Sun Yuchen's strongest competition, Stablechain arrives tonight

Written by: Saye

The top alpha is both political and business, such as Chuan Bao, or Sun Mo and Gabriel Abed, the current Binance.com Chairman, and even more amazingly, this old brother was previously Barbados' ambassador to the UAE.

You say that I, a Barbados ambassador studying in North America, became the chairman of Binance? Therefore, people should consider their own struggles, and more importantly, keep up with the course of history.

Caption: Gabriel Abed, Stable investor, image source: @zuoyeweb3

Before today, USDT was equivalent to half a TRC-20 USDT, and Sun Mo relied on providing USDT circulation channels to support a business empire with $TRX as the core, but the emergence of Stablechain caused cracks in the empire.

Stablechain is a payment-only L1 issued by Stable with USDT as the gas token, and Stable is directly supported by USDT, so the introduction of Gabriel Abed and the end of the chain can be regarded as Tether exploring outward, pointing to the institutional-grade market.

This is directly related to the current market competition situation, in addition to USD1, which is a pure Trump concept coin, USDC/USDe and other competitors are doing institutional settlement market, not to mention that USDG supported by Paxos and Kraken is also eyeing this piece of fat, and even BUSD is planning to be reborn.

Stablecoins are heading to businesses

Stablecoins are used as a C-end user market, which is about the same as being a black and grey industry.

In terms of C-end users, Justin Sun gave the most successful business strategy so far, not to make Tron the issuance network of USDT, but to find a specific group of people in the real world who have a rigid need for stablecoins, and the binding relationship between TRX and USDT also makes Tron a blockchain with real users second only to Ethereum.

But under the wave of institutional adoption by Stablechain, CPN, and Converge, I don't know if Brother Sun can still come up with new ideas, and it's not enough to just surround the Trump family, because he has four years at most, and business is a lifetime.

Nowadays, the U card and the battlefield of life have been boiled up, and YBSBarker is also continuing to follow up, and B-end companies are far away from ordinary users, but there is a potential opportunity for the next Circle or Stripe. (Recently, the number of friends who have come to me for advice on stablecoins has grown exponentially, and there are countless projects large and small, and everyone says they are the next Stripe, which shows how fierce the market is.) )

In the B-end market, pure compliance will bring huge increments, and it is also more suitable for entrepreneurs who grow savagely, and stablecoins begin to converge and evolve, so let's roll them up together!

Caption: USDC/USDT/USDe comparison, image source: @zuoyeweb3

-

USDT-->USDT0 (LayerZero)-->Stablechain

-

USDe-->USDtb-->Converge

-

USDC-->CCTP (Wormhole)-->CPN (Circle Payment Network)

In the current market structure, stablecoins - > on-chain cross-chain - > off-chain institutions are the basic forms, and the way of business development is divided into three main lines: compliance, cross-chain and institutions.

USDT expands the on-chain market through USDT0, and in addition to the direct deployment form, the OFT format token created by LayerZero is issued by USDT 1:1 reserves, with the main goal of providing compatibility similar to Circle CCTP, but USDT does not do it itself, but chooses USDT0 to do it.

For example, L2 Ink, which is supported by Kraken, also deploys USDT0, and Stablechain will also use USDT/USDT0 to expand more institutional-level transfer and settlement services.

In addition to the ontology, USDe issues USDtb, a compliant stablecoin backed by BlackRock BUIDL, to meet the compliance requirements of institutions, and USDe focuses on developing the on-chain ecology, such as cooperating with TON to enter the third world.

The benchmark against Stablechain is Converage, which is also the main institutional adoption and transfer and settlement business, and its business form is basically the same, but it has a slight focus on compliance, cross-chain standards and institutional adoption.

USDC, on the other hand, prefers to develop its own products, and although it has a cooperative relationship with Wormhole, the USDC cross-chain standard CCTP is mainly operated by itself, while CPN is a USDC global settlement network similar to Visa/SWIFT.

To sum up, USDT prefers to support the ecosystem, USDe uses more cooperation methods, and Circle likes to do it on its own.

Decoding the Stablechain is still difficult to develop

Technological innovation is over, and commercial operation capabilities are highlighted.

From a technical point of view, Stablechain is lacklustre as an L1 innovation, such as adopting the CometBFT variant StableBFT as a consensus protocol, and then upgrading to the DAG model, which is quite surprising.

In general, Stablechain has also announced that it will be a dPoS mechanism, in order to ensure efficient operation, it will basically not be too centralised, and will even adopt a "stand-alone model" similar to Hyperliquid's early days, although it is not a perpetual contract, but a large number of USDT transfers, which has huge requirements for network robustness.

In addition, the follow-up StableEVM will be upgraded to StableVM++ to introduce more parallel capabilities, which is based on the Block-STM transformation proposed by Aptos.

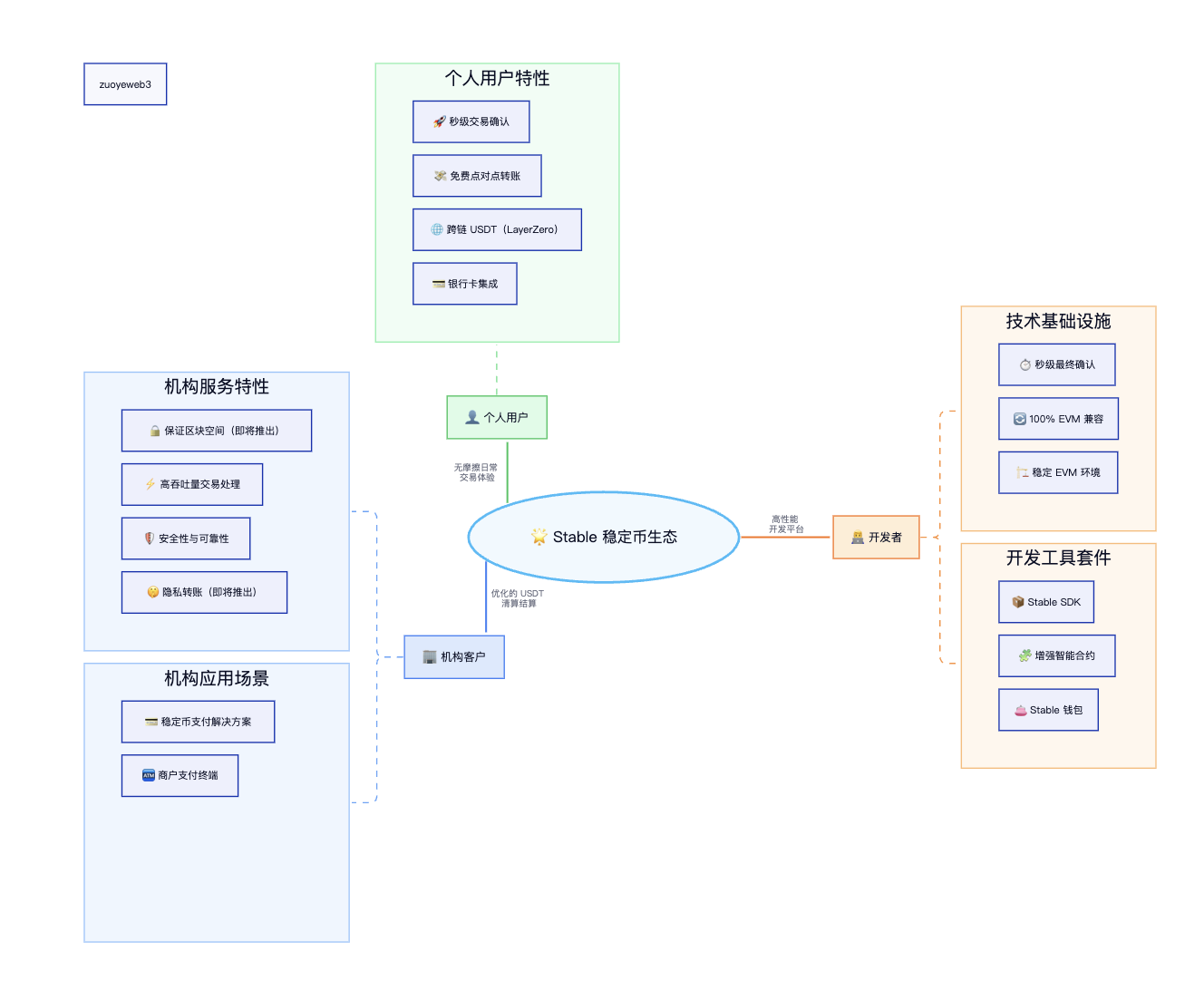

More broadly, Stablechain is mainly divided into individual users, business users and developers, and most of the enterprise-level customers and developers are still in a silly and unclear stage compared to the user education that has been completed by USDT.

Caption: Stablechain features, image source: @zuoyeweb3

Facing enterprise users is the focus of Stablechain, and I have summarised three main features from the documentation, which can be described in more detail and for individuals and developers.

-

Guaranteed Blockspace, enterprise transactions can enjoy customised block space to ensure the reliability and correct execution of transactions, which is equivalent to reserving the high-speed lane during the Golden Week.

-

Trade only USDT to ensure security, high speed, and even real-time tracking, ensuring compliance with high compliance requirements such as anti-money laundering.

-

Private transfers, inter-enterprise settlements are not public, and on the basis of compliance, the details of transactions are not discovered by the outside world, especially commercial counterparties, to ensure business privacy.

In addition, the general features are mainly gas-free transfers, sub-second confirmation, USDT0 cross-chain bridges, etc., most of which are not interesting, and in essence, the significance of Stablechain is not here, but to complete the commercial blocking of Circle.

Let's talk about the potential commercialisation possibilities, at this stage, everyone actually doesn't know the correct entry point for B-side commercialisation, please note that this does not conflict with the start of commercialisation mentioned above.

What your opponent does, you have to keep up, just like Sui made the storage product Walrus, Aptos has to rush to make a Shelby, although everyone knows that enterprises need to settle and internal transfers, but how to do it?

For example, the Yiwu settlement network used TRC-20 USDT before it was hit, which is everyone's default industry standard and a real business need, but can Stablechain meet this demand?

At present, it is not possible to catch it, because Stablechain does not belong to the compliance settlement system, so it can only retreat to the next thing, such as turning to business cooperation with licensed PSP companies, which will greatly reduce the brand awareness of Stablechain by target customers.

In Stablechain's planning, future business operations are divided into consumer payment solutions, merchant acquiring tools and Stable Wallet, as well as built-in compliance tools, which are too broad and have not yet formed a specific operational strategy, which can only be left for subsequent observation.

epilogue

Stablecoins form a clear divide.

One is traditional financial practitioners, or the public knows: stablecoins are used as US dollars and Alipay, which is also the goal that USDT is trying its best to become.

One is the way of DeFi, which is still expressed as the share of financial wealth management products, which is YBS (interest-bearing stablecoin), and the core is to represent financial management certificates and dividend distribution shares, and USDe also wants to transfer to USDT after YBS.

Stablechain At present, it seems that it does not have much to do with Brother Sun, and I hope that Brother Sun can survive this time.