$QTO @QuantoTrade perpetual non KYC dex (rebrand OXFUN)

quantoL84tL1HvygKcz3TJtWRU6dFPW8imMzCa4qxGW

I bought a bag of $QTO, reasoning below:

Let’s compare it $Hype, $dYdX, $Aevo, Level Finance.

Quanto $QTO

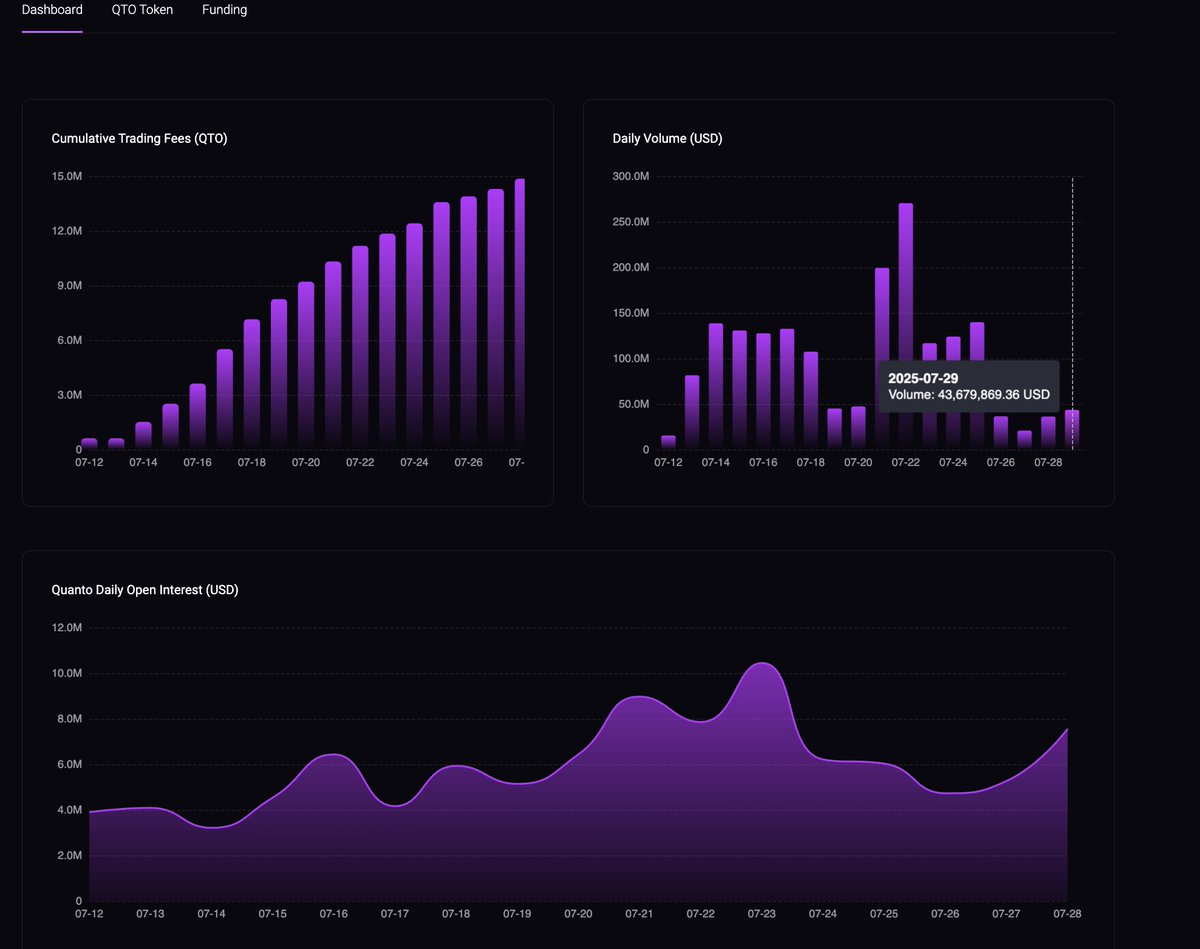

$43M daily volume

$7.5M open interest

No KYC

Source:

Fluctuation obviously, but I took today, which is slightly below average, I assumed this looking at the data (not a lot of data spots though, that's what happens when you are early, we need upwards volume and OI over time)

Let's assume any market cap <$30M for $QTO

Hyperliquid ( $HYPE )

- $12B daily volume

- $10.6B open interest

- Token launched late 2024

- Market cap: ~$15B

- On its own L1

Basically, the Uniswap of perps now

They own ~75% of the on-chain perp DEX volume.

$dYdX

- $500M volume

- $180M OI

- FDV: ~$1.5B

- On $atom

- Battle-tested, but fading slightly in hype

Still a strong player, but not dominating anymore.

$Aevo

- $60M volume

- $25M OI

- FDV: ~$500M

- Perps + options

- Optimism-based

Kinda underrated, but volume still not explosive.

$lvl

- $15M volume

- $5M OI

- FDV: ~$75M

- On $BNB chain

OG DEX with loyal fans

Small but solid.

Compare this to a new (rebranded, shiny) player $QTO, advised by @zhusu $QTO (could use his network to get exposure on X etc, for example @smartestmoney_ one of the best if not best perp traders in crypto follows @QuantoTrade and there are others like @GiganticRebirth)

If FDV is <$30M, then:

- Volume/FDV = 1.4x to 4.3x

- OI/FDV = 0.25x to 0.75x

Based on source:

That’s better than Aevo, Level, and dYdX on a per-dollar basis.

Even stacks up surprisingly well next to Hyperliquid.

Now, $hype is clearly the king, and that won't change anytime soon.

- $12B vol on $15B market cap = 0.8x

- $10.6B OI on $15B = 0.7x

Insane liquidity + usage. Institutions, whales, degens—all in.

But $QTO is showing similar ratios at a microcap scale.

Besides all of this, they are currently buying back tokens daily, basically buying the equity.

They bought back 506k usd as of now, still + 200k usd in their wallet: JBShwQbkqq9dUM6VCKHT5hiWF6hiD7VgxTbkCGsgWXSw

- 21% supply is in a custody wallet

- Team has a 20% alloc vested.

- 20% alloc is reserved.

If they don't sell any of this, just as the buyback wallet then 67% is out of circulation, so circ mcap is give or take 33% -> = 0.33 x 18.2 = 6m usd (lol)

Another good thing is that the UI is actually really great, and some perp trades I know really enjoy the smoothness of the platform.

Obviously, there are some risks with failed/mismanaged projects in the past, that's why I think it's currently flying at a much lower mcap.

Bottom line:

My thesis is that if Quanto’s numbers are organic and sustainable, it’s undervalued compared to Aevo, Level, and maybe even dYdX.

If they keep growing, this could be the best low-cap perp DEX play right now.

X

Shark

just another disclaimer as it might not be clear for everyone, numbers CAN always be not real, this is ALWAYS a risk, especially in crypto.

Usage of the platform on the other side for early users might get rewarded as well, another uncertainty.

I'm betting on the fact that this will get exposure rather sooner than later on social platforms, a mix of fundamentals and speculation.

11.4K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.