Space Review|Three major engines drive the new cycle of the bull market, how does TRON define the survival rule of the "infrastructure faction"?

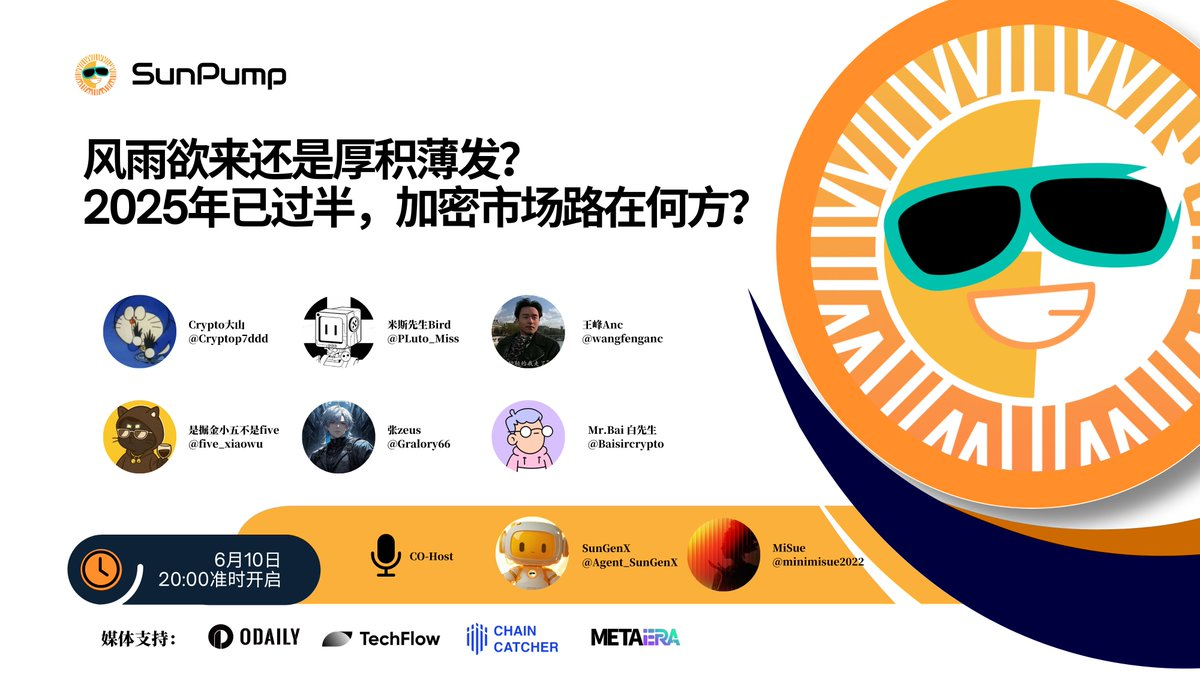

Halfway through 2025, the crypto market is at a critical inflection point where uncertainty and opportunities are intertwined. At 8 p.m. on June 10, #SunFlash圆桌以 "Is the storm coming or accumulating, where is the crypto market going?" "Start an in-depth conversation on the topic at X Space. This issue of Space brings together a number of senior industry KOLs to face the core anxiety of the market, discuss the survival logic of mainstream coins and new narratives, and clarify the rational path in the fog for investors.

The crypto market in 2025 is treacherous, presenting a complex scene of double game. First of all, Bitcoin (BTC) has repeatedly hit the $1110,000 mark, institutional funds have continued to pour in through ETFs, and trading volume has repeatedly hit new highs. At the same time, new narratives such as AI, Meme, and RWA have swept through, further exacerbating market fragmentation.

It is in this context that the differentiated survival logic of mainstream coins and the prosperity of their respective ecosystems are becoming the key dimensions to judge the true health of the market. This article will focus on the core insights of the roundtable, sort out the subsequent trend of the market and the core strategic positioning and development momentum of the TRON ecosystem at the inflection point of the industry.

1. BTC broke through $110,000: Three engines drive a new bull market cycle

In June 2025, BTC broke through the $110,000 mark, and the market ushered in a key choice in the midst of the hustle and bustle - is this rally the beginning of a new bull market or the end of a bubble? Based on on-chain data and historical rules, the guests of this issue of Space have reached a consensus: the increase in holdings of institutions and whales, the law of the BTC halving cycle, and the influx of compliant funds of BTC spot ETFs, three ironclad evidences are intertwined: the crypto market is entering a new round of growth cycle.

-

Institutional hoarding dominates the market landscape

Nuggets see deep changes in on-chain data, and he points out: "Institutions are becoming the cornerstone of the market – they don't create noise, but they accumulate strength in the dark." The on-chain data reveals that institutions are accelerating their layout, and giant whales continue to absorb chips, which shows that everyone's long-term value of BTC has not wavered. In addition, the data given by Wang Feng Anc also confirms this trend: from November 2024, there will be more and more addresses with more than 1,000 BTC. Institutions and whale users play the role of "cornerstones" to support BTC to a new wave of peaks.

-

The halving cycle points to new all-time highs

"Macroeconomic disturbances are just ripples, and the halving cycle is the tide that dominates prices." Based on the historical cycle data of BTC, Mr. Bai pointed out that the law that BTC peaks at about 518 days after the halving has not expired for ten years. He added: "Based on the April 2024 halving time, BTC will form a cycle peak from August to December this year, with a target of $150,000."

-

Fundamental changes in the market structure

The adoption of BTC spot ETFs is changing the player structure. "It's no longer a retail carnival, BlackRock is sucking in liquidity like crazy after the BTC spot ETF passes, and the regular army is rewriting the bull playbook," Mr. Bird noted from Meate. "This shift means that the market will shift from being emotion-driven to being dominated by compliance funds," he stressed. "

2. The altcoin market is differentiated, and the value revaluation logic of TRON is realised

Against the backdrop of rising industry attention, many KOLs predict that funds may gradually spill over into the altcoin market, but unanimously emphasise that it is difficult to reproduce the grand occasion of "10,000 coins rising", and only a few agreements with technical barriers, real income and user stickiness can attract capital inflows.

-

Structural opportunities in the context of market fragmentation

Crypto Dashan keenly pointed out the structural changes in the current altcoin market in Space: "This round of altcoins as a whole is volatile and trending downward, and market sentiment has become the dominant factor. He observed that only a few projects with solid technology and practical application scenarios, such as TRON TRON, can get out of the independent trend in the BTC-dominated market.

-

Investment strategy reconstruction: from heat chasing to value squatting

Faced with the core question of "how to explore low-valuation projects", Mr. Bird proposed a cognitive change: "Altcoin investment needs to abandon the past thinking of 'sector rotation and bet up' and turn to potential projects with 'solid infrastructure'. Crypto Dashan further supplemented the screening criteria: technology is the foundation of survival, actual application scenarios determine the sustainability of demand, protocol revenue ability verifies business logic, and user activity reflects ecological vitality. Only "buried builders" who meet these four elements have the potential for reevaluation.

The TRON ecosystem is an excellent example of this concept:

1. Developer-friendly architecture: TRON relies on the underlying advantages of 2500TPS high throughput performance and near-zero friction cost to build a global inclusive financial infrastructure. With a fully EVM-compatible virtual machine architecture, Solidity developers can seamlessly migrate smart contracts.

2. Rigid application scenarios: TRON has built a global financial application matrix through a three-level architecture of stablecoin payment network, DeFi liquidity engine and meme economic infrastructure. As of June 2025, its ecological core data has achieved multi-dimensional breakthroughs: TRC-20 USDT in circulation accounts for 51% of the world's total; JustLendDAO TVL exceeded $6.4 billion, firmly ranking as the leader in the lending market; DeFi protocol JUST TVL topped $9.7 billion; TVL of $740 million on the decentralised trading platform Sun.io and over 98,000 tokens on SunPump, a fair meme coin issuance platform. The cross-chain protocol BTTC network has processed more than 290 million transactions, and the total number of smart contracts deployed has exceeded 7.6 million.

3. Negotiated revenue capacity: In May, the total revenue of the TRON agreement exceeded US$343 million, a record high, with an average daily revenue of US$11 million.

4. User retention barriers: The DeFi TVL on the TRON chain exceeds 5 billion US dollars (ranking fifth in the whole chain), and there are 2.48 million active addresses in 24 hours.

3. TRON Solution for Meme Sector: How SunPump Reshapes Structural Opportunities

In the Space roundtable, Mr. Bai was the first to point out the role of Meme as an ecological engine: "Meme is the core catalyst of the bull market and the thermometer of market sentiment. Whether it's the 'zoo carnival' led by Dogecoin (DOGE) in 2021 or the new cycle in 2024, Meme has always been the on-ramp for incremental funds. Mr. Bird, Mr. Meath, further deconstructs its deep value chain: "Meme has built the minimum threshold for the crypto world, and newcomers may complete their first on-chain interaction due to the doghead meme token, and eventually precipitate into long-term holders of Bitcoin." "This kind of conversion funnel of 'entertainment entrance-on-chain practice-value precipitation' converts outsiders into crypto market participants in batches.

When the market verifies the commercial value of emotional consensus, mainstream public chains have built a closed loop of meme economy. Among them, SunPump staged a textbook-level case in the TRON ecosystem. First of all, SunPump has lowered the threshold for meme creation to the extreme with the AI agent of "one-click coin issuance" and SunGenX, an AI tool for "tweet instant coins", attracting users to create more than 98,000 tokens, driving SunPump to achieve 37 million TRX revenue.

With the influx of traffic, SunPump has promoted the prosperity of the entire TRON ecosystem. SUN.io trading volume has increased significantly since SunPump's launch, and other DeFi projects such as SunSwap and JustLend have also grown due to SunPump's traffic dividends. After the launch of the SunPump platform, TRON has seen its highest level of DEX activity since 2022.

SunPump has become a converter that connects incremental users to the underlying infrastructure. This just proves Mr. Bird's point of view: high-quality meme protocols can feed back the fundamentals of the public chain, rather than the "vampire effect" as traditionally believed.

IV. Conclusion

When BTC rushes to the next high, the crypto market is moving from hustle and bustle to deep reconstruction, and TRON has shown ecological resilience in this transformation, and the TRON ecosystem is building a "run-through crypto financial closed loop" with stablecoins as the foundation, meme as the traffic, and ecological internal circulation as the drive. The "infrastructure faction" represented by TRON is building a digital financial foundation with a lower-cost, higher-efficiency, and wider-coverage ecological network. When technology returns to the essence of service, the market will crown the value with real money.