A1 Research: With nearly 70% of the market share, what is Ethena doing right?

Author: A1 Research

Compiled by: Deep Tide TechFlow

This data-driven report provides an in-depth analysis of @ethena_labs's recent growth performance while successfully retaining over 70% of its capital.

Due to Ethena's rapid growth over the past week, some of the reported data is not up to date. Here's how it has changed since this article was written:

-

TVL: From $5.88 billion to $7.55 billion (+28.4%)

-

Market position: Improved from 17th to 15th among all DeFi

-

Track Dominance: Market share increased from 68.1% to 70.6%

The paradox of DeFi loyalty

In a field known for short-lived hype, rapid turnovers, and mercenary capital, one protocol breaks the mold. While most DeFi platforms lose users when they show signs of volatility, Ethena quietly builds a fortress: it retains 76% of its total value locked (TVL), accounts for 68.1% of the entire track, and has the lowest volatility among all mainstream DeFi protocols.

This article sheds light on the science of capital retention – an in-depth look at how Ethena transformed from an experimental stablecoin protocol to DeFi's first true infrastructure-grade financial primitive, with resilience, dominance, and sustainability reflecting the TradFi system more than yield farming.

Introducing Ethena: an infrastructure-grade digital currency

Ethena is a synthetic dollar protocol built on Ethereum that combines spot long positions in BTC/ETH and short positions in BTC/ETH perpetual contracts through an innovative "delta-neutral" basis trading strategy, forming a dollar stablecoin solution that does not require centralized collateral, providing users with an "internet currency" in the form of $USDe.

Revenue Mechanism:

-

Get 15% annualized basis arbitrage by shorting perpetual futures (most of your income)

-

ETH-based long collateral yield of 3%

-

Stablecoins deployed to liquidity pools earn a fixed yield of 4%

As of July 2025, Ethena's assets are allocated across derivative-based trading, staked ETH assets, and liquid stable assets, with specific allocations varying based on market conditions and governance decisions.

Key takeaways

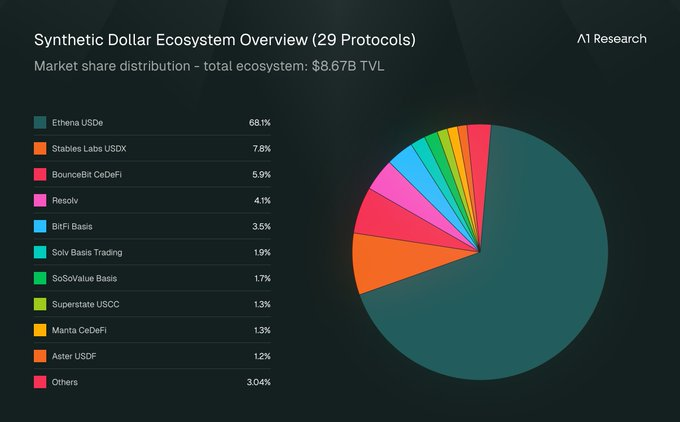

As the infrastructure layer that supports yield-based synthetic dollars, Ethena holds 68.1% of the market share in an ecosystem spanning 12 chains and covering 29 protocols. With a total value locked (TVL) of $8.71 billion, it has become a core pillar of the space.

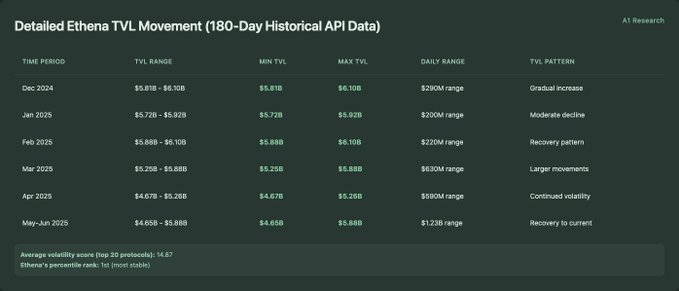

Ethena has demonstrated exceptional operational maturity, with a volatility score (based on a 90-day daily TVL percentage change) of just 8.23, well below the usual 15-25 range for DeFi protocols. At the same time, the protocol has maintained continuous growth, significantly outperforming similar benchmarks, and has become a model of steady growth in the industry.

A1's Core Argument: Ethena embodies successful category creation, demonstrating resilience and operational maturity that has been tested under pressure. It demonstrates how infrastructure protocols can achieve sustainable market leadership through focused financial innovation and superior risk management.

Breaking New Ground: Ethena and the Architectural Path of the Synthetic Digital Dollar

Ethena has not just entered a market; Most DeFi tracks are slow to mature, with market share divided between 3-5 incumbents.

Ethena's dominance shows that it inspired the track, rather than being part of it, and became the standard that others now refer to.

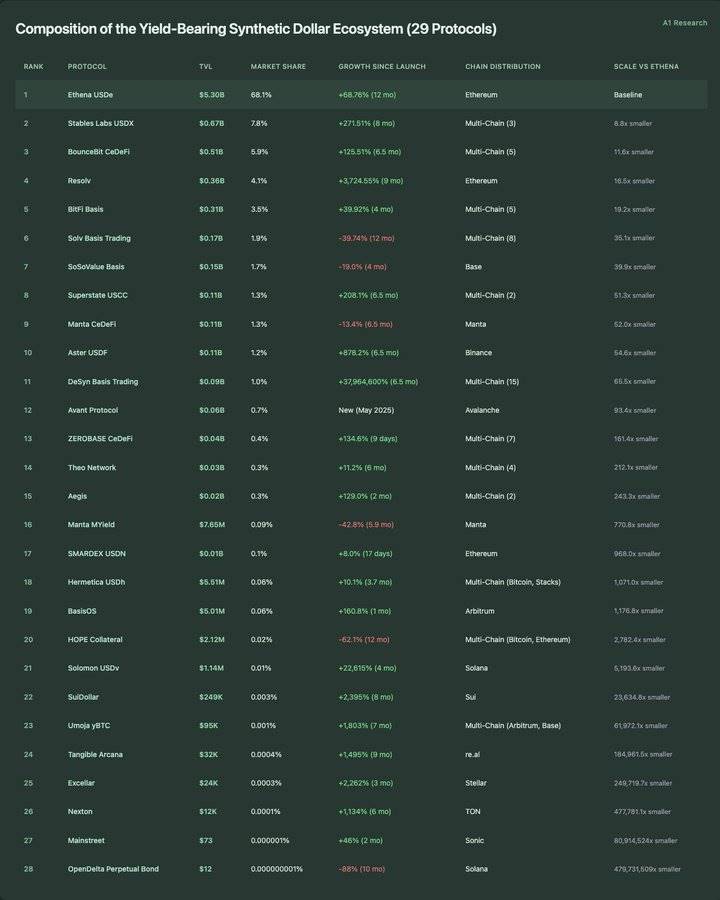

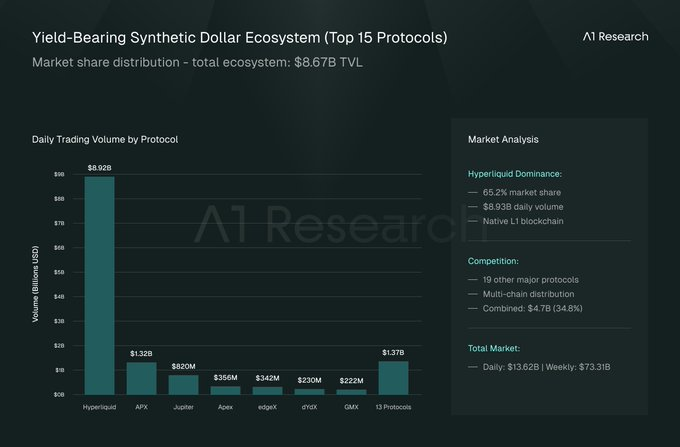

Composition of the yield-based synthetic dollar ecosystem (29 protocols):

A blueprint for innovation in the DeFi category

Ethena gives birth to a new ecosystem

The launch of Ethena has sparked a series of protocol innovations around synthetic, yield-bearing dollars, giving rise to a stable value system ecosystem worth $8.67 billion, covering 29 protocols on 12 public chains. Data from the past 12 months shows that this is not a gradual market evolution, but rather an innovation in infrastructure-level performance.

Maintain infrastructure-grade performance throughout the market cycle

Ethena's impressive annual growth rate of 68.85% and its continued market dominance of 68.1% reflect a rare infrastructure-level performance in the DeFi space. The protocol has gone through five distinct phases, validating its position as the defining infrastructure for the DeFi space.

Recovery Excellence: Ethena's +132.7% rebound from its October 2024 lows showcases a typical institutional confidence pattern for infrastructure protocols. While most DeFi protocols struggle to maintain momentum in a bear market, Ethena's V-shaped recovery is in line with traditional infrastructure assets.

Volatility Management: A volatility score of 8.23 places Ethena within the infrastructure-level stability range, significantly lower than typical DeFi protocols. Maintaining such high stability while achieving an annual growth rate of 68.85% indicates that the protocol achieves the perfect blend of growth and reliability that is characteristic of infrastructure leaders.

Practical application of power law

The distribution of ecosystems presents an extreme power law: 1 protocol is worth more than $5 billion (Ethena), 1 protocol is worth between $500 million and $1 billion, 3 protocols are worth between $300 million and $500 million, and 24 protocols are worth less than $300 million. Even more striking is the microconcentration: 13 protocols have a total value locked (TVL) of less than $10 million, and 6 protocols are worth less than $1 million despite months of operation.

Size Gap: The largest competitor (USDX, $670 million market cap) is 8.8 times smaller than Ethena, while the smallest protocol tracked (OpenDelta, $12 market cap) is 479,731,509 times smaller than Ethena. This unprecedented distribution of scale shows that the track has rapidly matured into an infrastructure-led architecture rather than competitive fragmentation.

The Multi-Chain Paradox: Liquidity Depth > Chain Ecological Breadth

Of the 28 synthetic dollar protocols tracked, 15 operate cross-chain across 12 blockchain ecosystems, indicating strong demand for multi-networking. However, Ethena maintained its deployment-only model on Ethereum and accounted for the majority of the track's TVL.

Multi-Chain Efficiency Paradox: @DesynLab Basis Trading operates on 15 blockchains but has a total locked value of just $89 million (65.5 times smaller than Ethena). USDX operates on 3 blockchains with a total locked value of $670 million (8.8 times smaller than Ethena). This challenges the common assumption that "multi-chain expansion drives scale expansion."

Protocol Resilience Practices:Ethena's performance under pressure

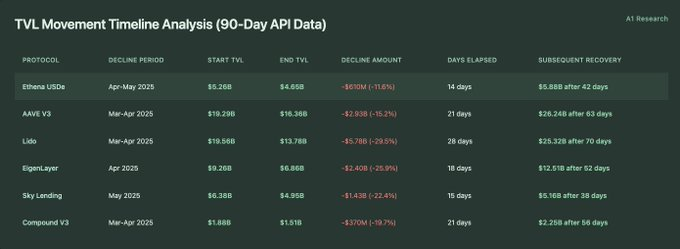

The tide receded, showing the strength of infrastructure, and most DeFi protocols suffered severe capital outflows during the two major pullbacks in 2025 (March and April-May). However, Ethena has shown rare resilience: not only retaining funds but also achieving recovery and growth. In contrast, Ethena has been particularly prominent in the TVL of lending markets (such as @aave), staking giants (such as @LidoFinance), and re-staking leaders such as @eigenlayer.

-

Average volatility score (top 20 protocols): 14.87

-

Ethena's Percentile Rank: 1st (Most Stable)

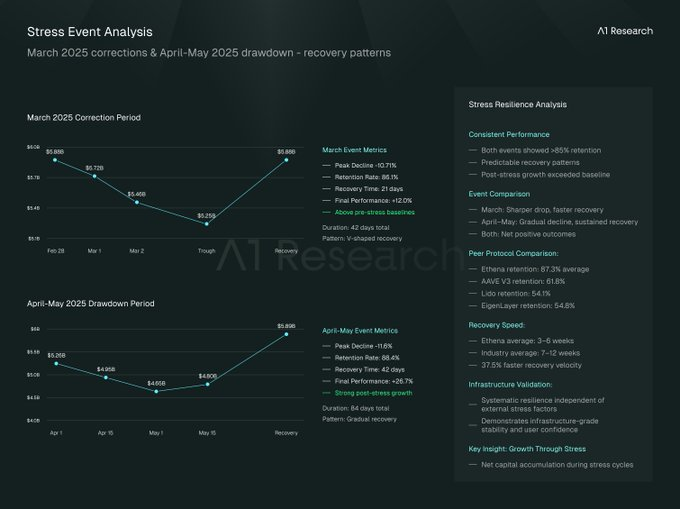

Detailed stress response metrics

Retention rate during stress: 86.1% (March), 88.4% (April-May)

Average Retention Rate: 87.25%

Volatility score: 8.23 (180 days), while the measured protocol average was 14.87

Speed of recovery: 3-6 weeks, compared to the average recovery rate of 7.2 weeks for the measured protocol

Post-stress performance: 19.25% higher than pre-stress levels on average

Comparative protocol TVL range analysis (90-day API data):

TVL change timeline analysis (90-day API data):

Ethena TVL dynamic details (180 days of historical API data):

Detailed stress period analysis (daily TVL change):

Market correction period in March 2025:

Market retracement period from April to May 2025:

How Ethena Outperformed the DeFi Space in the Crisis

When the market is turbulent, most protocols react. A few protocols will show their design. Ethena has been particularly strong during recent market stress events, with data showing stronger relative retention and resilience than other protocols.

Cross-protocol performance: Capital stays where it is most trusted

Ethena's TVL retention rate of 76.2% outpaced all measured mainstream DeFi protocols, including AAVE V3 (61.8%), Lido (54.1%), EigenLayer (54.8%), and Sky Lending (68.7%). This results in Ethena's retention rate during stress testing by 14-22 percentage points higher than similar protocol samples.

Volatility: The most robust helmsman in the market

A volatility score of 8.23 makes Ethena the most stable of all 20 DeFi protocols tested. Measuring from 8.23 (Ethena) to 19.67 (SparkLend), Ethena's stability was 24.6% higher than that of Sky Lending (10.25), which came in second.

Speed of recovery: Ethena was the first to rebound strongly

Comparative recovery timeline analysis showed that Ethena had an average recovery time of 3-6 weeks in measured events, compared to 7-12 weeks for the other comparator protocols (AAVE V3: 8-9 weeks, Lido: 10-12 weeks, EigenLayer: 7-8 weeks). This means that Ethena recovers significantly by 37.5% faster in the test protocol sample.

Deciphering Ethena's Stress Response: A Dual Manifestation of Stability and Growth

In addition to outperforming its peers, Ethena has shown significant internal consistency across two major stressful events:

Continued Resilience: Despite different stress characteristics, Ethena maintained a retention rate of over 85% (March: 86.1%, April-May: 88.4%) across two distinct periods of stress, indicating systemic protocol resilience rather than event-specific market conditions.

Predictable recovery: Both recovery periods followed a similar 3-6 week schedule, regardless of the severity of the initial decline, suggesting that the predictable recovery mechanism was not influenced by external stressors.

Growth Under Pressure: Both recovery periods resulted in TVL levels significantly exceeding pre-stress baselines (+12.0% for March events and +26.7% for April-May events), indicating net capital accumulation during stress cycles.

Derivatives Market Integration: Examining Ethena's Future Potential

Ethena's role has long gone beyond stablecoins, and its unique model makes it an ideal underlying collateral asset for decentralized derivatives platforms. With over $13.6 billion in daily trading volume in this space, traders need low-volatility, yield-generating collateral assets to meet margin and liquidity pool needs, and Ethena is designed to fit this scenario perfectly.

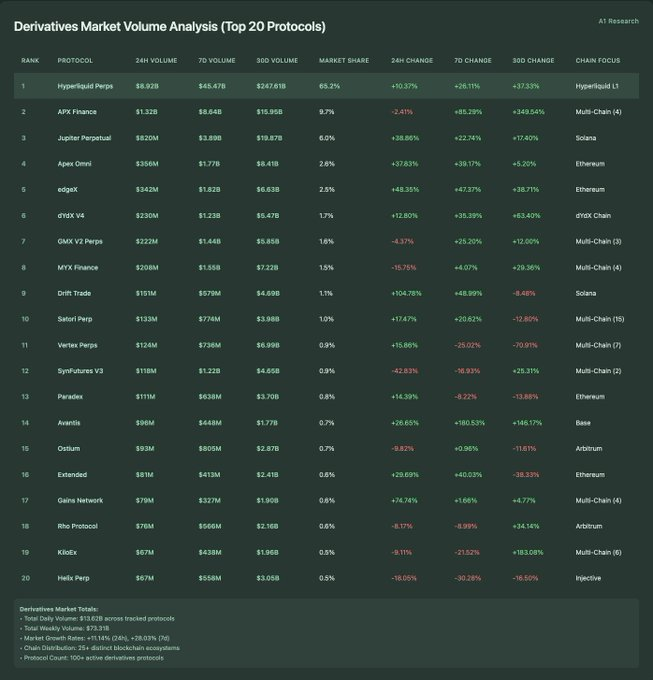

Analysis of the trading volume of the derivatives market (top 20 protocols):

Derivatives Market Total:

-

Total daily trading volume: $13.62 billion across tracked protocols

-

Total weekly trading volume: $73.31 billion

-

Market Growth: +11.14% (24 hours), +28.03% (7 days)

-

Chain Ecological Distribution: 25+ different blockchain ecosystems

-

Number of Protocols: 100+ active derivative protocols

Analysis of the chain ecological distribution of the derivatives market

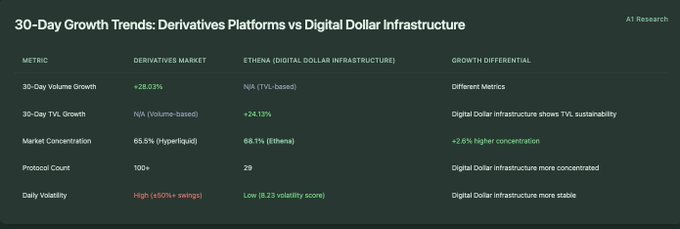

30-Day Growth Trend: Derivatives Platforms vs. Digital Dollar Infrastructure

A low-key fit between derivatives and DeFi collateral infrastructure

The cryptocurrency derivatives market is large, fast-growing, and expanding. But beneath its volatility lies a quieter, more stable foundation that is increasingly being defined by protocols like Ethena. The two dimensions of speed and stability are beginning to show a deep structural interdependence.

Scale determines success or failure: rapid growth is inseparable from high-quality mortgage assets

The decentralized derivatives market has a daily trading volume of $13.62 billion, while Ethena's total value locked (TVL) is $5.88 billion, a ratio of 2.3 times. The mathematical relationship suggests that even a 5% increase in derivatives volume capture ($681 million) would mean that Ethena's current position would increase by 11.6%. In short, a small amount of quick money requires a lot of stable collateral.

Analysis of centralization trends in parallel markets

Hyperliquid accounts for 65.5% of decentralized derivatives trading volume, while Ethena accounts for 68.1% of TVL in the yield-based digital dollar ecosystem. The two markets have similar concentrations (ranging between 65% and 68%), indicating a similar pattern of market structure in the DeFi track based on trading volume and TVL.

Different speeds, different roles

The derivatives market recorded a weekly growth rate of 28.03%, while Ethena's monthly growth rate was 24.13%. Normalized by frequency, the derivatives industry is growing 4 times faster than Ethena, highlighting its faster market circulation and the more stable TVL growth model of the synthetic dollar protocol.

Derivatives protocols exhibit high volume turnover rates and significant daily variations (volatility is generally ±50% across protocols), while Ethena demonstrates TVL stability (volatility score of 8.23). This 7x difference indicates that the market functions complement each other – high-frequency trading versus a stable supply of collateral.

Same design, different ending: single-chain advantage

Hyperliquid is dominated by single-chain transactions (65.5% of transactions are concentrated on Hyperliquid Layer1), but other blockchains also show distributed activity: Ethereum (5 protocols totaling $1.02 billion) and Arbitrum (8 protocols totaling $2.26 billion). Multi-chain derivatives trading volume reached $4.76 billion (34.8% of market share) involving more than 20 protocols.

In the derivatives and synthetic dollar ecosystem, the single-chain dominance of leading protocols suggests that concentrated liquidity often outperforms multi-chain distributions when building the underlying market infrastructure.

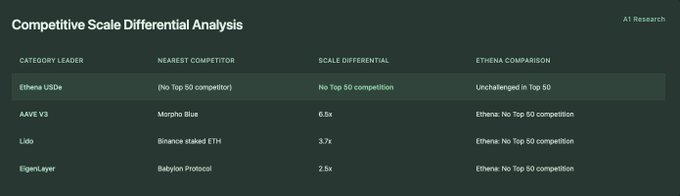

Competitive positioning: Ethena vs. infrastructure giants

As DeFi expands, competition intensifies across most verticals. Notably, Ethena is the only synthetic dollar protocol in the top 50 for DeFi, reflecting not only its current market leadership but also its emerging structural defenses.

DeFi Infrastructure Top 50 Competitive Analysis

*Top 50 single protocols in this track

Competitive analysis of the lending track (top 15)

Total lending track: The top 15 agreements totaled $43.6 billion

Complete Liquidity Staking Track Competitive Analysis (Top 10)

Total liquidity staking track: The top 10 protocols totaled $38.2 billion

Analysis of the difference in the scale of competition

When one protocol dominates the entire track: Ethena's structural advantage

In most DeFi spaces, protocols compete for incremental share in established tracks. But in a few cases, a protocol emerges early, establishes standards, and maintains dominance as the industry matures. Ethena is one of them.

The synthetic dollar at the top: a unique existence

In the top 50 major DeFi tracks, market share concentration ranges from 58.0% (Uniswap V3 in DEXs) to 100.0% in single protocol representative tracks. In the synthetic dollar track, Ethena holds 50% of the top 100, highlighting the lack of comparable competitors at this scale.

System-level ranking background

Ethena ranks 17th overall among DeFi protocols (excluding centralized exchanges) and in the top 3% of all tracked protocols. Currently, it ranks 17th in total engagement value, between Bitget (16th, $6.02 billion) and BitMEX (18th, $5.54 billion).

Competitive structure: centralization vs. decentralization

Ethena is the only synthetic dollar protocol in the top 50 for DeFi. This is in contrast to the following tracks:

-

Lending: 7 types of protocols

-

Liquid staking: 5 protocols

-

Re-staking: 2 types of protocols

-

Decentralized exchanges: 2 protocols

This asymmetry reflects a deeper structural dynamic: synthetic dollar protocols tend to focus on a single dominant infrastructure, while other verticals exhibit greater decentralization.

Growth profile: Steady rather than accelerating

Among the top 50 category leaders, the most recent weekly growth rates are as follows:

-

EigenLayer: +8.07%

-

ether.fi: +7.11%

-

Lido: +6.08%

-

AAVE V3: +4.37%

-

Babylon: +3.74%

-

Ethena: +1.47%

Ethena's lower short-term growth reflects a more mature and stable adoption curve, aligning with infrastructure behavior rather than earlier protocol dynamics.

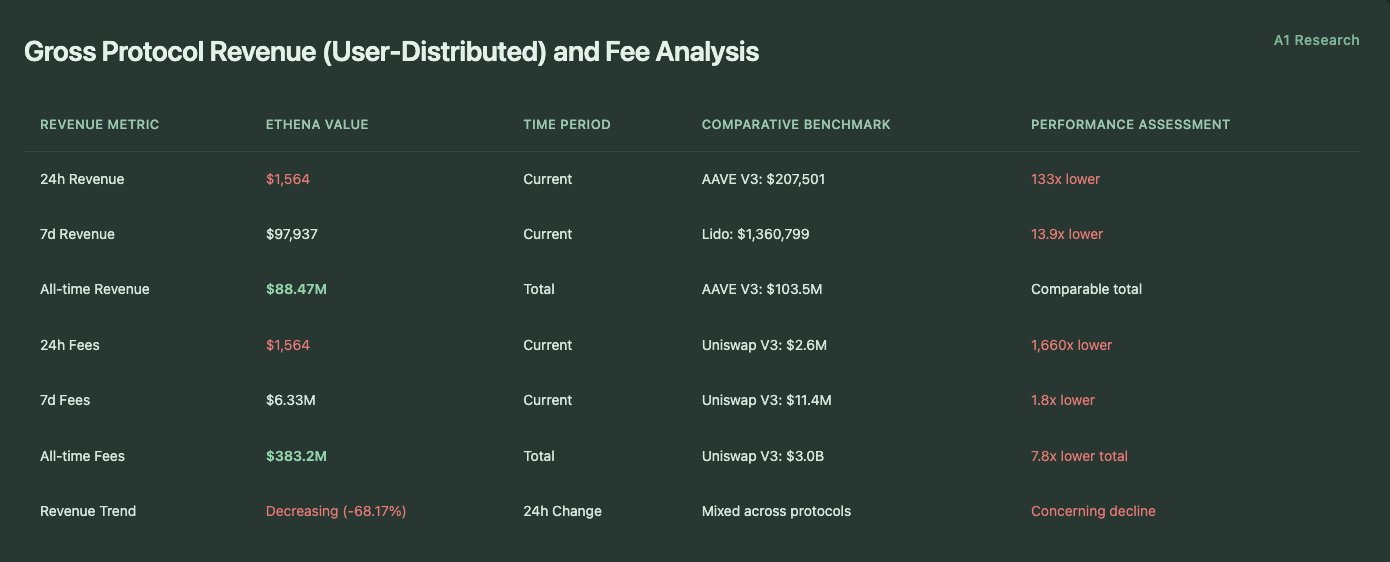

Utility over Extraction: Ethena's infrastructure-first economic model

Since its launch, Ethena has accumulated over $400 million in protocol revenue, ranking among the highest-grossing protocols in the DeFi space. But unlike many protocols, Ethena will not use these revenues to expand its own funds. Instead, almost 100% of the protocol's revenue is distributed to USDe holders in the form of yield.

Total Agreement Revenue (User Allocation) and Fee Analysis

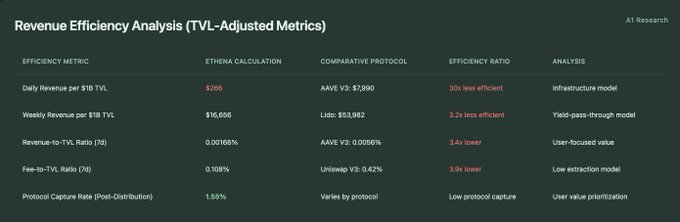

Revenue Efficiency Analysis (TVL Adjustment Metric)

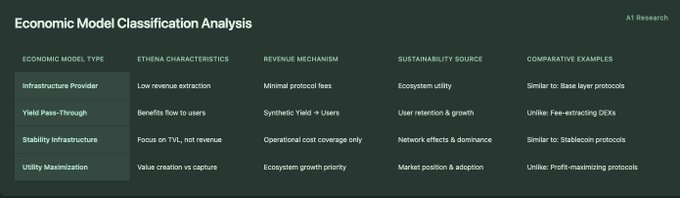

Classification and analysis of economic models

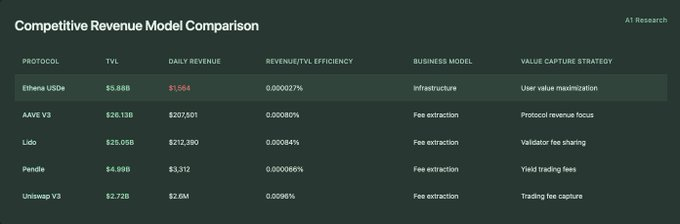

Comparison of competitive income models

Sustainability Framework Analysis (Quantitative Indicators)

Rethinking Protocol Value: Ethena's Infrastructure-Led Economic Model

While many DeFi protocols are built around transaction-based yield extraction, Ethena operates on a fundamentally different premise: infrastructure utility is above protocol profitability. Its economic model prioritizes user value creation and market functions over short-term profits.

Infrastructure and revenue: deliberately low profitability

Ethena's operating model is infrastructure, not a profitable agreement. The protocol has a TVL of $5.88 billion, a daily gain of $1,564, and a yield efficiency of just 0.000027%. This is fundamentally different from fee-centric protocols like Uniswap V3 (with an efficiency of 0.0096%) or AAVE V3 (with an efficiency of 0.00080%). This model implies a clear priority: maximizing user utility, not protocol returns.

Revenue transfer: a core feature in the design

Ethena's low yield retention rate (1.55%) suggests that the yield generated by the system primarily goes to USDe holders rather than being captured by the protocol's treasury. This structure aligns closely with the stablecoin infrastructure model, where economic value is passed on to users rather than accumulated by the protocol.

Sustainability is rooted in market roles

Unlike protocols that rely on fee generation to maintain sustainability, Ethena's persistence appears to be rooted in its ecosystem role and infrastructure value. Key performance indicators support this:

-

68.1% market share

-

Volatility score of 8.23

-

87.3% pressure retention

These metrics suggest that a protocol's competitive advantage stems from market positioning rather than fee flow.

The illusion of efficiency: how revenue distribution is the engine of user retention

At first glance, Ethena's "yield efficiency" appears to be 3-30 times lower than mainstream DeFi protocols, measured by revenue per $1 billion in TVL. But this is actually a false signal of weakness. The low capture rate of the Ethena protocol is not due to poor revenue generation; The protocol has generated over $400 million in cumulative revenue. Instead, its yield pass-through design distributes almost all proceeds directly to USDe holders.

This architecture prioritizes user consistency over protocol profits, sacrificing short-term profits in exchange for long-term capital stickiness and system integration. The result is strong defense: high user trust, low churn rate, and strong TVL resilience.

Revenue resistance and the cost of market dominance

Despite its well-defined positioning, there are inherent risks. The daily revenue change of -68.17% highlights the volatility of revenue streams, which could pose sustainability challenges if operational costs start to exceed protocol revenue. Since revenue is primarily driven by funding rates in the perpetual contract market, a shift to a bearish mechanism could compress funding spreads and further reduce yields at the protocol level.

However, Ethena's role as an infrastructure layer is deeply rooted in usability, suggesting that it may remain viable without high income dependencies as long as the ecosystem's value continues to expand.

Conclusion: Infrastructure, goals and long-term layout

Ethena currently fully reflects its consistent and thoughtful design philosophy in various indicators (track creation, stress resilience, ecological integration, structural positioning, and economic model): not only as a product, but also as the infrastructure of the DeFi ecosystem.

Rather than pursuing protocol-layer yield maximization, Ethena prioritizes capital stability, user value retention, and ecosystem coordination. This allows it to build trust and scale, not through aggressive mining or rapid multi-chain expansion, but by establishing itself as a core building block for specific market segments.

Infrastructure Blueprint

Ethena successfully demonstrated the blueprint for the creation of the DeFi track:

-

Achieve infrastructure-grade scale and reliability early – 68.1% market share and 8.23 volatility score

-

Maintaining dominance throughout the market cycle - Maintaining a 76.2% TVL retention rate during major stress events

-

Be the operational standard that defines an entire market segment, rather than competing within one

Critical performance validation

The track was successful:Ethena sparked the ecosystem's emergence from 1 → 29 protocols, maintaining a dominance of 28% despite achieving over 1,000% growth with 68.1 new entrants.

Institutional model:The V-shaped recovery (up 132.7% from the October low), infrastructure-level stability, and continued market leadership reflect traditional infrastructure assets rather than typical DeFi volatility patterns.

Network Effects: Single-chain Ethereum deployments outperform multi-chain competitors, indicating that liquidity concentration outperforms the geographical distribution of infrastructure protocols.

The model has a profound impact

Ethena's trajectory provides a useful reference point for how infrastructure protocols in DeFi can succeed:

-

Not by controlling every indicator, but by choosing the ones that are important to its function

-

Not through broad competition, but by becoming indispensable in narrow, strategically important verticals

-

Not through extraction, but through utility maximization and user value alignment

As DeFi matures and subdivides into specialized infrastructure layers, Ethena's trajectory may no longer be an anomaly and more like a preview of how a sustainable, institutional-oriented protocol will work.

The protocol's success suggests that some verticals, particularly those serving as financial infrastructure, may naturally lean towards a winner-takes-all outcome, which will have long-term implications for DeFi's evolving market structure.

The content of this article is for informational purposes only and does not constitute financial, investment, legal, or tax advice. The views expressed in this article are those of A1 Research at the time of publication and are subject to change without notice. Nothing in this article should be construed as a recommendation to buy, sell, or hold any assets. A1 Research does not guarantee the accuracy or completeness of the information contained herein. Please conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. This article is not financial advice.