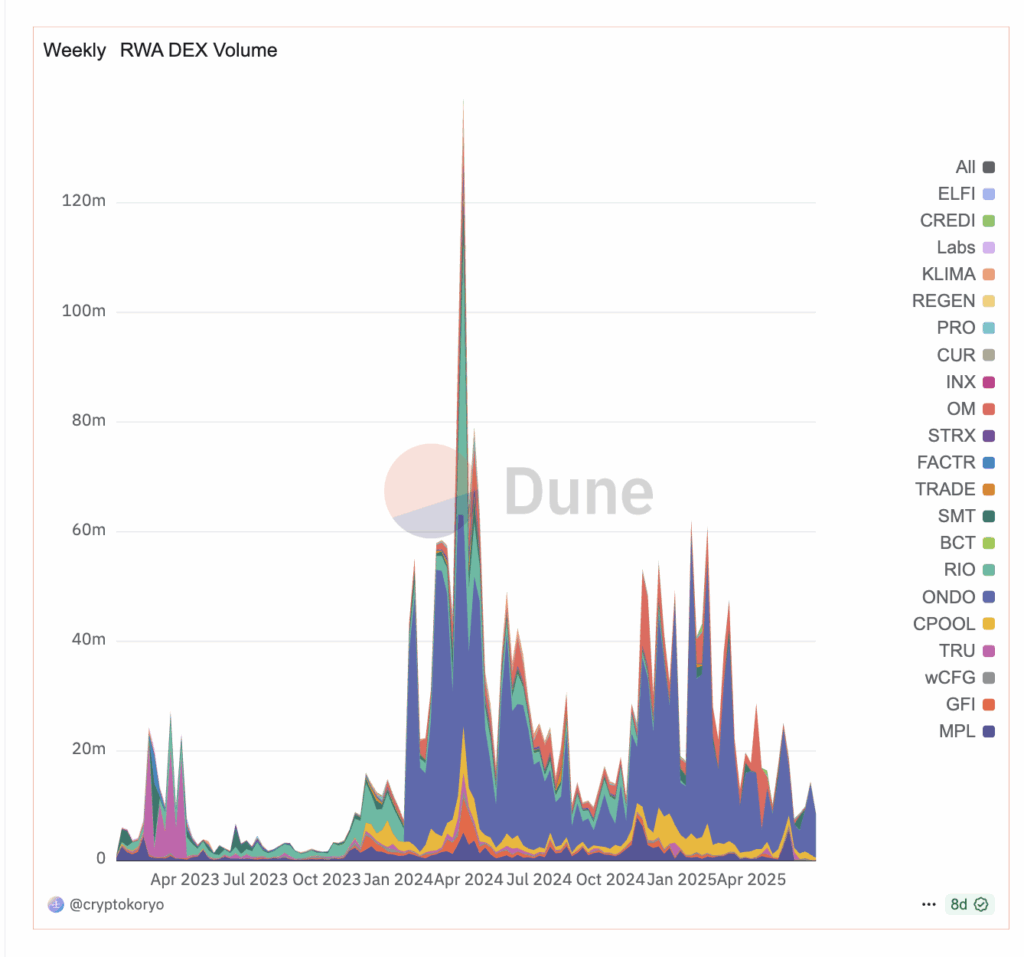

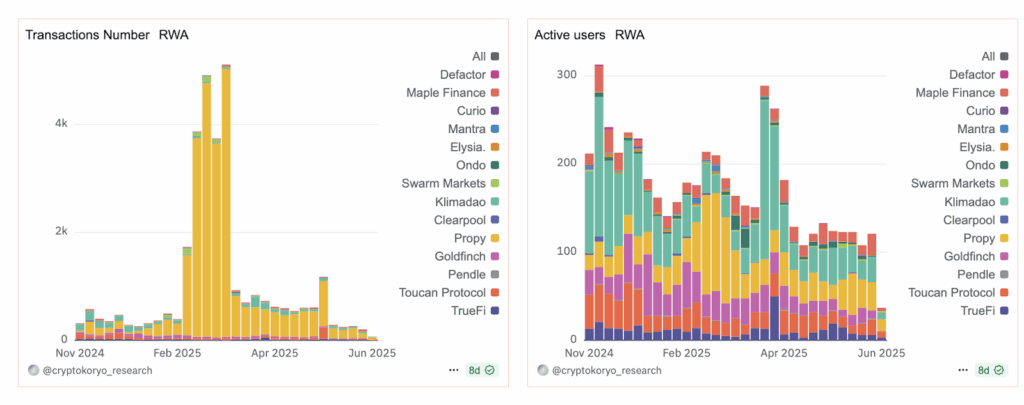

Despite a wide array of RWA protocols, user activity is highly concentrated. Dune dashboards show that while weekly transaction volumes across Real-World Asset platforms remain high, the number of active wallets has barely crossed 300.

That’s a small crowd for the kind of capital moving through the space.

Instead of thousands of DeFi users chasing quick yields, this RWA wave looks more selective. The pattern: high volume, low user count, often points to bigger players quietly stepping in. Think family offices, compliance-friendly funds, or TradFi-backed entities experimenting with onchain rails

Franklin Templeton confirmed that their tokenized fund is being eyed by family offices and private banks seeking on-chain settlement without regulatory compromise.

What’s Next for the RWA Market?

The Genius Act, a U.S. legislative bill currently being considered by Congress, could bring greater clarity to the issuance and trading of tokenized securities.

If passed, it may allow platforms like Ondo and Franklin Templeton to directly issue to retail without jumping through state-level hoops.

At the same time, Ethereum (ETHUSD) continues to serve as the dominant base layer for RWAs. Despite experiments on Avalanche and Polygon, most protocols are settling on Ethereum for legal clarity and tooling maturity.

For now, smart money continues to load into tokenized RWAs, but clarity around legal frameworks may decide whether this momentum sticks through 2025.

The post Tokenized Real-World Assets Up 65% As Smart Money Pours In appeared first on The Coin Republic.