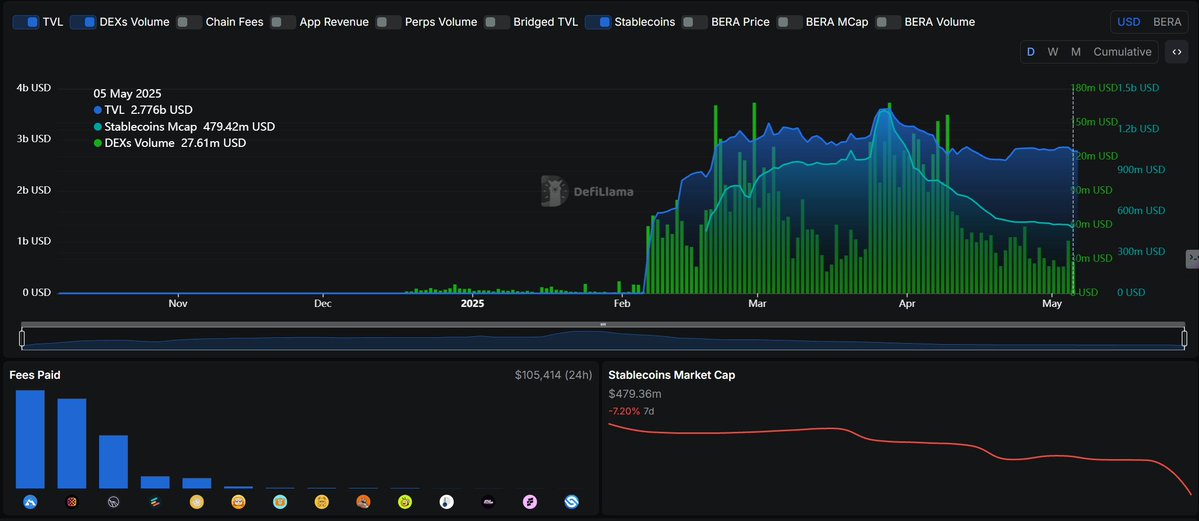

Berachain has seen outflows from both TVL and stablecoins in the past week, and the focus is currently on tonight's Boyce unlock. My personal view is that the short-term ecology has suffered a strong setback, and the long-term development pain points have not been solved 👇

Boyce unlocks the impact

1. More than half of TVL will continue to flow out: Boyce's assets are mostly BTC, ETH, and U, and BearChain cannot provide attractive income opportunities outside the second pool. Depositors tend to have negative emotions and are not motivated to continue participating.

2. $BERA short-term short-term counterattack 3 knives, but lack of reversal momentum. If the $BERA is forcibly raised and the underlying problem is not solved, the current long-to-short ratio of Binance will only make smart DeFi Farmers more hungry if they rely solely on chips to trade.

In the long term, three issues remain unresolved

1. $BERA is a pure consumable: Both LST protocols and DeFi Farmers essentially use high bribery efficiency to extract value from BearChain.

2. Unhealthy emissions distribution: Nearly half of the $BGT emissions go to $BERA or its and $BGT LST as vaults for deposited assets, and there is a lack of other assets with users and trading volume.

3. More than half of the bribes come from derivatives of $WBERA and $BGT and $HONEY, and the bribery asset structure is unhealthy.

In short, sooner or later, the mine will collapse.

What does BearChain need to do to achieve nirvana? A few points in vain

1. Achieve a healthier emissions and bribery structure. Limit the power of nodes through rules, decentralise emissions, and limit the proportion of emissions in pure BERA and BGT derivatives matching pools.

2. Limit the cap on emission rights held by some nodes.

3. Introduce more high-quality projects. Other protocols are encouraged to migrate liquidity over and incentivise these assets that already have a user and volume base to leverage the POL flywheel. Since it is going to be dug up, why not use it to attract investment?

Finally, I still hope that BearChain can go out of a different way, if the market-driven, decentralised incentive structure does not work, it means that it still has to rely on centralisation to issue incentives, and it will return to the old road of public chain DAO governance.

Show original

19

20.57K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.