New updated mega-thread on 𝑦𝑖𝑒𝑙𝑑-𝑏𝑒𝑎𝑟𝑖𝑛𝑔 stable loops (from highest to lowest Open Interest): 🧵👇

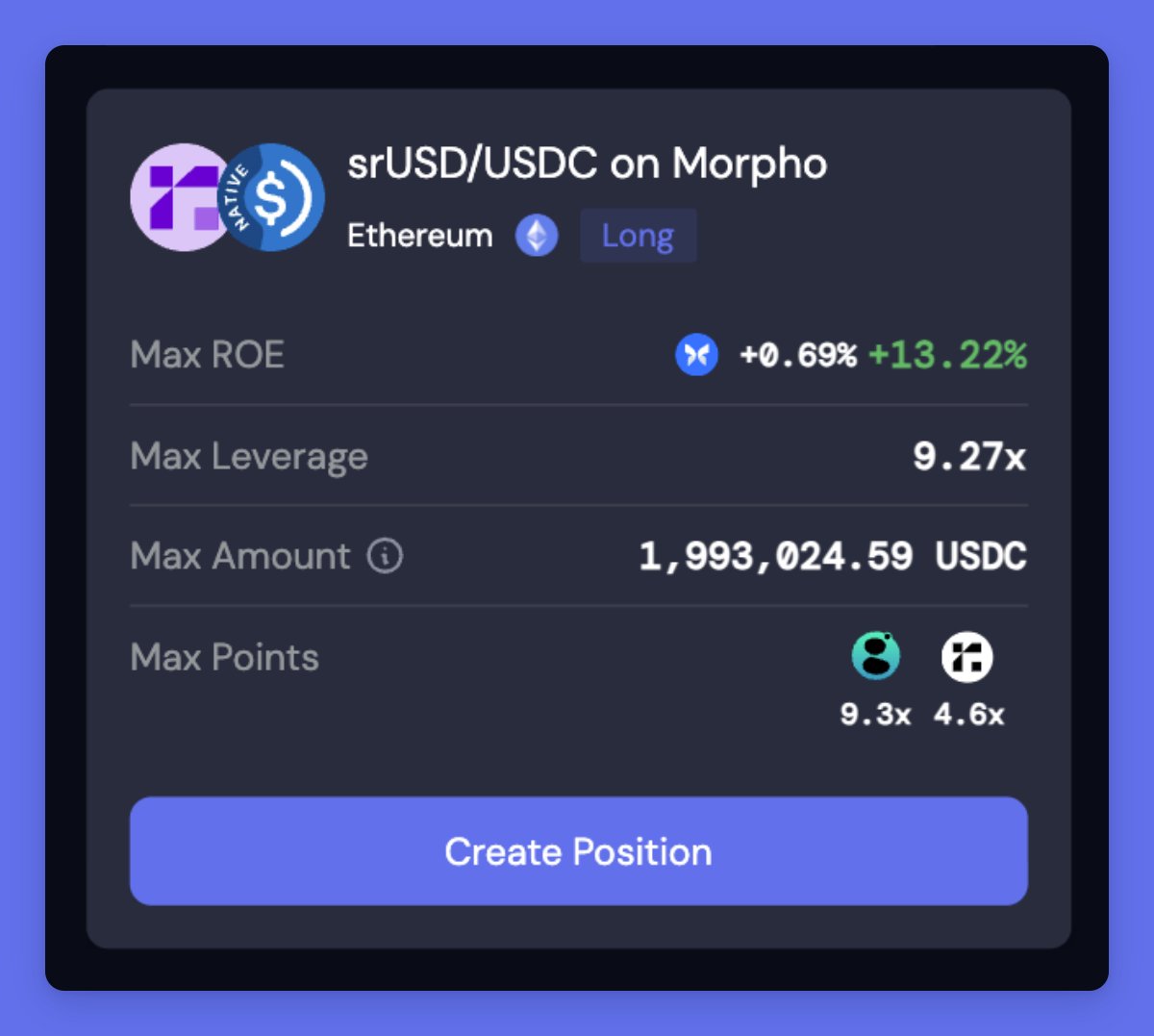

1️⃣ srUSD by @reservoir_xyz ($15.3M OI)

→ Bearing yield comes from T-bills as well as defi lending and delta-neutral strategies (currently ~6.7%).

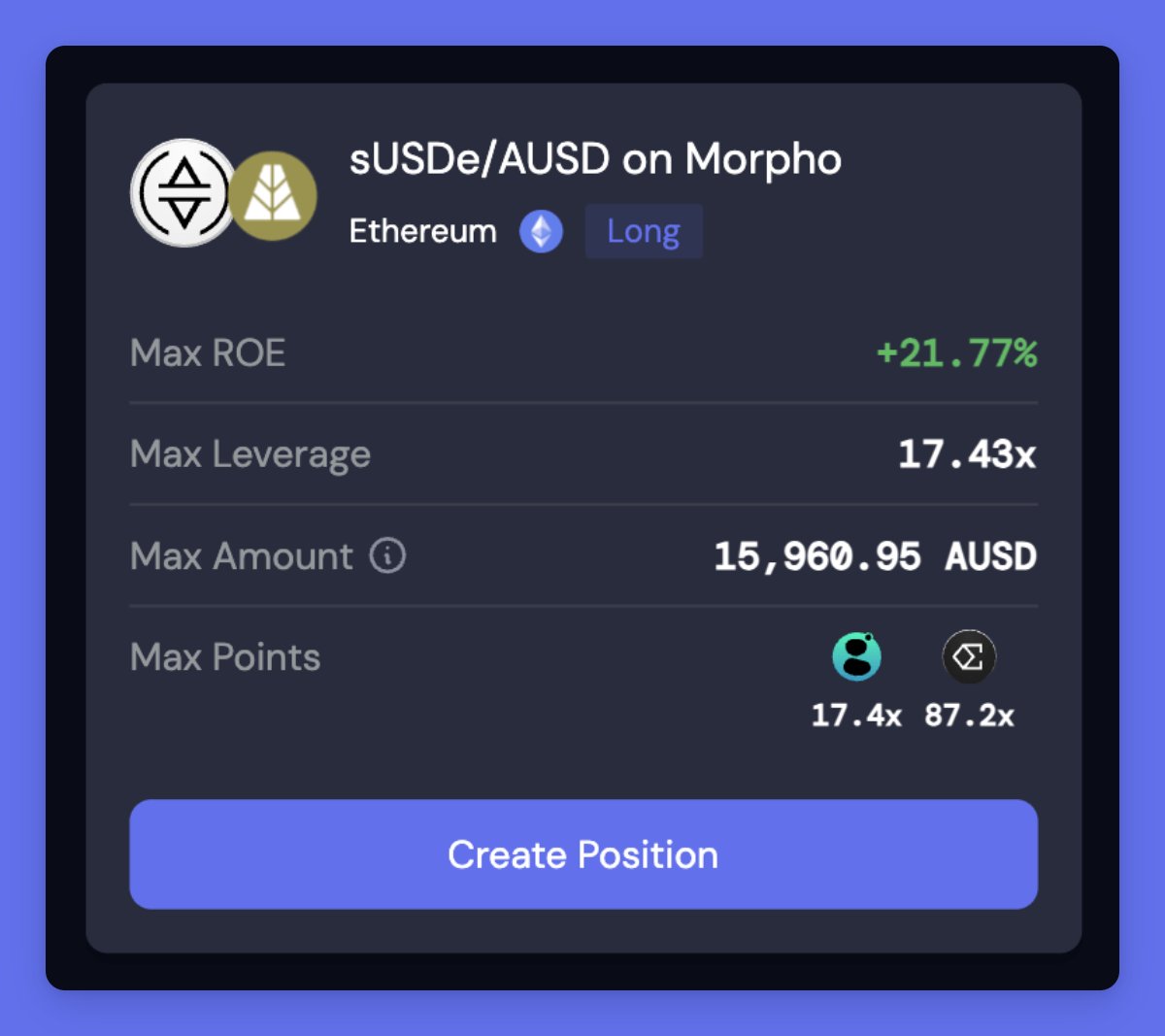

2️⃣ sUSDe by @ethena_labs ($9.2M OI)

→ Bearing yield is generated primarily through delta-neutral strategies involving staked ETH and perpetual futures (currently ~4%).

3️⃣ slvlUSD by @levelusd ($3.7M OI)

→ Bearing yield is generated from USDC and USDT reserves deployed into in lending protocols (currently ~5.3%).

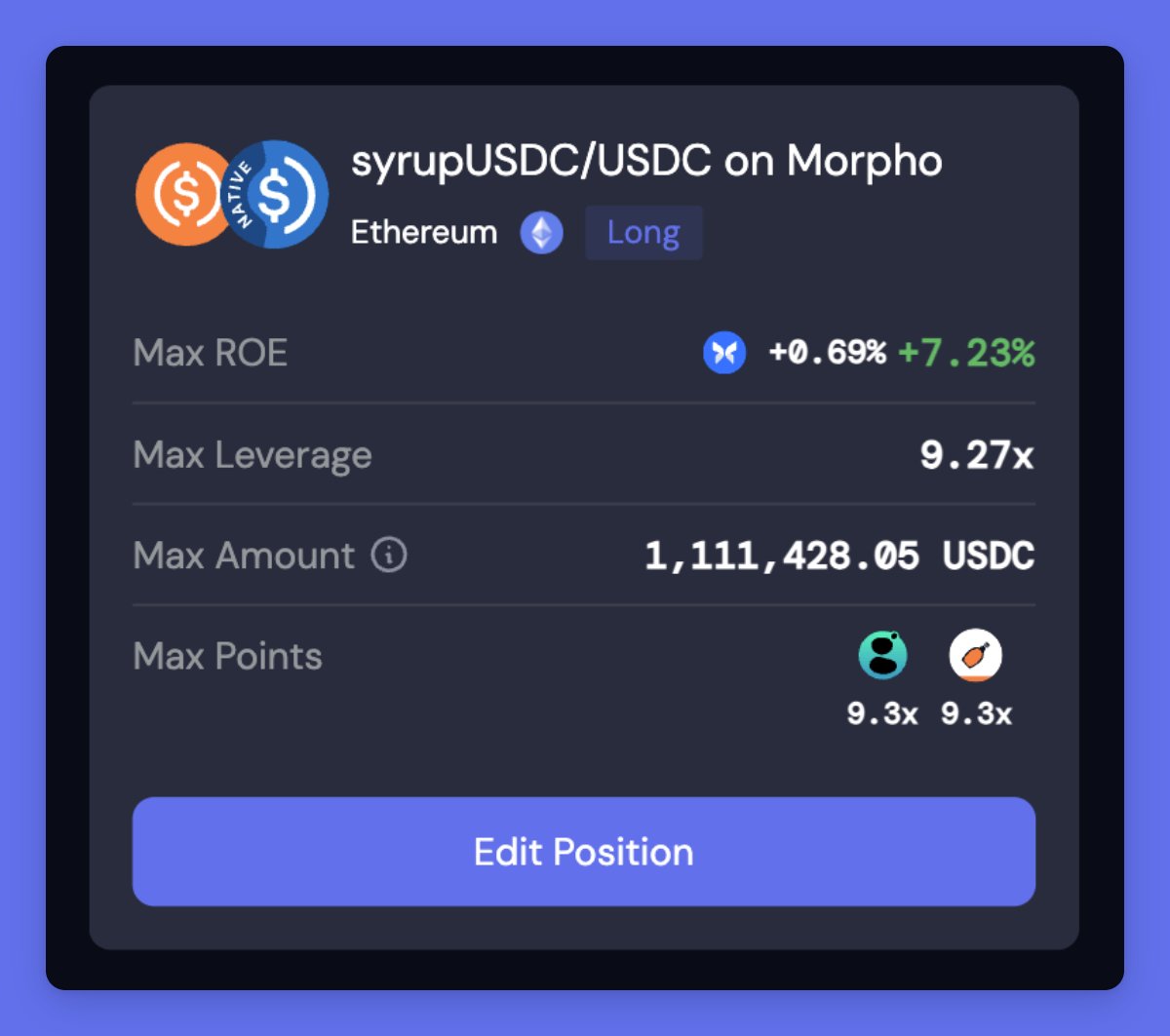

4️⃣ syrupUSD by @maplefinance ($2.3M OI)

→ Bearing yield comes from fixed-rate, overcollateralized loans to institutional borrowers (currently ~6.3%)

6️⃣ sexyDAI by @gnosischain ($1.3M OI)

→ Bearing yield comes from the xDAI bridge earning the DSR (currently ~5.22%).

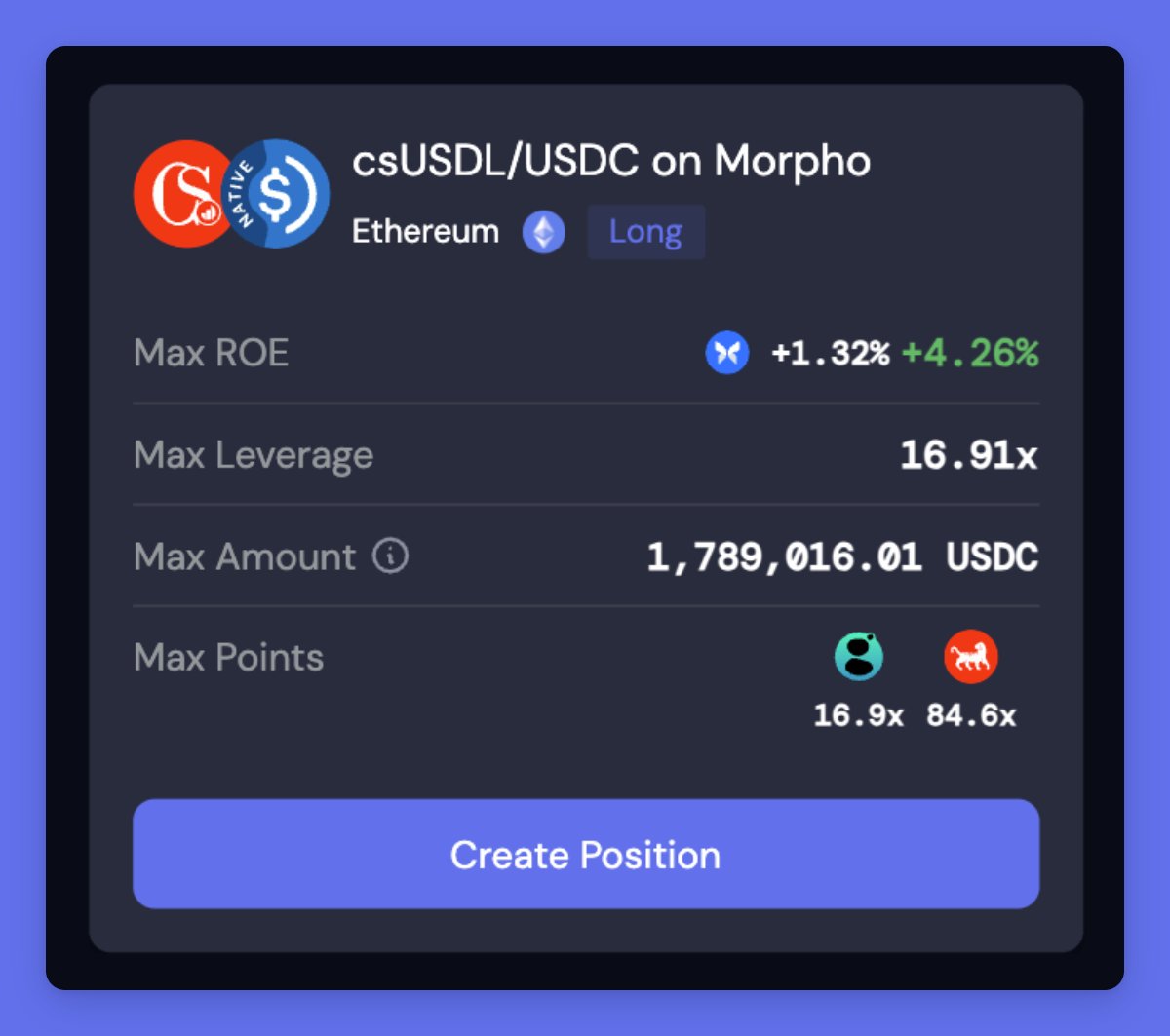

csUSDL by @0xCoinshift ($1.2M OI)

→ Bearing yield comes from T-bills and onchain returns via Morpho Blue (currently ~4.4%).

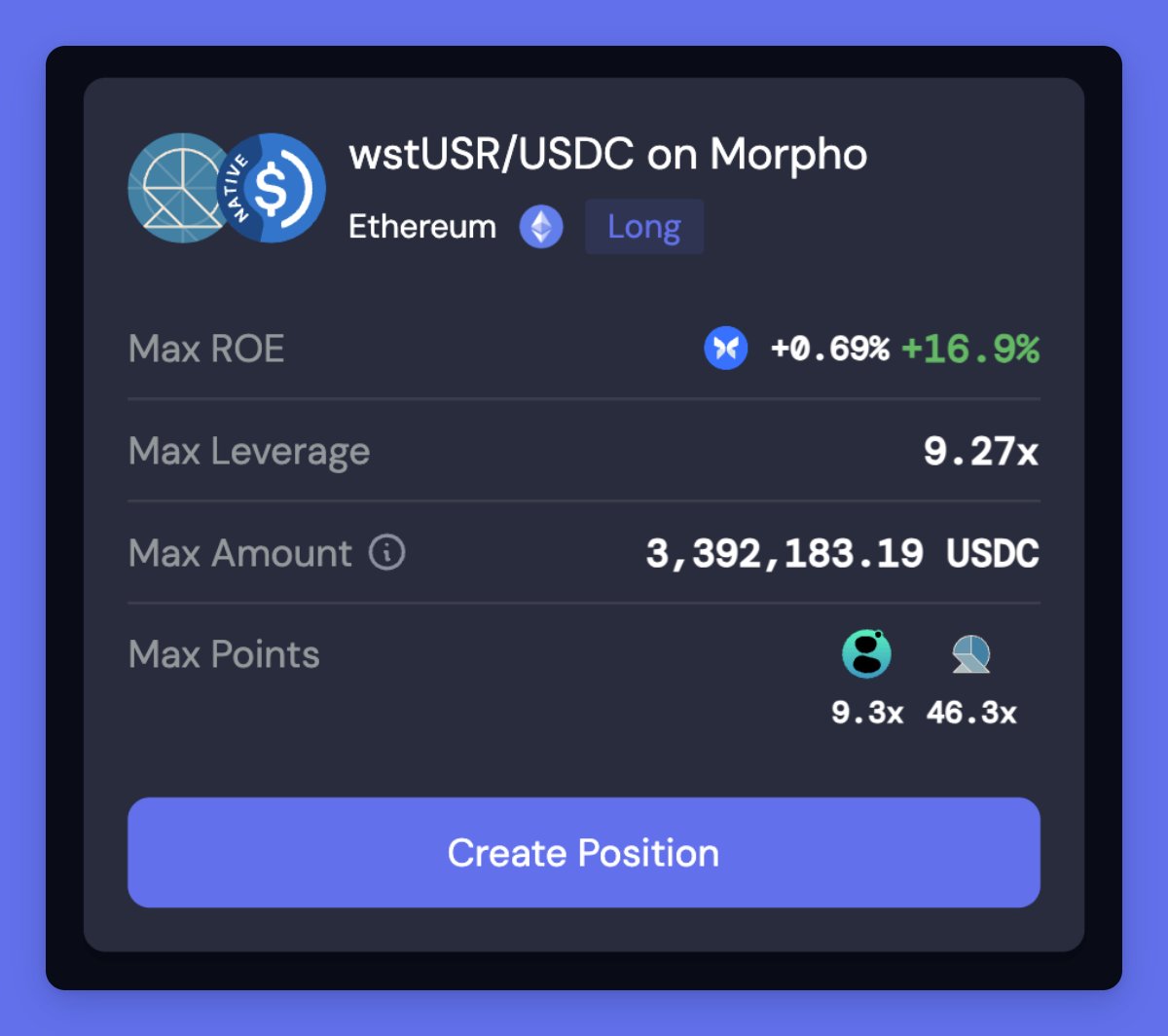

wstUSR by @ResolvLabs ($1.12M OI)

→ Bearing yield comes from ETH staking and funding fees (currently ~5.9%).

4.52K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.