Everyone is watching @ethena_labs

If you don't buy $ENA at this price

Are paying attention to

The ONLY token on converage

→ @Terminal_fi on @convergeonchain

🔥 Farm points or locked in 15% fix APR on stables with @pendle_fi

Guide 👇

Before I lose the short attention span bros

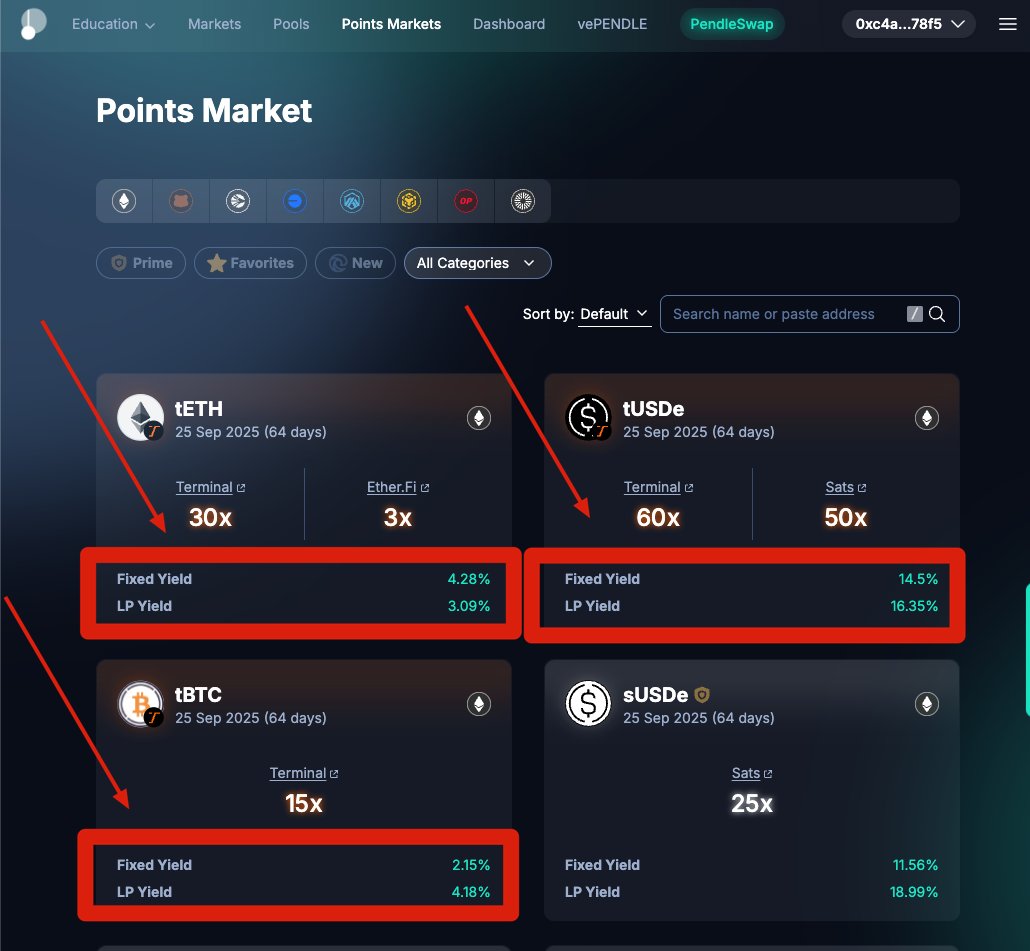

🔹 Opportunities

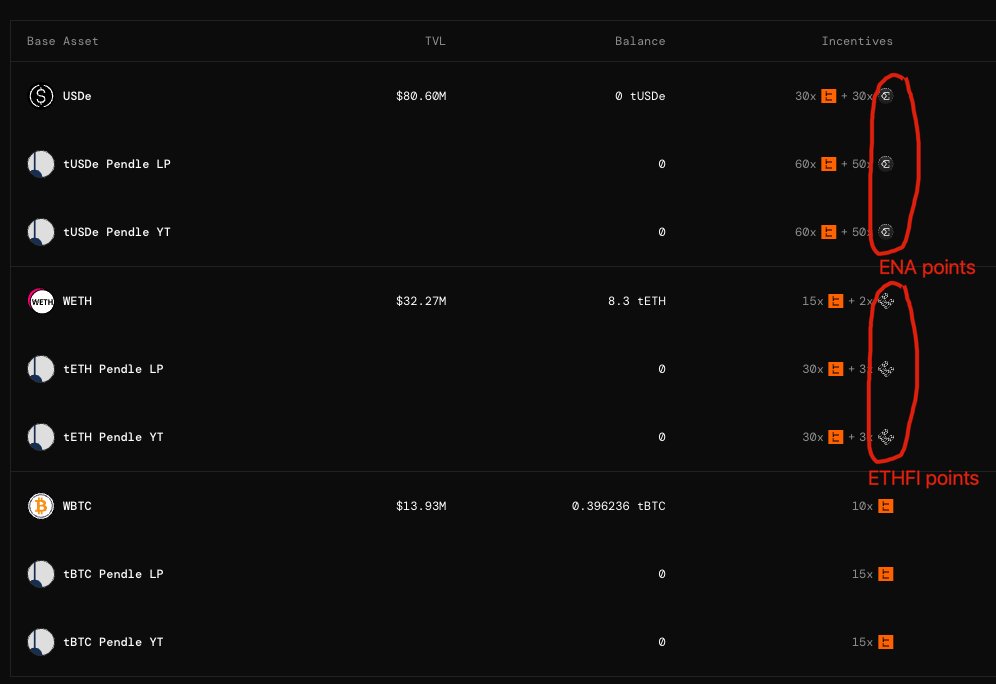

• Farm roots (points) and ENA points for the ONLY token on convergeonchain with stable, ETH or WBTC

• Lock in 14.5% fixed yield on @pendle_fi

• LP on pendle for 16% yield + points

• Buy YT for points speculation

"Terminal is the @convergeonchain liquidity hub for institutional assets and digital dollars."

📊 Why Terminal matters:

• Yield-bearing stablecoins like sUSDe are exploding (500%+ growth in a year)

• Institutions need liquid, scalable venues to trade

• But secondary markets have been thin, illiquid

• Ethena: $300M+ revenue in a year

But secondary markets? Still illiquid.

Institutions need a venue—Terminal is that venue.

Let’s get into how it works.

Terminal uses concentrated liquidity pools (like Uniswap v3) but optimized for yield-bearing stablecoins.

That means LPs provide capital in a specific price range, maximizing capital efficiency and reducing slippage.

Here's the twist:

Yield-bearing tokens (like sUSDe) naturally grow in value over time vs their base token (USDe).

This causes a unique "impermanent loss" due to yield accrual.

Terminal doesn't ignore it — it captures it.

Yield is treated as protocol revenue.

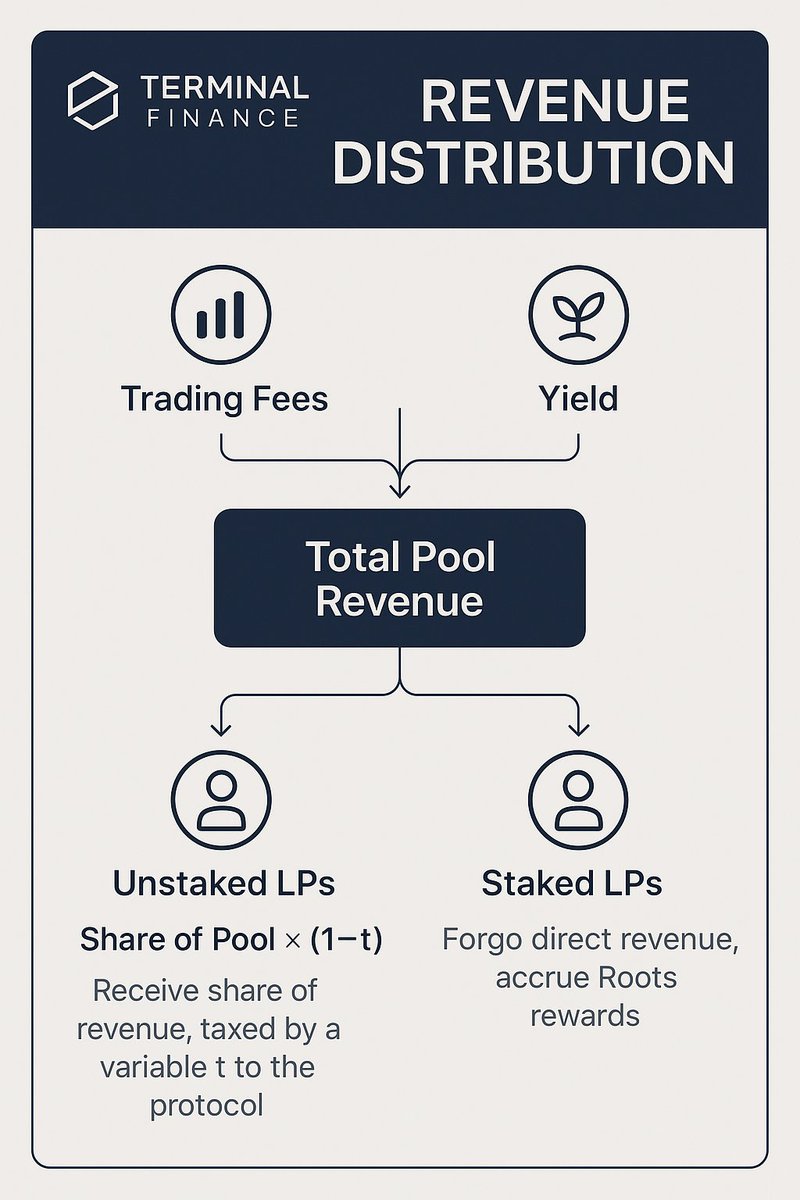

This revenue is split in two ways:

🔹 Unstaked LPs

→ Earn trading fees + yield immediately

→ Less protocol incentive

🔸 Staked LPs

→ Forego immediate yield

→ Earn Roots – Terminal’s point system, with real value in the ecosystem

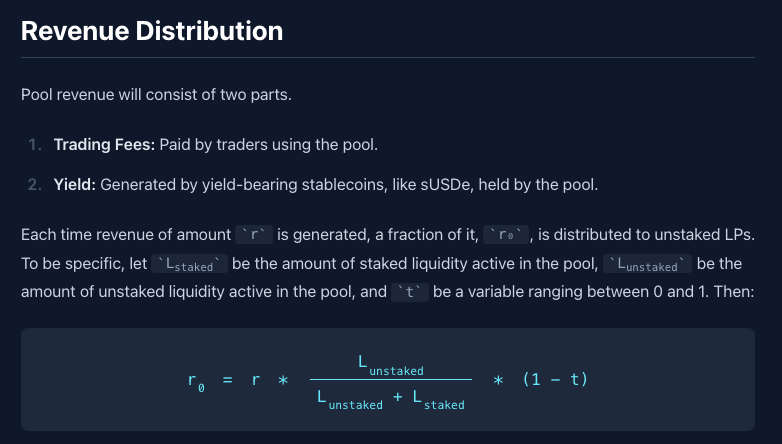

The math behind it:

Each pool has a tax mechanism on unstaked LPs.

The “foregone” yield is routed to reward staked LPs with Roots.

This encourages long-term liquidity provisioning and aligns incentives with the growth of the Terminal + Converge stack.

📈 What are Roots? points points points

Terminal’s incentive layer.

Points earned scale linearly with deposit size and time.

In Session 1, you can:

• Deposit USDe, WETH, or WBTC

• Receive tUSDe, tETH, or tBTC receipt tokens

• These form the launch trading pairs on Terminal

Some detail why this farm is good

• No lock-ups

• Withdraw anytime (except right before bridging)

• Boost multipliers:

→ Ethena: 30x

→ @ether_fi : 3x

Early movers are being rewarded.

TL;DR:

Terminal =

• Uniswap v3-style AMM

• Designed for yield accrual + trading

• Revenue = fees + stablecoin yield

• LP options: short-term (fees) or long-term (Roots)

• Launching with Converge mainnet

• Ethena-powered

• likely becomes one of the top RWA beta

Feed my village with my referral code

38.02K

32

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.