Inspired by @ColeRotman and @BennettSiegel,

I ran the numbers on crypto Series A deals to find the companies that drove returns since 2011.

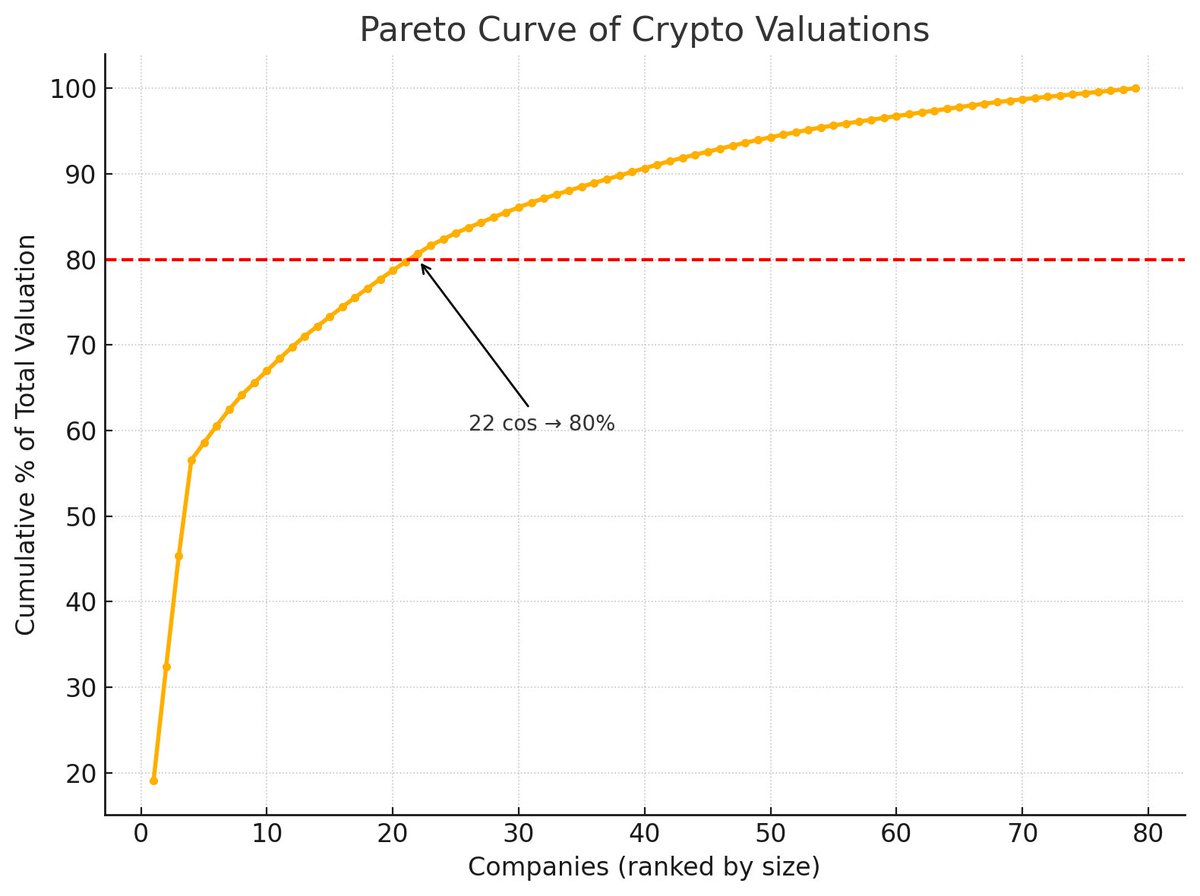

Power laws in practice:

The top 25% of companies--> 80% of returns.

The top 10% of companies --> 64%

The top 5 companies --> 59%

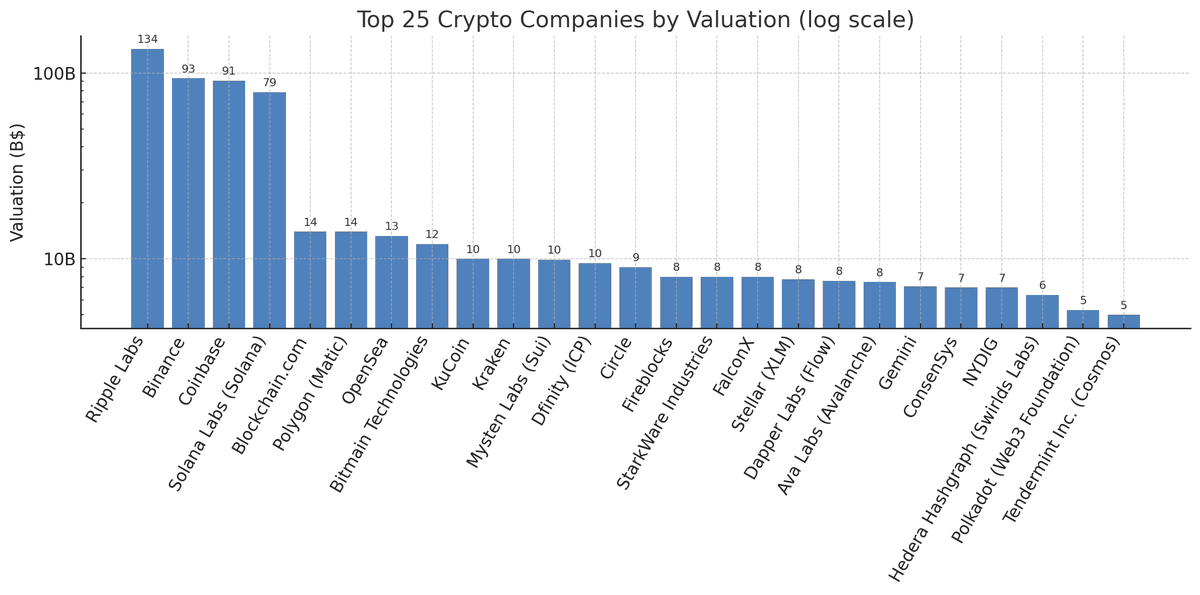

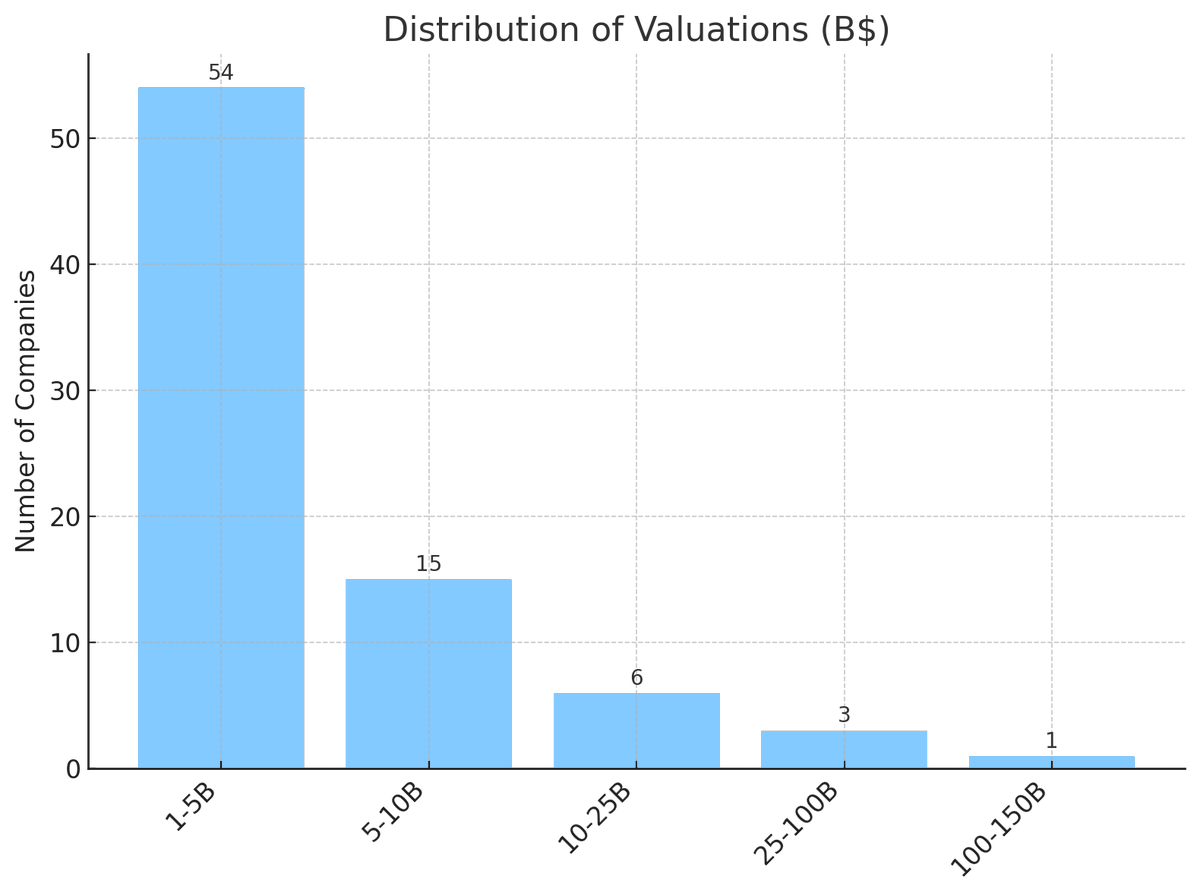

There were only 3 companies/networks (market-cap) worth more than 25B and only 1 company worth more than 100B

The companies that drove returns by year:

2011:

@blockchain led by @jeremysliew (@lightspeedvp)

@krakenfx led by @barendvandenb (@hummingbirdvc)

2013:

@coinbase co-led by @fredwilson (@usv) and @mickymalka (@RibbitCapital)

@circle co-led by @davidorfao (@generalcatalyst) and @JimBreyer (@Accel)

2014:

@StellarOrg led by @stripe (may be considered a seed)

2015:

@Ripple led by Li Feng (@IDGCapital)

2017:

@binance co-led by Fun City Capital, Black Hole Capital

@BITMAINtech co-led by @sinovationvc, @hsgcap, @IDGCapital

@NYDIG led by @alexferrara (@BessemerVP)

2018:

(1) @kucoincom co-led by Young Guo (@IDGCapital), @matrixvc, and Neo Global Capital

(2) @dfinity co-led by @cdixon (@a16zcrypto) and @kukulabanze (@polychain)

(3) @FireblocksHQ co-led by @giliraanan (Cyberstarts), Tom Banahan (Tenaya Capital), Davor Hebel (Eight Roads Ventures) and @edsim (MState)

(4) @dapperlabs co-led by @cdixon (@a16zcrypto) and @fredwilson (@usv)

(5) @hedera led by @DCGco

2019:

(1) @solana led by @KyleSamani (@multicoincap)

(2) @Mysten_Labs led by @AriannaSimpson (@a16zcrypto)

(3) @Consensys led by SK Group

(4) @Polkadot

(5) @cosmos led by @_charlienoyes (@paradigm)

2020:

@FalconXGlobal led by @skirani (@Accel_India)

@AvaLabs

2021:

@opensea led by @katie_haun (@a16zcrypto)

@Gemini led by @sjaitly (Morgan Creek Digital)

2022:

@0xPolygon led by @peakxvpartners

The firms and partners that led the Series As of the most unicorns since 2012:

1. @a16zcrypto | @cdixon, @AriannaSimpson

2. @paradigm | @matthuang, @_charlienoyes

3. @usv | @nickgrossman, @fredwilson

Honorable mention: @IDGCapital, a firm not as well-known as the above but has put up $$$ returns from investments in Ripple, KuCoin, and Bitmain.

16.39K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.