Circle plummets by 15%, can stablecoins still play stably?

Author: Gelong

I woke up early this morning and saw the first share of the popular Spicy Chicken stablecoin in the U.S. stock market, Circle, plummeting 15%, and immediately went to ask a friend of mine, because he sold a put of 200 expiring on June 27, and last night the price of this was dying and sat up in shock.

Yesterday's 11.6 billion transaction of Tianfeng Securities in A-shares, repeatedly fried the board, the long and short game was extremely intense, and the leading brother Guotai Junan International, which stimulated this wave of brokers, plummeted nearly 15% yesterday. The plunge of the Circle in the evening, the bulls in these tickets are probably going to be uneasy.

So what exactly is a stablecoin? Is it a wave of hype, or is it a future megatrend?

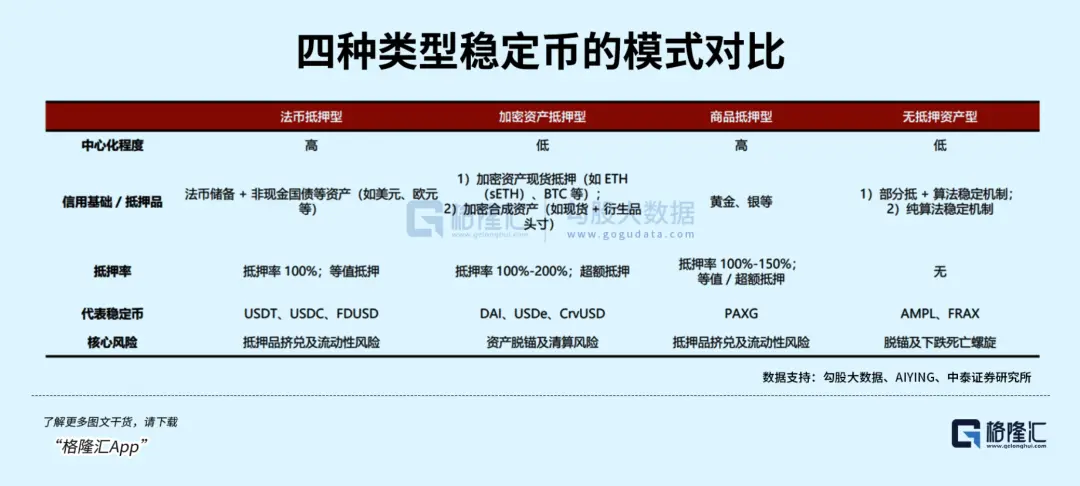

Stablecoins, as the name suggests, are coins with relatively stable prices. It's a cryptocurrency, like Bitcoin. The difference is that its price is tied to some kind of stable asset. Generally, there are four types of stablecoins, of which the fiat-backed type is the largest.

As a simple example, you give $1,000,000 to Circle, and Circle mints 1,000,000 USDC worth in your wallet. The USDC it issues must be collateralized by the assets it owns, and its collateral assets are generally fiat currency (such as the US dollar) or short-term US bonds.

Because of this 1:1 peg, stablecoins such as USDC have basically achieved stable currency value. Of course, it also had a brief plunge, that is, in March '23, because Circle had $3.3 billion in Silicon Valley Bank in the United States, and the bank suddenly closed, causing panic in the market, and USDC fell to $0.88-0.92 at one point. However, the anchor was restored in the next two days, as the Fed and FDIC guaranteed depositors to pay in full.

Many people may have a puzzle as to why I should give 1 million to Circle in exchange for an equivalent stablecoin. You know, Circle doesn't pay interest on the 1 million you give (the latest "genius" bill in the United States explicitly prohibits it from paying interest), and it can use the 1 million to buy short-term U.S. bonds, so as to obtain interest income. It is equivalent to prostituting an interest-free amount of money for nothing, how can there be such a good thing in the world?

This brings us to the trading of cryptocurrencies such as Bitcoin. Before there were stablecoins, users who wanted to buy bitcoin had to use fiat currency, and the conversion between fiat and bitcoin had to go through a bank, which was very difficult, slow and expensive at the time. The buying and selling of bitcoin must wait for the buyer to be ready to make money, and the money can only be released when the money arrives, which is extremely inefficient. At the same time, the trading infrastructure is immature, the quotations of BTC on various exchanges vary greatly, and there is a lack of an intermediate bridge to move bricks across platforms.

This led to the illiquidity of cryptocurrencies such as Bitcoin in the early days. Stablecoins are born from the satisfaction of this demand, and its core significance is to break through the liquidity barriers of cryptocurrency transactions, which can be quickly matched with Bitcoin on an exchange platform, and stablecoins can also quickly transfer funds across chains and exchanges. In addition, stablecoins have the benefit of protecting the privacy of digital currency investors. After the emergence of stablecoins, it is equivalent to building an isolation barrier between Bitcoin and bank accounts, blocking the association of sensitive information.

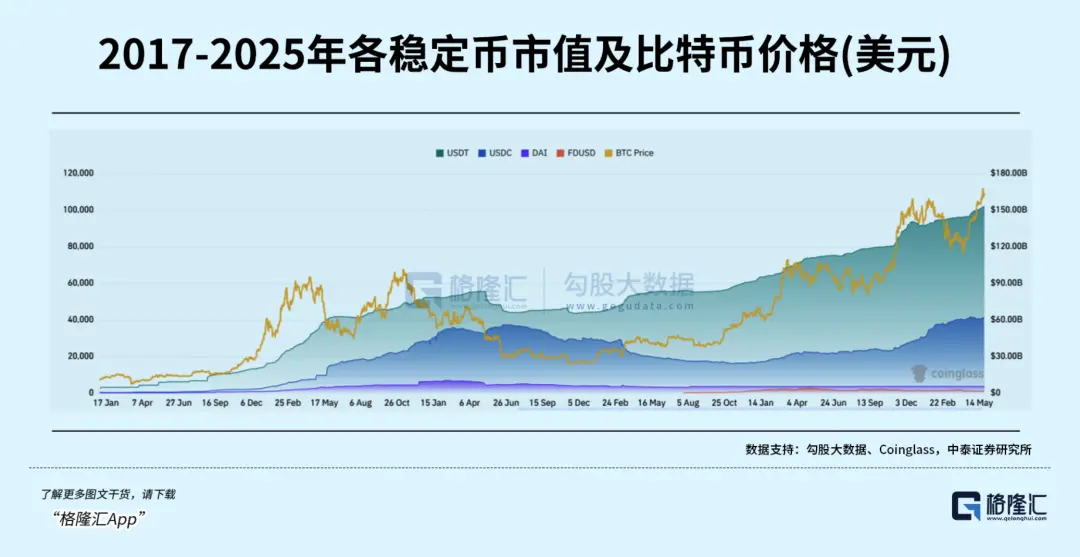

So you can see that the scale development of stablecoins is basically in sync with the price of Bitcoin. The higher the price of Bitcoin, the more it stimulates the expansion of Bitcoin, and more people want to participate, which stimulates more demand for stablecoins.

It can be said that stablecoins are born out of the trading demand of cryptocurrencies such as Bitcoin.

At this point, you may be aware of a problem. We now want to engage in RMB stablecoin, maybe there is no shortage of technical facilities, but there is a lack of scenes, what do I do with RMB stablecoin? Send a little association to sigh, when Nvidia's graphics card is our neck, everyone traces the antecedents and finds that it may be because of the butterfly effect of our banned games back then. If the development of RMB stablecoins lags far behind in the future, the reason for this may not necessarily be traced back to the ban on cryptocurrency trading in 2021.

If stablecoins only stay on the trading needs of cryptocurrencies, in fact, it doesn't matter if we engage in it or not, this kind of evil capitalist speculative trading is not engaged. But the use of stablecoins in another scenario portends a potential reshaping of the global monetary system in the future.

This scenario is cross-border payment. Stablecoins can be used as an efficient settlement tool to support instant and low-fee transactions for cross-border transfers and online purchases. Because it is based on blockchain technology, the two parties of the transaction directly interact through the wallet, without the need for intermediary layers such as correspondent banks and clearing institutions in the traditional financial system, and the settlement can be completed within 30 seconds at the earliest and the fee rate is controlled at 0.1%-1%. Banks can take anywhere from hours to days and pay an average of 6% of the combined fees.

It is only a matter of time before high-efficiency and low-cost tools replace low-efficiency and high-cost tools.

As you can imagine, if stablecoins penetrate into the field of cross-border payment in the future, whoever uses stablecoins in large quantities will have the right to speak in the monetary system. At present, by currency, US dollar stablecoins account for almost all of the share, with US dollar stablecoins accounting for 99.8% and the euro accounting for 0.2% as of June 8, 2025.

Contrary to what some have advertised, stablecoins have not weakened the dollar, and dollar stablecoins will greatly strengthen the dollar's position, not the other way around. The dollar stablecoin gives residents of these countries another option to obtain dollar-level assets and enjoy stability without having to be as frightened as if they were placed on bitcoin (bitcoin goes up, you pay with it and you feel lost, it falls, your assets shrink).

From this point of view, China will definitely go all out to engage in RMB stable coins, without the transaction scenario of cryptocurrency, it is difficult to say whether it can be done, but it must be chased. And isn't this kind of catch-up the favorite theme of our A-share investors?

Therefore, stablecoins will continue to be a big theme in the future. In the short term, Circle has exploded, and there is a callback demand. Circle fried, purely because of valuation. The total market value of USDC issued by Circle is about $61 billion, and the total market value of Circle's stock price exceeded the market value of USDC at the peak of the stock price before.

Do you know what this concept is?

As I mentioned earlier, Circle's business model is to issue USDC and prostitute a wave of interest-free funds to earn interest income. This is cooler than the bank, which still has to pay interest on the deposit. And the market capitalization exceeds the USDC value, which is equivalent to ICBC's market capitalization exceeding its deposits. ICBC's deposits in the first quarter of 25 are 36 trillion yuan, and imagining ICBC with a market value of 36 trillion yuan is really exciting.

Therefore, after a wave of speculation here, it is very normal to plummet a wave, and it will definitely rise again later.