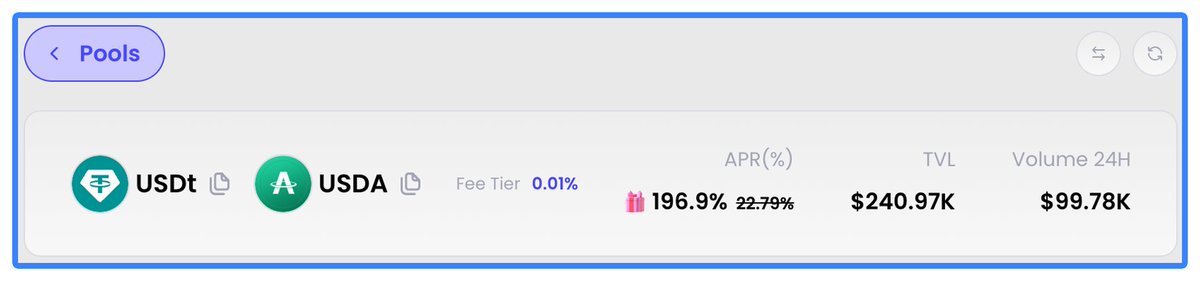

Little Mine: Stablecoins with over 190% APR?

Recently, community members have been discussing this in the group, and I just took another look at this coin and did some research.

The APR mainly comes from Hyperion's subsidies, and USDA is a new protocol launched by Auro. Currently, the TVL is 1.9M, and I can't find any relevant financing or background information.

Its minting method is not new; it involves collateralizing APT or LST APT assets and then borrowing to mint.

What piqued my interest is, on one hand, the APR, and on the other hand, the simple and memorable name USDA.

The stablecoin that I am most familiar with that is minted in a similar way is lisUSD, but it is not as eye-catching. Lista is mainly to blame for not naming it well; if it were called USDB, it would be much better (originally, Binance's stablecoin was called BUSD), haha.

However, the stablecoin minted by Lista can also use non-public chain native tokens. If it could only use BNB or LST/LRT BNB or wrapped BNB to mint stablecoins, combined with financing from public chain backgrounds, it should perform more relevantly.

Using public chain native tokens for collateralized borrowing to mint stablecoins can also serve as another way to lock in and increase public chain TVL, and stablecoins are already a major trend.

I estimate that in the future, all public chains will have their own supported stablecoins, which can only be minted by collateralizing the public chain's native tokens.

Note: The above is for information sharing only and is not investment advice. Please do your own research!

DeFi Enthusiast: BitHappy

Show original

9.88K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.