First dartboard call was a win (not trading this, scalping ranges, just testing market sense)

Let's see if 108.3 by tomorrow.

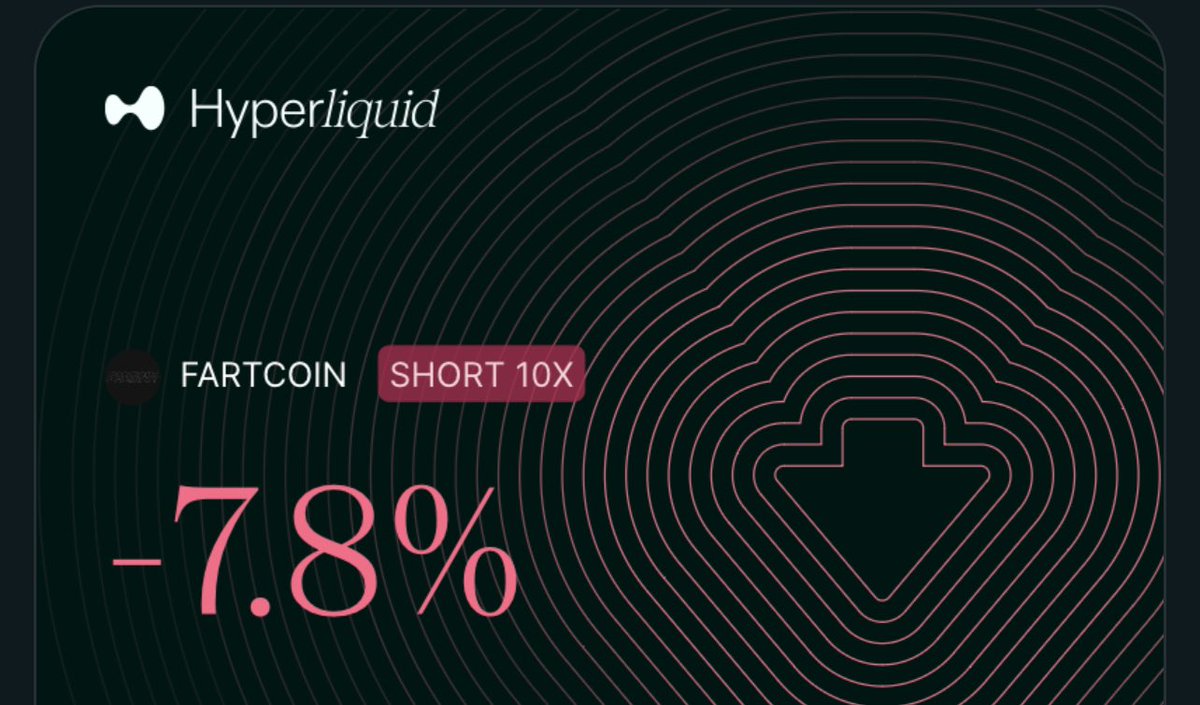

Macro bullish but not convinced the PvE goat runs tonight. Shorted top purple

Sunday night so I'm guessing insomnia wakes me early

Here's hoping DipWheeler's Asia sleeper cell agents don't liq me tn

Think if I had to assign a confidence level to this short would be ~25%

Ye felt too retarded shorting that. Took the DD

Could've closed in profit but related problem I'm trying to work through

Related text on what I'm trying to work through for shorts cashpoint

I'm not really sure what to do. Shorting is on par with my SOL "fully fill and cut half" FTX PTSD

LCR helped me fix my leverage aversion

maybe I should load up a new speciality LCR account specifically for holding shorts to target

My TP was 1.23 so would've made ~4:1. Prime example of why I need to work on risk tolerance for shorts

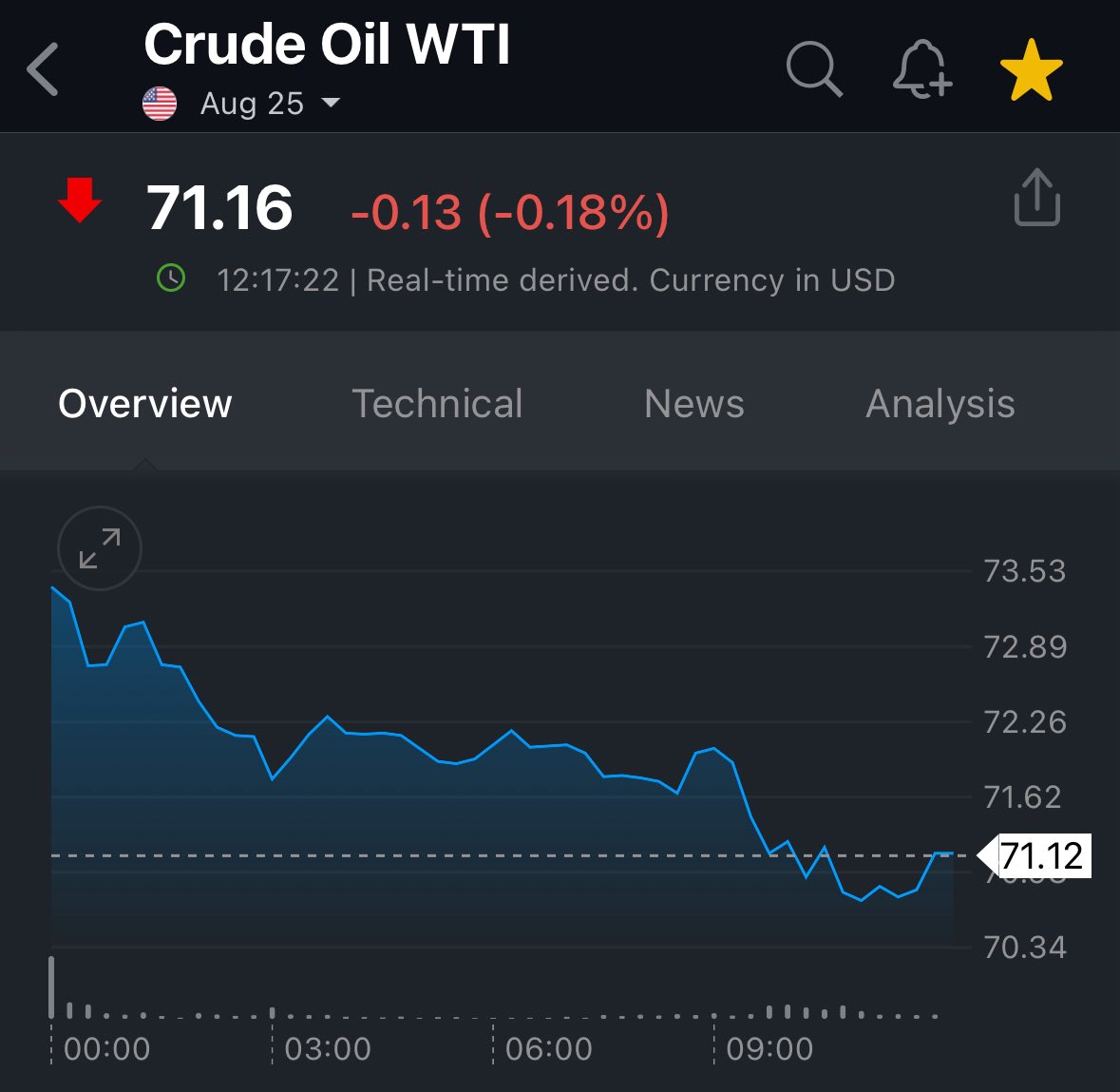

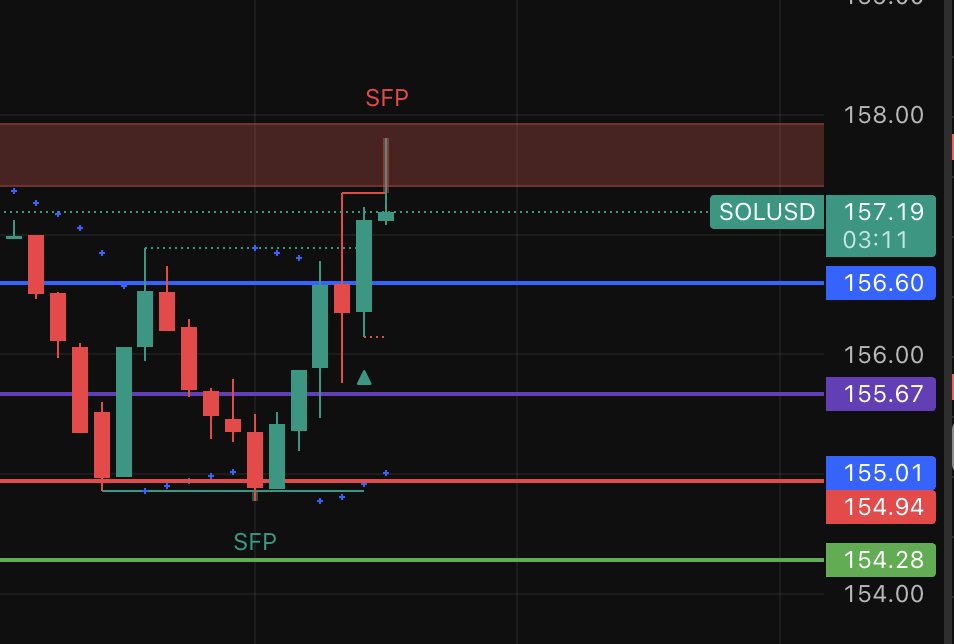

Expected SOL to dip more last night

Just bought FART 1.24 and SOL 155

Waiting for open to see whether I need to cut or not but seems like market is bullish overall. 180 in sights if true (I'm a ticket tout so won't hold that long, but comfy regardless)

@glu3sniffer Cut FART long don't wanna be double directionally exposed. Leaving SOL long til open

The mad lad bought another billy:

@glu3sniffer SFP printed on 1H. Looks like lower

CB filed spot SOL ETF. Idk how much this impacts price tho; people don't seem to buy ETF news any more

We've always been a "buy the dip, sell the news" industry but ETF's used to give us a pop on coins yrs ago

@glu3sniffer Went lower but firm rejection off red line. Bodes well

Open in 2min

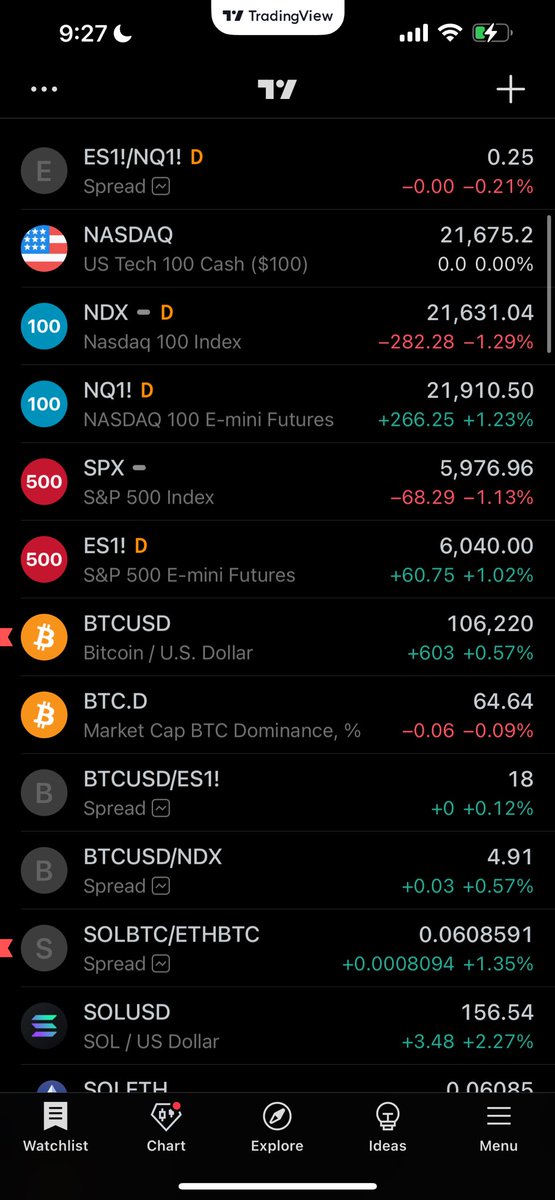

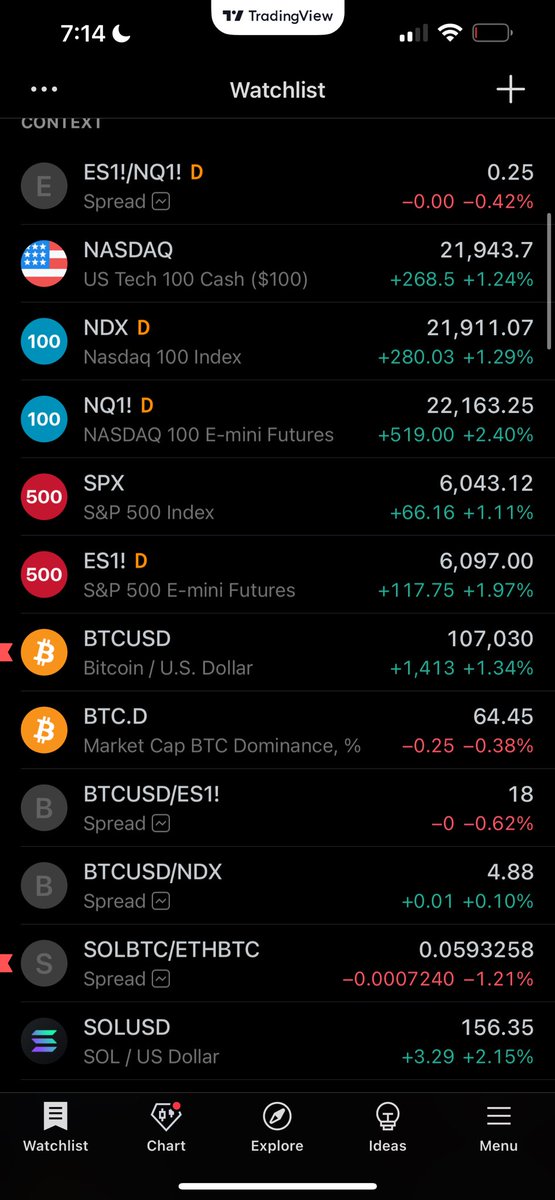

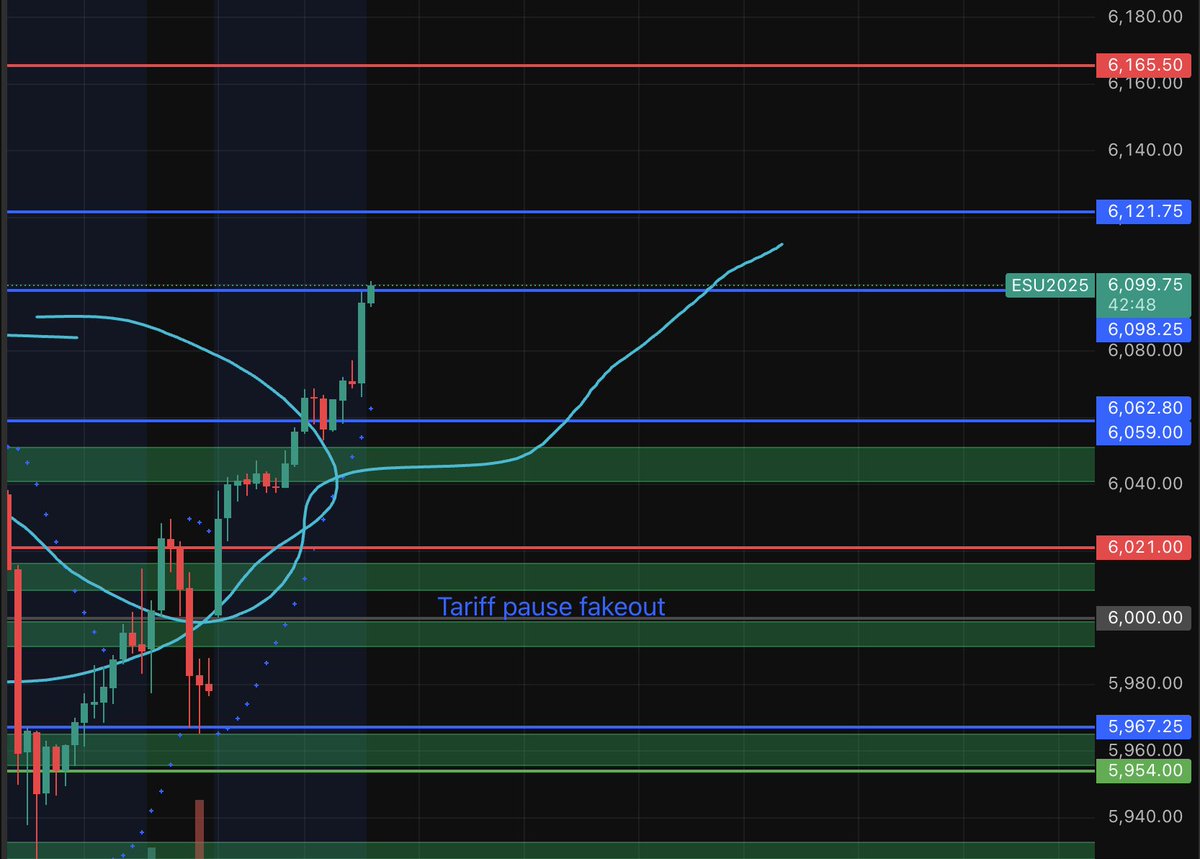

@glu3sniffer SPX > 6033 and ES not waffling

While BTC > 107

Love to see it

@glu3sniffer ES feels overextended here

target for week is 6121 so already >6100 makes me uncomfy idk why (should just be happy about it lol)

@glu3sniffer SOL stuck in this ugly uber-tight range rn

Holding rn cuz i think it might be accum under resistance before break up to >160

SOLBTC/ETHBTC premium -1%

Expected SOL to outrun ETH today but should've bet on the other horse it seems

@glu3sniffer Bounce or alt death

2.41K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.