anyone have a view on NEAR? this volume spike is interesting. curious on everyone's take.

𝐓𝐡𝐞 𝐀𝐥𝐭 𝐕𝐢𝐞𝐰: @NEARProtocol

While most blockchains chase volume through speculative incentives, NEAR’s latest milestone tells a different story.

One of product-market fit.

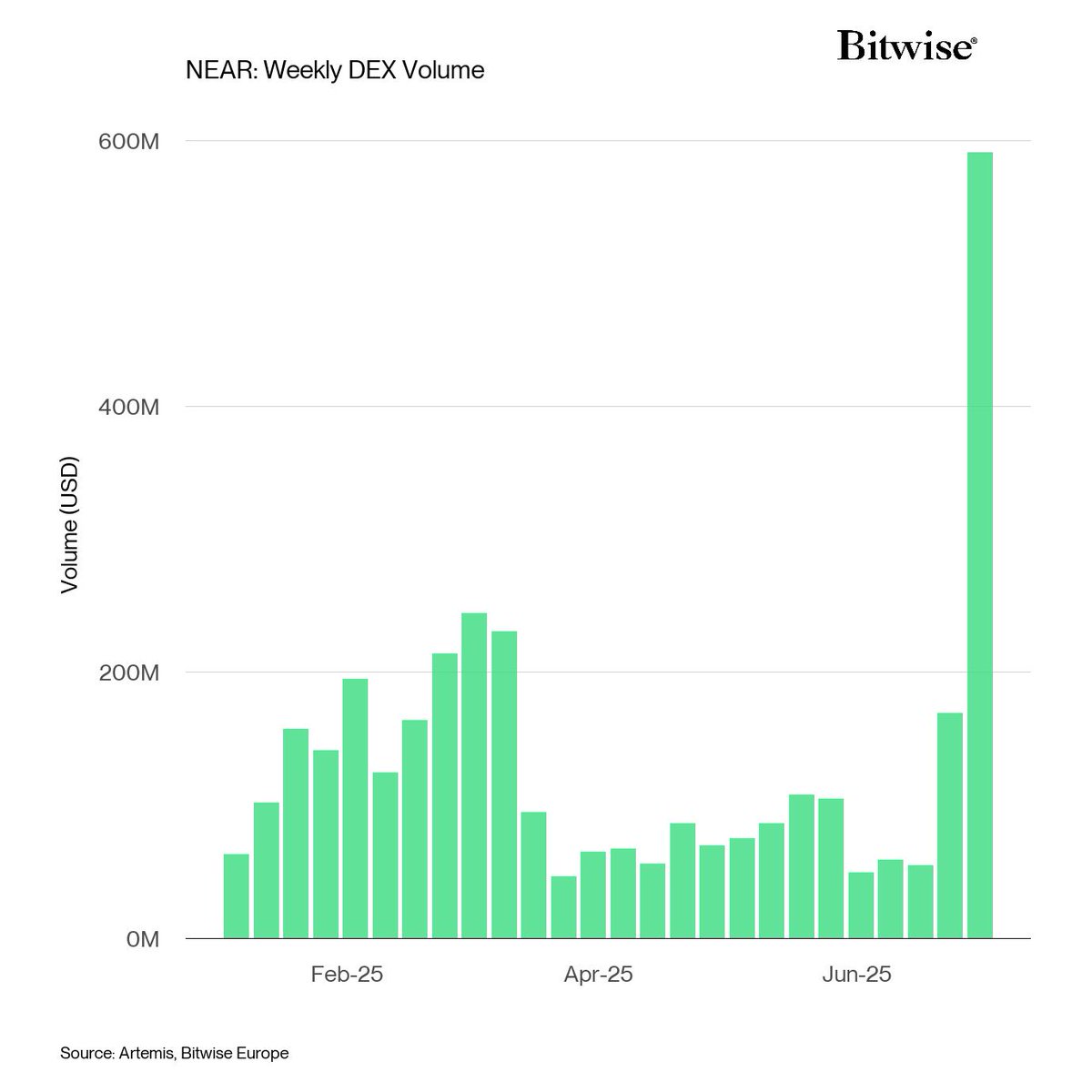

NEAR DEX volumes reached an all-time high last week, with weekly volumes hitting $591 million for the seven-day period ending June 30, 2025. This marks a +249.7% week-over-week increase from the prior week's $169 million. The momentum is even more notable when benchmarked year-to-date: from just $63.1 million in early January, weekly volumes have grown +835.9%. The scale and speed of this expansion has raised a question...

What is driving this?

We think it’s NEAR Intents.

Co-founder @ilblackdragon recently summarized NEAR’s long-term value proposition:

“NEAR’s long-term value accrual will not come from speculative volume or raw gas fees. It will come from protocol fees tied to intents, marketplace participation, and liquidity coordination.”

NEAR’s Intents allows users and agents to define outcomes—not execution steps. A request such as “Swap Token A for Token B” is picked up by solver networks that compete to deliver the most efficient result. The user reviews a quote, and once approved, the system executes the entire transaction atomically—without requiring manual bridging or multiple interfaces.

This approach not only simplifies on-chain activity but enables new institutional and agent-based workflows.

From portfolio rebalancing to treasury operations, intents allow entire multi-chain, multi-asset strategies to be executed via a single instruction.

It is also scaling quickly.

As of July 8, 2025, NEAR Intents have processed $409 million in cumulative volume. In just the first week of July, it handled $43.3 million. And over the past 30 days, it processed $215 million—representing more than 52.5% of all-time volume. With 943,637 transactions executed to date and an average transaction size of $434, adoption appears to be exponentially accelerating.

Supporting this growth is Infinex, a self-custody wallet purpose-built around NEAR Intents. With integration rolled out in April 2025, Infinex combines centralized exchange-level UX with decentralized security. It eliminates seed phrases, simplifies onboarding, and enables seamless cross-chain swaps across Bitcoin, Solana, XRP, NEAR, DOGE, and USDT/USDC. As of today, it has reached 100,000 users and over $500 million in TVL—a strong example of how intent-based infrastructure can support high-velocity retail flows at scale.

So what does this chart tell us?

The pace of adoption is accelerating. Those tracking on-chain trends would be wise to keep a close eye on the NEAR ecosystem.

@ayush_research @Andre_Dragosch @BradleyDukeBTC @HHorsley @Matt_Hougan @BitwiseInvest @Bitwise_Europe @NEARFoundation

14.11K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.