Pendle, Ethena, and Silo: The Next Big Trio in DeFi?

@pendle_fi is growing fast, with more DeFi use cases showing up every day

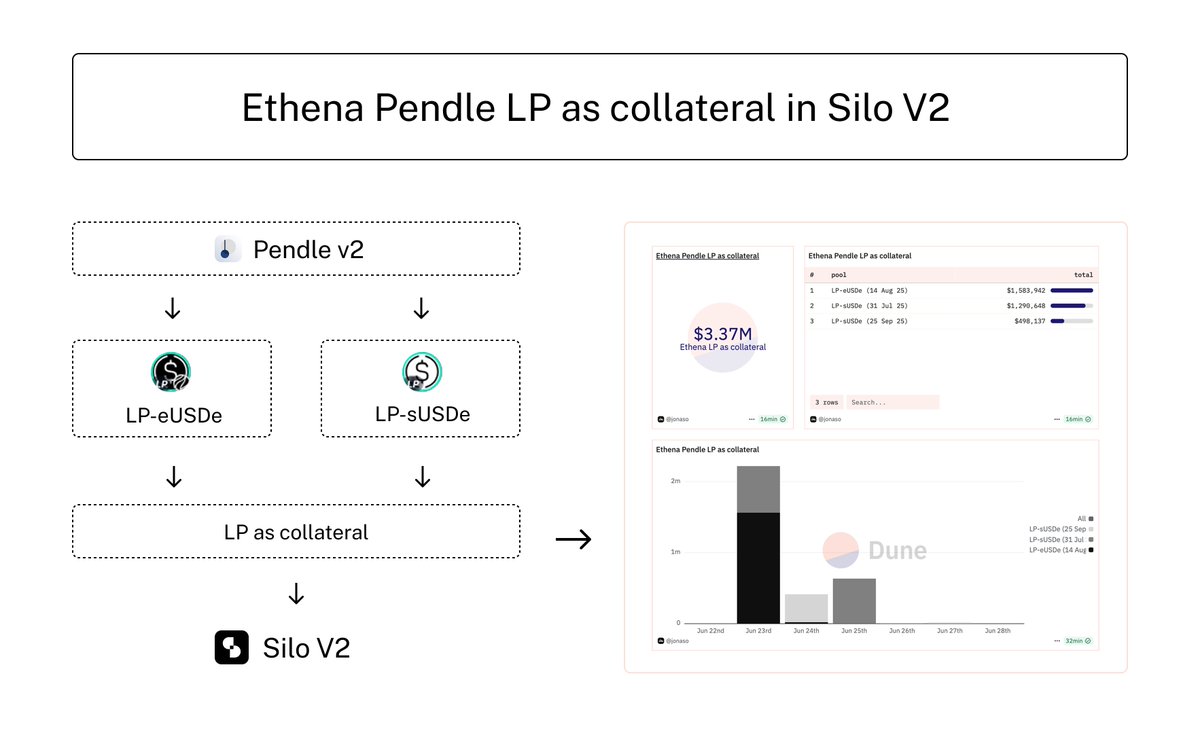

After Ethena PT was accepted as collateral on money markets, now Ethena LP tokens are also getting adopted

@SiloFinance is the first to support them, Over $3.4M of Ethena LP has been deposited into Silo last week

Two markets are available:

▸ @etherealdex LP-eUSDe

▸ @ethena_labs LP-sSUDe

How It Works ↓

• Deposit USDe to Pendle LP

• Receive LP-sUSDe, then wrap it

• Deposit the wrapped LP into Silo as collateral

• Borrow USDC

• Use that USDC to zap back into LP

• Repeat steps 2–5 to loop

This strategy turns your LP into a productive flywheel with more yield, Ethena and Ethereal Points

Stacking real yield, points, and composability into one seamless loop

Ethena PT & LP Economics, covers:

▸ Ethena Pendle PT market size

▸ PT usage in defi

▸ LP as collateral in money market

10.36K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.