Vitalik's latest article: Low-risk DeFi is to Ethereum what it is to search for Google

Written by: Vitalik

Compiled by: CryptoLeo, Odaily Planet Daily

Fora long time, the Ethereum community has faced an important contradiction: "those applications that can bring enough economy to keep the entire ecosystem running, whether it is maintaining the value of ETH or supporting the value of individual projects" and " Those applications that meet people's original intention to join Ethereum".

Historically, these two categories have been very disjointed: the former is some combination of NFTs, memecoins, and a kind of DeFi backed by temporary or recursive forces: people borrow and borrow to get the incentives provided by the protocol, or form a circular argument: "ETH is valuable because people use the Ethereum chain to buy, sell, and trade ETH with leverage." At the same time, there are non-financial and semi-financial applications (e.g., Lens, Farcaster, ENS, Polymarket, Seer, privacy protocols) that are attractive but have very low usage or too little money (or other forms of economic activity) for users to support ETH, a $500 billion economy.

This disconnect has led to many conflicts in communities, and much of the motivation in the community stems from the theoretical hope that an application will emerge that satisfies both conditions. In this article, I will demonstrate that as of this year, Ethereum already has such an application, and it means as much as a search for Google is to Google: The low-risk DeFi goal is to democratize global access to payments and savings for valuable asset classes (such as major currencies, stocks, bonds with competitive interest rates).

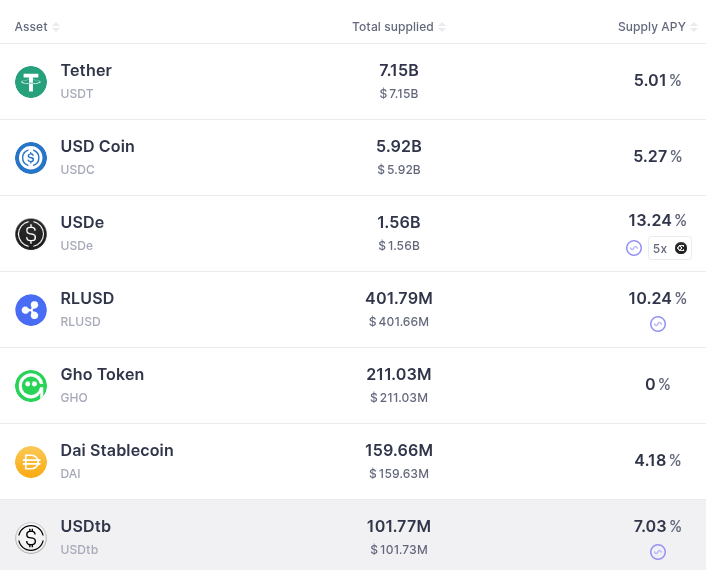

Source: Aave

Theanalogy between Ethereum's low-risk DeFi and Google search is as follows. Google has made many interesting and valuable contributions to the world: the Chromium family of browsers, Pixel phones, artificial intelligence work including the open-source Gemini model, the Go language, and more. But in terms of revenue generation, they are not highly profitable and may even lose money. Instead, Google's biggest revenue streams are search and advertising. Low-risk DeFi can play a similar role for Ethereum. Other applications, including non-financial and more experimental ones, are essential to Ethereum's role in the world and its culture, but they do not need to be seen as a source of income.

In fact, I hope Ethereum can do better than Google. Google has often been disoriented by criticism and has become like the anti-social profit-maximizing company it is trying to replace. Ethereum's idea of decentralization is deeply rooted in its technical and social dimensions, and I believe that low-risk DeFi use cases establish a strong alignment between "doing good" and "doing well" that doesn't exist in the advertising space.

Why low-risk DeFi?

What I mean by "low-risk DeFi includes both the basic functions of payments and savings, as well as easy-to-understand tools such as synthetic assets, fully collateralized lending, and the ability to exchange between these assets.

There are two reasons to focus on these applications:

-

These applications provide irreplaceable value to Ethereum and its users;

-

These applications are culturally aligned with the goals of the Ethereum community, both at the application level and in the technical features of L1.

Why is DeFi Valuable Now?

Historically, I've been skeptical of DeFi because it doesn't seem to offer much substantial service; Instead, its main "selling point" seems to be making money by trading highly speculative tokens (Ethereum's highest single-day fee revenue came from a poorly designed BAYC otherdeeds auction) or earning 10% to 30% through yield farming incentives.

One of the reasons for this is regulatory hurdles. Gary Gensler and others are to blame for creating a regulatory environment where the more useless your app is, the safer you are; The more transparent your actions are, the clearer the assurances you provide to investors, the more likely you are to be considered a "security".

Another reason is that in the early stages, the risks (protocol code vulnerability risk, oracle risk, general unknown risk) are too high to make more sustainable use cases difficult to achieve, and if the risk is high, then the only application worth adopting must be the one with higher returns, which can only come from unsustainable subsidies or speculation.

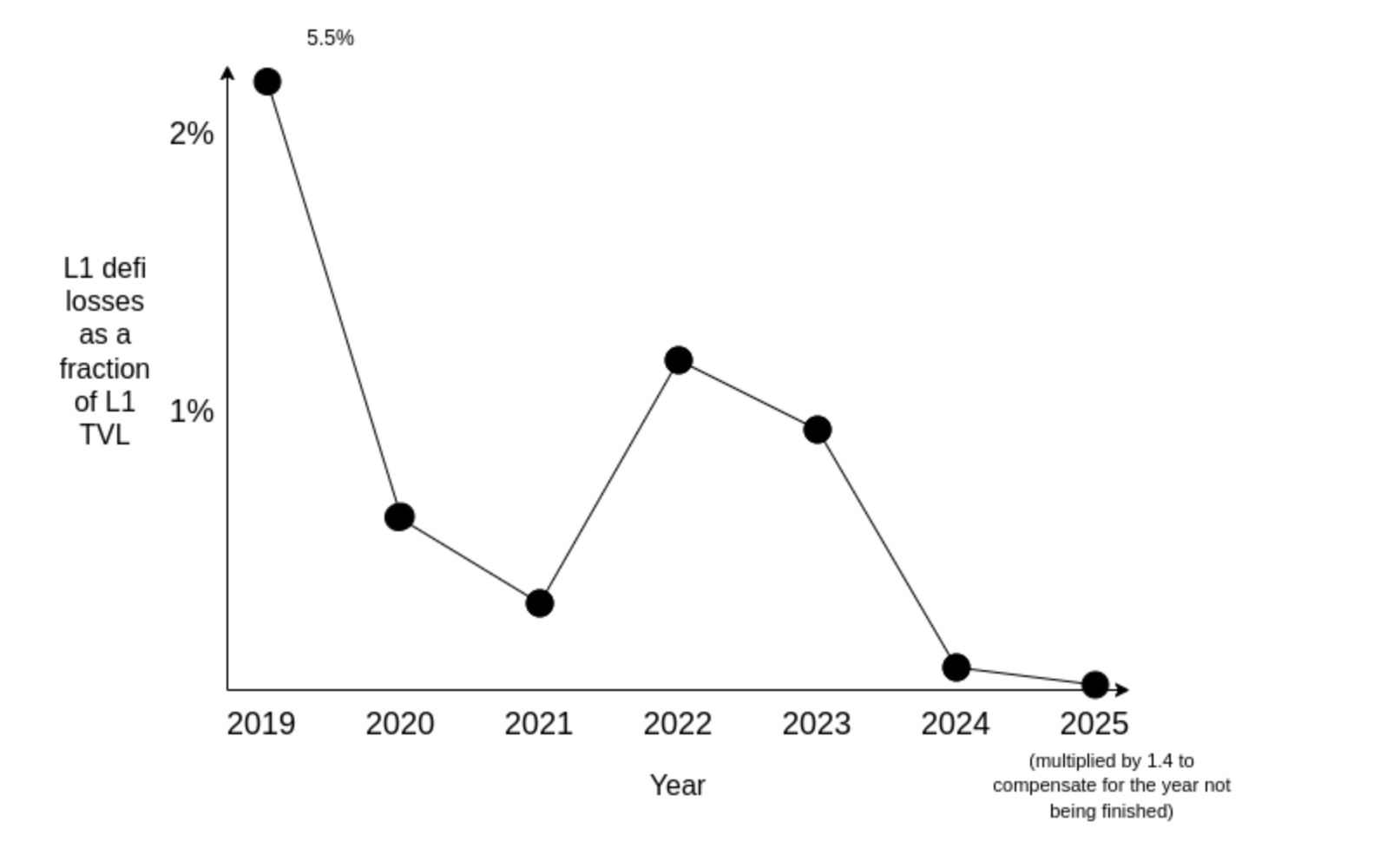

However, as time goes by, the security of the protocol gradually improves, and the risk decreases.

– >

– >

Ethereum DeFi Decline

DeFi attacks and losses continue to emerge. But these events are gradually being pushed to the edge of the ecosystem — a place where users are more experimental and speculative. More robust core applications are currently emerging, and while tail risks that cannot be ruled out still exist, TradFi also has such tail risks – which for many people around the world now surpass DeFi in light of increasing global political instability. In the long run, it is foreseeable that the transparency and automated execution of the mature DeFi ecosystem will make it more stable than traditional finance.

Which "Ourourobus" users are all of this more meaningful? Basically, individuals and businesses who want to enter the global market and buy, hold, and trade mainstream assets in it, but for them, there is no reliable traditional financial channel to achieve these goals. Cryptocurrencies cannot sustainably generate higher yields, but they do have a magical part of allowing economic opportunities that already exist around the world to be accessed without permission.

Why does low-risk DeFi culturally align with the goals of the Ethereum community?

Low-risk DeFi has several advantages that make it an ideal choice:

-

By using ETH as collateral assets and paying high amounts of gas, it contributes economically to the Ethereum ecosystem and token;

-

It has a clear and valuable noble purpose: to enable people to interact economically and accumulate wealth on a global scale without permission;

-

There are no perverse incentives for Ethereum L1 (e.g., over-centralization in pursuit of high-frequency transaction efficiency, which is more suitable for L2)

These are some very good attributes.

Returning to Google's analogy, a major flaw in its incentive alignment mechanism is that ad revenue prompts companies to collect as much data as possible from users and retain ownership of that data. This is contrary to the open source and positive harmony ethos that has historically inspired its more idealization (i.e., win-win for all parties). For Ethereum, the cost of this inconsistency is even higher, as Ethereum is a decentralized ecosystem, so any activity on Ethereum cannot be decided behind the scenes by a few, and it must be a cultural cohesion point to be viable.

A revenue-generating project isn't necessarily the most innovative or exciting application of Ethereum, but it's at least not something that looks unethical or embarrassing. If the biggest application in the Ethereum ecosystem is political meme coins, then you can't seriously say that you are interested in this ecosystem. Low-risk DeFi, which aims to enable permissionless payments and optimal savings opportunities worldwide, is a form of finance that is positively changing the world, as many in poor regions around the world can attest.

What can low-risk DeFi evolve into?

Another important feature of low-risk DeFi is its ability to naturally synergize with, or evolve, many more interesting applications in the future. For example:

Once we build a full-fledged ecosystem of financial and non-financial activities on-chain (see: Balaji's concept of ledger of record), it makes sense to explore reputation-based, low-collateralization lending, which could be a stronger driver of financial inclusion. The low-risk DeFi we build today, as well as non-financial technologies like ZK identity, help achieve this.

If prediction markets become more mature, we may start to see them being used for hedging. If you hold a stock and you believe that a global event is likely to increase the price of the stock on average, and the prediction market for that event is liquid and efficient, betting on that event is a reasonable statistical hedging strategy. Running on the same platform as prediction markets and traditional DeFi will make it easier to participate in such strategies.

Low-risk DeFi is often about making dollars more accessible to people. But most people didn't enter the crypto space to drive the adoption of the dollar. Over time, we can begin to shift the ecosystem to other stable forms of value: baskets of currencies, "stablecoins" directly based on consumer price indices, "personal tokens", etc. The low-risk DeFi we build today, as well as more experimental projects like Circles and various "stablecoin" projects, are all designed to make this outcome more likely.

For all of the above reasons, I believe that a greater focus on low-risk DeFi than Google's search and advertising business allows us to better sustain the ecosystem economically while maintaining cultural and values alignment. Low-risk DeFi is already supporting the Ethereum economy and synergizes with many of the more experimental applications that people on Ethereum are building, which is a project we are all proud of.