LA contract "pin" turmoil: Gate.io The data source is abnormal, but the user can only bear the loss?

Author: momo, ChainCatcher

Recently, Gate.io has been caught in a storm due to the abnormal "pin" of the $LA/USDT contract. A number of users alleged that Gate.io was suspected of manipulation during the period of sharp fluctuations in contract prices, which led to the abnormal liquidation or even liquidation of many users' positions, resulting in heavy losses.

Although Gate.io has responded to the cause of the accident and the compensation plan, community users do not seem to be buying it. Drew asked Gate.io for further responses to the user's questions, but Gate.io the key causes of the accident and the compensation planThe reply is basically the same as in the announcement, and there are no new details.

Why aren't Gate.io's responses bought by users?

At 8 p.m. on June 4 (UTC+8), Gate.io launched the $LA/USDT swap. About 4 minutes after the market opened, the price of $LA skyrocketed from around 0.36 USDT to 27 USDT in a matter of seconds, and then flashed down to0.2 USDT. During this period, the spot price of LA and the on-chain price on other exchanges with the same currency are mostly around 1 USDT.

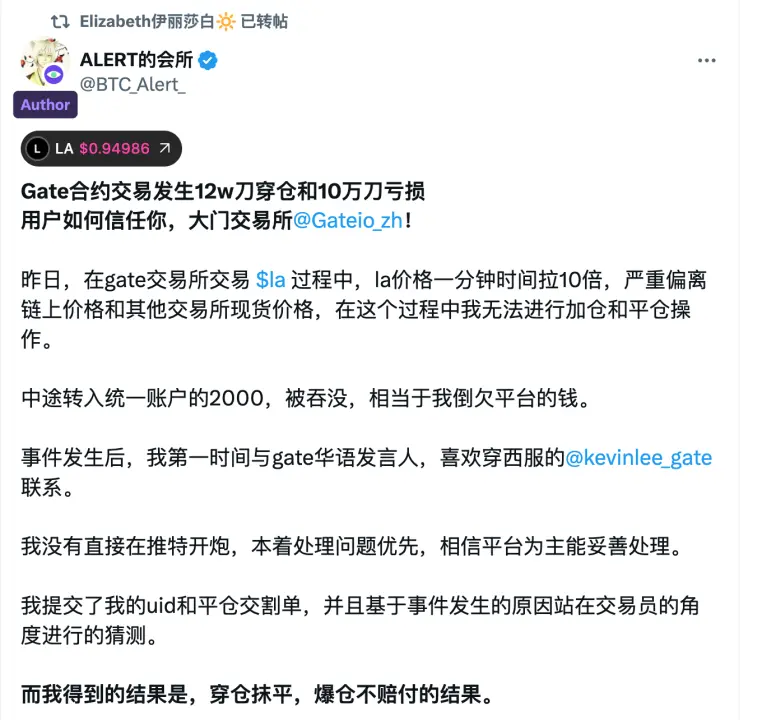

This "pin" phenomenon that deviates from normal fluctuations has led to a large number of users liquidating their positions in a short period of time, and some accounts have even lost their positions. Crypto KOLs @Elizabethofyou said they lost 20,000 USDT in the event, while @BTC_Alert_ said that he lost 100,000 USDT and owed 120,000 USDT to the platform. During this period, it is not possible to add or close positions.

Gate.io then removed the contract, and announced at around 9:28 p.m. that night that it would compensate for the part of the liquidation.

@BTC_Alert_, @Elizabethofyou and other users reported that the delivery order of the transaction was tampered with after the Gate.io issued the compensation for the liquidation. @Elizabethofyou said that there were 3 trading orders with a total trading volume of 4,994USDT, 7,999 USDT, 13,990 USDT, which was changed to 49.94USDT and 79., respectively 99USDT、139.34USDT。

As a result, some damaged users questioned Gate.io platform for suspected "malicious trading" or problems with the platform's risk control.

On June 5, Gate.ioCBO Kevin Lee further responded to the abnormal trading of the contract, saying that the cause of the incident was the abnormal source data of the contract index and the superposition effect of the automatic risk control mechanism, and there was no internal operation. There is no "single point liquidation" or deliberate behaviour of blowing up users. Gate.io also denied that the platform had tampered with user transaction data.

In terms of the compensation plan, the Gate.io still only pays all the parts of the position. The amount of the loss payout, plus the fact that all users are allowed to keep the profits they have made, Gate.io bear a total payout of about $30 million.

But many users don't buy it. First, it is considered that the compensation plan is unreasonable. The user believes that whether it is liquidation or liquidation, it is caused by the price deviation from the normal fluctuation caused by problems on the platform, why only compensate for the liquidation part, but not for the losses of liquidated users?

Second, it is not convincing to attribute the cause of the accident to the abnormality of the data source. Some users suggested that the platform should disclose the index source composition and exception logs to prove that there was no internal manipulation.

In addition, affected users expressed dissatisfaction with the platform's feedback and response speed and attitude throughout the Gate.io incident. For example, why did you respond to the AMA why users were not allowed to go to the microphone and only opened an English AMA?

Under the platform vulnerability, what is the basis for Gate.io not to pay for liquidation?

In response to the user's concerns in the Gate.io response, CoffeeChat asked Gate.io sought further responses, removing some duplicates from the announcement, and Gate.io's key response was as follows:

1、ChainCartcher: Gate.io there is a lack of clarification on the specifics of the index source anomaly, such as which data source is the problem? Why can't platform risk control detect anomalies in advance? Is there market manipulation involved? Can you provide further evidence and elaborate?

Gate.io did not provide further evidence and clarification. (Because the content of the reply and the announcement are basically the same, no specific presentation will be made).

2、ChainChatcher: Due to the abnormal transaction of the user due to the abnormal data source of the Gate.io, why only pay for the liquidation and not the liquidation part? On what basis?

Gate.io: After technical inquiry, all LAUSDT contract transactions are executed in strict accordance with the predetermined trading rules, and the matching and liquidation mechanisms are triggered normally based on the index price rules, and no system abnormalities are found. Therefore, the part of the loss caused by the liquidation is not within the scope of the platform's compensation.

In addition, the loss of liquidation is usually borne by the user, and other platforms in the industry follow similar rules. However, this compensation is an additional subsidy that the platform takes the initiative to bear, and it is a reflection of its responsibility for the systematic liquidation results caused by extreme markets.

3. ChainCartcher: From the feedback of the X platform, there are many Chinese users The $LA/USDT contract has suffered a lot of losses due to its anomaly. Why did Gate only choose to respond with an AMA in English? And why was the user's microphone request denied and the reply limit for that tweet was set? Considering another Chinese AMA response?

Gate.io: The AMA was held within 24 hours of the incident, and the primary goal was to quickly respond to market concerns and convey the platform's position in a timely manner. Given that Gate users are widely distributed around the world, we prioritise the arrangement of English AMAs to ensure that the information can reach the majority of affected users as soon as possible. We also attach great importance to the voices and demands of Chinese users, and have simultaneously strengthened communication with Chinese users through multiple channels such as internal messages, communities and customer service.

If the community or users have further needs, we are willing to arrange a special event for Chinese users in the near futureAMA, which provides more direct and open communication opportunities.

Our decision not to open the microphone and reply privileges is mainly for the balance of maintaining the pace of the discussion and avoiding the escalation of the dispute, and there is no intention of avoiding communication. We will refine the questioning mechanism in the follow-up arrangements to achieve fuller interaction and response.

4、ChainCatcher:@Elizabethofyou、@BTC_Alert_ A number of users reported that the order was tampered with, and you responded that there was no tampering and the user did not accept it, during which did you further verify and explain in detail the user's abnormal order feedback?

Gate.io: We attach great importance to the abnormal feedback of individual users in the community on the order records, and the technical team carried out a case-by-case check at the first time, and has not found any cases of orders being tampered with so far. The price jump shown in the screenshots of some users is actually a normal result of the amplification of the difference between the transaction price and the mark price in extreme markets.

We welcome users to provide more detailed original records (such as order IDs, transaction screenshots, etc.), and we will continue to cooperate with the survey and provide targeted feedback to each user who raises questions.

5. ChainCatecher: Subject to $LA/USDT Users affected by contract events still have questions about Gate's payouts and responses, do you have any new responses and compensation plans?

Gate.io: There is currently no new unified compensation plan, if there are other questions or special circumstances outside the existing mechanism, we welcome users to continue to submit information.

A crisis of confidence in the wake of frequent accidents in CEX contracts

Contracts are CEX's core profitable business. However, the controversy caused by the Bitget VOXEL contract turmoil and the Gate.io LA contract anomaly reflects the technical and risk control challenges faced by CEXs in high-leverage and high-risk contract trading. However, there are problems such as lack of transparency and insufficient guarantee of user rights and interests in CEX crisis management, which further leads to the loss of users Crisis of confidence.

In a highly competitive market, CEX may be the only way to rebuild user trust by responding more actively to user demands and making up for various shortcomings such as risk control.