For the first time, real money, real companies, and real regulation are colliding.

𝘚𝘱𝘰𝘳𝘵𝘴, 𝘱𝘰𝘱 𝘤𝘶𝘭𝘵𝘶𝘳𝘦, 𝘧𝘪𝘯𝘢𝘯𝘤𝘦 𝘦𝘷𝘦𝘳𝘺𝘵𝘩𝘪𝘯𝘨 𝘪𝘴 𝘣𝘦𝘤𝘰𝘮𝘪𝘯𝘨 𝘵𝘳𝘢𝘥𝘢𝘣𝘭𝘦.

Miss this wave, and you’ll miss one of the biggest shifts in markets this decade👇

-----------------------------------------------

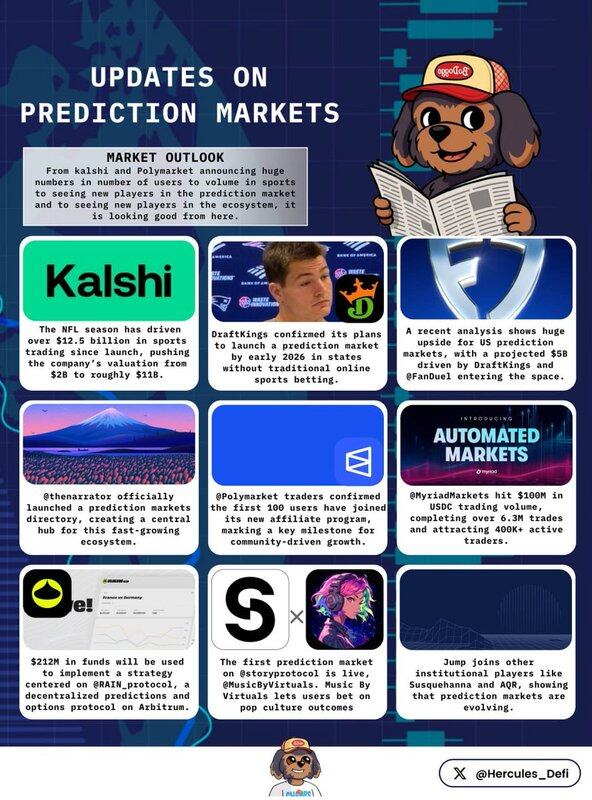

➢ @Kalshi is seeing explosive growth in sports-based prediction markets. The NFL season has driven over $12.5 billion in sports trading since launch, pushing the company’s valuation from $2B to roughly $11B in just a few months.

-----------------------------------------------

➢ Prediction markets took center stage at the Truist Securities GLL Summit in Boston, with big gaming operators watching closely how online leaders are rolling out event-contract products.

-----------------------------------------------

➢ @DraftKings confirmed its plans to launch a prediction market by early 2026 in states without traditional online sports betting. They’re expecting better margins thanks to fewer promotions and a stronger fee structure compared to regular sportsbooks.

-----------------------------------------------

➢ A recent analysis shows huge upside for US prediction markets, with a projected $5B total addressable market driven by DraftKings and @FanDuel entering the space.

Roughly $4.4B is expected to come from sports-focused contracts and $600M from non-sports events, mainly in states where online sports betting isn’t yet available.

Analysts expect both DraftKings and FanDuel to join Kalshi, Polymarket, and Robinhood as part of a “Big Five,”

-----------------------------------------------

➢ Jump Trading quietly stepped into prediction markets, becoming one of the first major prop trading firms to make markets on Kalshi.

With Kalshi and Polymarket processing $7.4B in combined volume in October alone, Jump joins other institutional players like Susquehanna and AQR, showing that prediction markets are evolving from niche products to a new Wall Street liquidity venue.

-----------------------------------------------

➢ @thenarrator officially launched a prediction markets directory, creating a central hub for this fast-growing ecosystem.

Projects like Kalshi and Polymarket can register, post jobs, and connect with traders, builders, and creators. With over 200 projects already active, the goal is to consolidate the space and make it easy to find talent and opportunities.

-----------------------------------------------

➢ @Polymarket traders confirmed the first 100 users have joined its new affiliate program, marking a key milestone for community-driven growth. Applications for the second batch are now open, with new slots reviewed on a rolling, case-by-case basis.

-----------------------------------------------

➢ @MyriadMarkets hit $100M in USDC trading volume, completing over 6.3M trades and attracting 400K+ active traders. That’s a huge jump in a few months.

Myriad is expanding across chains like BNB, Abstract, and Linea, partnering with Walrus to store all market data fully on-chain for transparency.

-----------------------------------------------

➢ Enlivex Therapeutics (NASDAQ: ENLV) raised $212M in a PIPE round, becoming the first publicly traded US company to formally adopt a prediction markets treasury strategy.

The funds will be used to implement a strategy centered on @RAIN_protocol, a decentralized predictions and options protocol on Arbitrum.

RAIN lets anyone create and trade markets without permission and features AI-based market resolution plus a token buyback-and-burn model. Enlivex says this gives investors direct exposure to prediction markets through a public vehicle.

-----------------------------------------------

➢ The first prediction market on @storyprotocol is live, @MusicByVirtuals. Music By Virtuals lets users bet on pop culture outcomes (like K-pop charts) via NFTs and the $IP token.

Which updates did I miss?

2,64 tys.

28

Treści na tej stronie są dostarczane przez strony trzecie. O ile nie zaznaczono inaczej, OKX nie jest autorem cytowanych artykułów i nie rości sobie żadnych praw autorskich do tych materiałów. Treść jest dostarczana wyłącznie w celach informacyjnych i nie reprezentuje poglądów OKX. Nie mają one na celu jakiejkolwiek rekomendacji i nie powinny być traktowane jako porada inwestycyjna lub zachęta do zakupu lub sprzedaży aktywów cyfrowych. Treści, w zakresie w jakim jest wykorzystywana generatywna sztuczna inteligencja do dostarczania podsumowań lub innych informacji, mogą być niedokładne lub niespójne. Przeczytaj podlinkowany artykuł, aby uzyskać więcej szczegółów i informacji. OKX nie ponosi odpowiedzialności za treści hostowane na stronach osób trzecich. Posiadanie aktywów cyfrowych, w tym stablecoinów i NFT, wiąże się z wysokim stopniem ryzyka i może podlegać znacznym wahaniom. Musisz dokładnie rozważyć, czy handel lub posiadanie aktywów cyfrowych jest dla Ciebie odpowiednie w świetle Twojej sytuacji finansowej.