Understanding MegaETH’s need for speed

MegaETH is an EVM L2 that settles to Ethereum.

What makes it special?

Well…it’s fast.

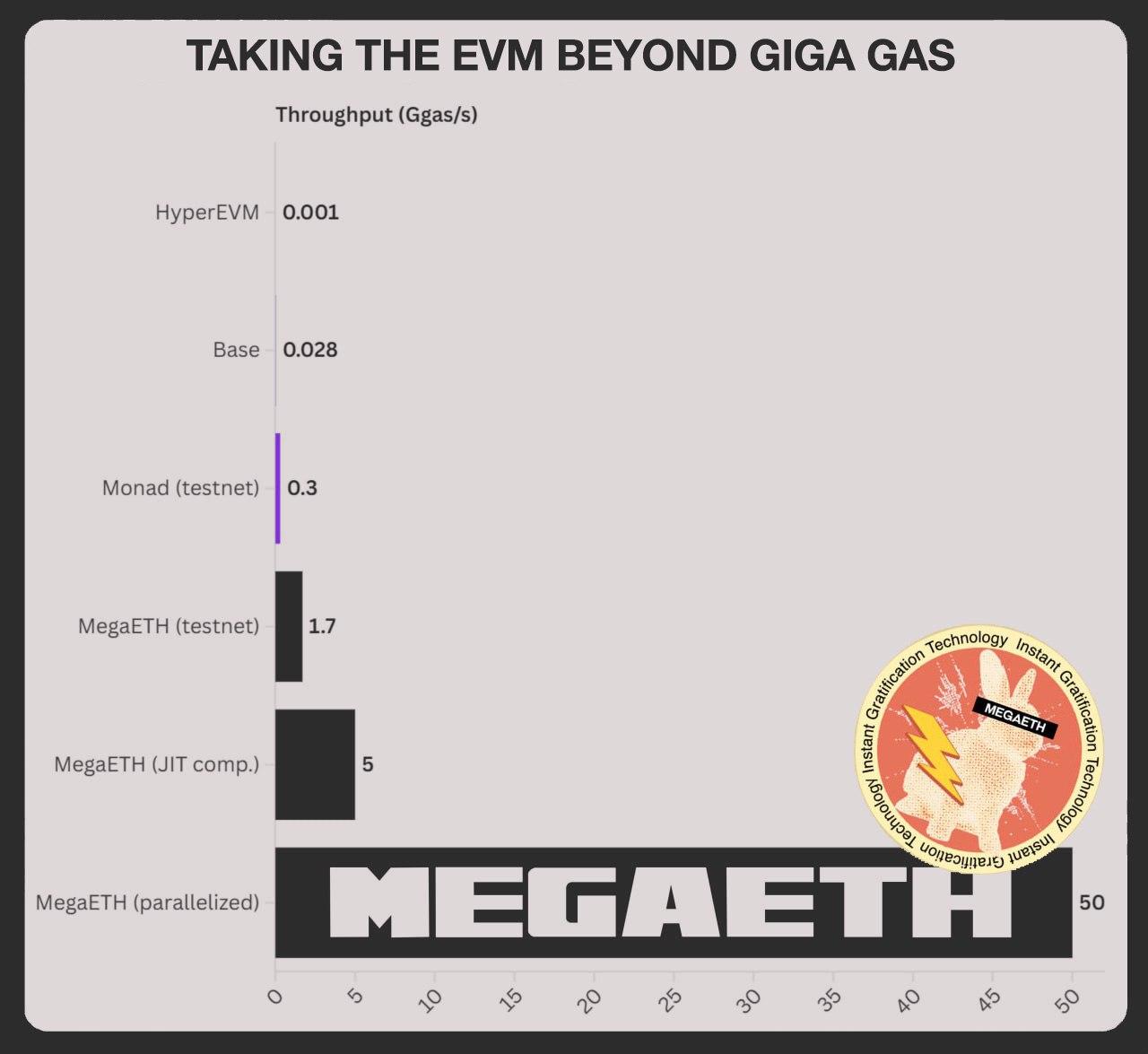

MegaETH markets itself as the first “real-time” blockchain. It theoretically claims to be able to process about 1.7 gigagas/s (or 1,700 Mgas/s) in transaction speeds on its current testnet.

Let’s put that into context.

1,700 Mgas/s completely dwarfs the speeds of the major L2s like Optimism (15 Mgas/s) and Arbitrum (128 Mgas/s).

It also eclipses Base’s announced target goal to hit 1000 Mgas/s, or Monad L1’s 300 Mgas/s.

Source: MegaETH

The chain claims to have 10 ms block times, which seems to check out on its three-week-old testnet’s block explorer.

MegaETH’s secret sauce?

MegaETH makes a few crucial trade-offs on the consensus layer that centralizes block production, or what is sometimes referred to by the team as “node specialization.”

Explained simply, the network uses a single sequencer that is consensus-free. Typically, blockchains have geographically dispersed nodes. The network is more decentralized, but it comes at the cost of latency overhead concerning distributed node consensus. MegaETH’s decision to use one sequencer removes the execution redundancy for nodes to execute all transactions, allowing MegaETH to achieve its very low sub-10ms latencies.

Another technical innovation that MegaETH made is replacing Ethereum’s default Hexary Patricia Merkle Tree with a custom state tree, which allows for up to 10x higher write bandwidth at the cost of full EVM-equivalency.

For a technical overview, listen to the 0xResearch podcast episode with MegaETH founders Lei and Namik.

MegaETH ecosystem

Unlike most chains raising at billion-dollar valuations from VCs, MegaETH has sought to signal community alignment by enabling retail access to its rounds at attractive valuations.

In December 2024, MegaETH opened its round at a $200 million valuation to retail investors on Echo, raising about $10 million in a record two-to-three minutes. Subsequently, MegaETH also raised 10k ETH in its “Fluffle” soulbound NFT sale, equivalent to about 5% of the MegaETH token supply.

MegaETH had previously raised $20 million in June 2024 from VCs in a seed round backed by Dragonfly and which included angel investors such as Ethereum co-founders Vitalik Buterin and Joseph Lubin.

Also of note is how MegaETH’s apps have together seemingly raised more money than the MegaETH protocol itself. This indicates investor belief in the MegaETH application layer, which suggests the blazing fast performance of the MegaETH protocol may be creating uniquely new apps that can’t be built elsewhere.

Such notable apps include the GTE DEX, the TikTok-gamified derivatives exchange Euphoria, and CAP, a stablecoin protocol that leverages EigenLayer restaking to outsource stablecoin yield generation.

DeFi apps like GTE and Euphoria in particular leverage “Bolt,” the “fastest oracle ever,” built by RedStone for high-performance chains like MegaETH. RedStone claims Bolt will be able to push new prices onchain at a speed of ~every 2.4 ms — making it the only oracle fast enough to keep up with MegaETH.