Token emissions are out. Real cash flow is in.

Token holders now demand buybacks — and @OriginProtocol is doing it with $4.5M+ in $OGN buying pressure on a $36M mcap.

Let’s break it down. 👇

Why buybacks are becoming essential:

> They create real demand for the token

> They align protocol growth with token value

> They prove the protocol is generating real revenue

Holders in 2025 want value from product delivered.

Origin is DeFi OG protocol, founded in 2017. Survived every cycle.

Its core product is making tokens liquid and yield-generating

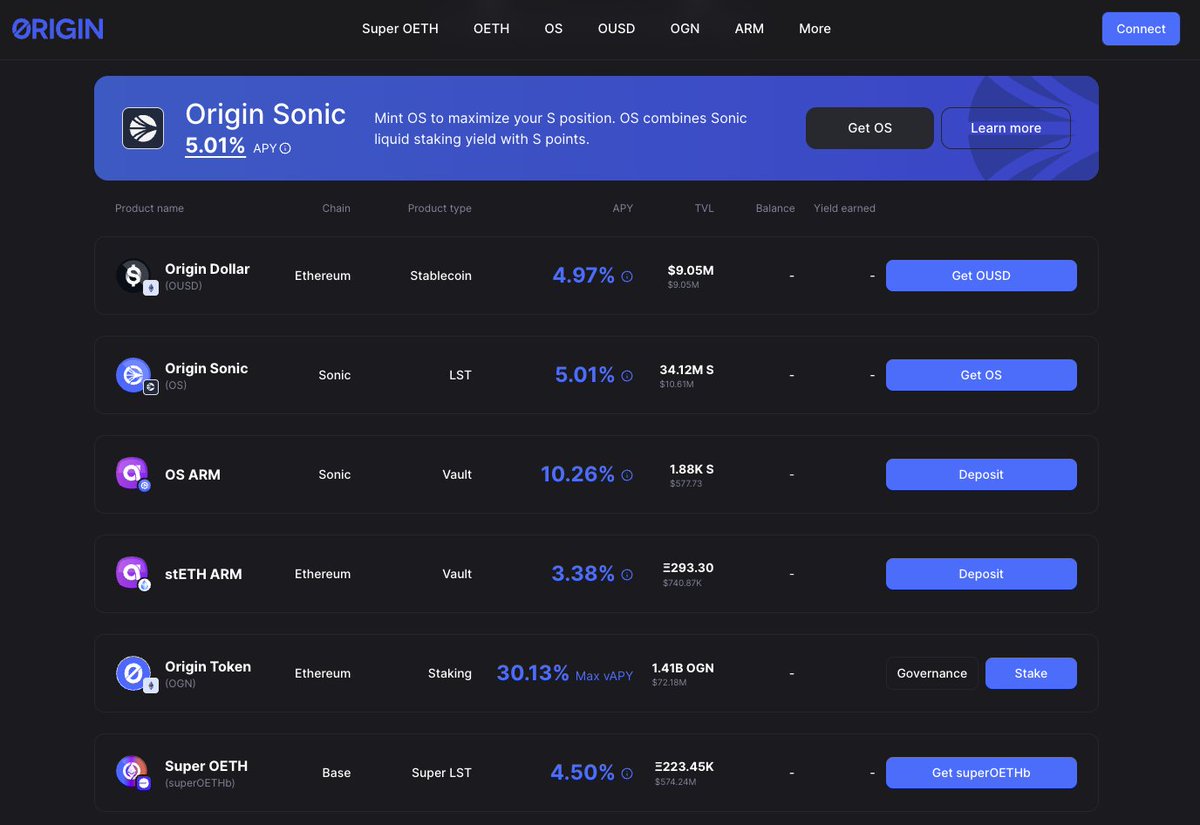

OETH, OUSD, OS, and more

It's doing great: $200M+ TVL, 7-figure annualized revenue

Origin started OGN Buyback Engine on June 30th.

It’s powered by:

• 100% of performance fees going to buybacks

• $3M from the OGN DAO treasury over 12 months

In total, $4.5M+ becomes buy pressure to $OGN.

What this means for $OGN holders:

> This buy pressure equates to 10% of circ supply

> All bought-back tokens are distributed to OGN stakers

> 30% staking APY — fueled entirely by buybacks. No emissions.

And backed by strong product suite of yield tokens.

2.73K

37

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.