What is $STAR? (@stardotfun)

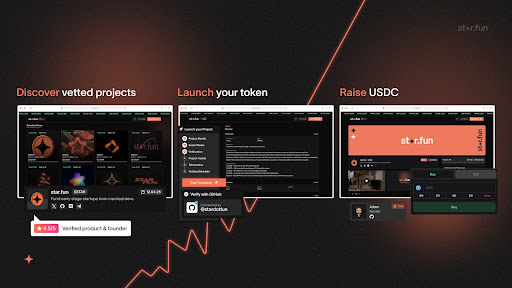

.star.fun, with the ticker $STAR, launched by @adamcreates_, is a new ICM launchpad where vetted founders raise funding through public token sales.

Topics in this Project Introduction

🔶 The problems and solutions star tackles and provides

🔶 Launching process and fundraising models

🔶 $STAR sale and token

So, let’s start! (TLDR at the end of the post)

What are the problems star tackles?

❌Retail is locked out

AI is accelerating how quickly startups create value. Normally, most startups get investments from either big institutions or wealthy investors in private funding rounds. However, it totally leaves out the regular retail investor in those early phases of raising capital. Star aims to bridge this gap, giving more investors early access to innovative projects.

❌Founders want users, not VCs

Traditional VCs often prioritize chasing unicorns while missing out on the opportunity for deeper community involvement. Therefore, founders increasingly prefer raising capital directly from communities and users. Star is trying to help founders raise funds directly from those most invested in the success of their project, which are their users.

❌Tokens need real vetting

Fungible tokens allow liquid, transparent fundraising. However, most of today’s launchpads still promote short-term hype and lack proper quality vetting. Star introduces high vetting standards, prioritizing long-term quality over short-term hype.

What are the solutions star proposes?

✅AI-led founder verification

Star uses AI for the verification of technical founders. Every builder goes through a GitHub-based verification process of their profile where they scan for commit activity, contributions and general repo stats. This process carries the most weight in star’s review. They are also implementing X and LinkedIn as verification data points.

✅Configurable token sales

Projects can launch tokens and raise USDC through flexible, configurable public sales. This method ensures they can adapt fundraising to their specific needs and circumstances.

✅Continuous revenue streams

Every project on star earns a 1.4% fee on every swap in its liquidity pool. This provides them with consistent income beyond the initial fundraising. The more their token gets traded, the more fees they earn.

✅Token integration for holders benefits

Tokens launched via star can be integrated into apps to unlock token-gated features and drive value directly to token holders via payment integrations. This enhances user engagement and support holder value accrual.

The process of launching on star

1⃣Opportunity based on <code>, not connections.

Before you can raise, you must connect your GitHub account to star. As mentioned in the previous section, they vet your GitHub profile, focusing on commit history, repository structure and contribution patterns. To go more into detail, star considers how long you’ve been active on GitHub, your open source contributions, stars and commit history. Next to this, they also check for authenticity, cutting out the option of buying someone else’s GitHub account. Lastly, they review your profile in the context of your project to make sure everything lines up.

Another option is submitting links to your public repos if you are an open source builder. They will then look at recent activity, code quality, originality and the complexity of your work.

2⃣Customizable on-chain fundraising

After you pass the verification process, you can start the fundraising for your project. You can either choose for the Bonding Curve for instant visibility or Pro Rata for fair distribution. Both of these will be explained more in depth in the next section of this introduction. Additionally, startups are able to customize supply allocations, raise targets, timelines and vesting. When the fundraising finishes, proceeds are collected in USDC and routed directly to your wallet. Both the Bonding Curve and the Pro Rata model will be explained later in the next chapter in this introduction.

3⃣Earn fees, build your a token that works for you.

Once launched, your token is publicly tradable. But this is not the only benefit. You also earn 1.4% on every swap in its liquidity pool, resulting in consistent income beyond the initial fundraising. There are numerous options of how to use these fees. For example, unlock features, power rewards and reach new users.

Fundraising models

Stardotfun offers two fundraising models (Bonding Curve and Pro Rata), each designed to fit different types of projects and communities.

Bonding Curve

This is a dynamic price curve based on supply and demand. Projects can set a maximum raise cap and let the sale run for up to 7 days or once the max raise is reached. After this, 12.5% of the raised USDC is paired with 25M tokens to create a new liquidity pool and the remaining funds are transferred to the wallet you signed up with. This allows your token to become instantly tradeable everywhere on Solana, across all major DEXs and aggregators, which is ideal for early projects seeking visibility.

Pro Rata

The Pro Rata model is designed for fairness and community. This model allows anyone to contribute over a 7-day window. After this time period, tokens are distributed proportionally to the amount invested and as well as the Bonding Curve model, 12.5% of the USDC is paired with 25M tokens to create a new liquidity pool while the remaining funds are transferred to the wallet you signed up with. This model is ideal for community-backed projects seeking fair, pressure-free distribution.

STAR Token & Utility

$STAR is a store of value for the internet capital markets. The token will offer access to premium token-gated features and rewards for those participating in the ecosystem. By holding STAR, users will be able to access premium sales and advanced project analytics. They will also be able to earn STAR by bringing founders onto the platform. To create mutual upside for all token holders, platform trading revenues will be allocated to regular STAR buybacks and burns.

Star’s own Fundraiser

Star is currently doing a pro-rata raise with a $500K minimum and a $2.5M cap. The raised funds are for 20% of tokens, so the valuation of the project will depend on the amount raised. Next to this, 2.5% of the raised USDC goes to start a new liquidity pool, along with another 2.5% of tokens to give deep liquidity for the new token. The fundraiser ends on June 30th.

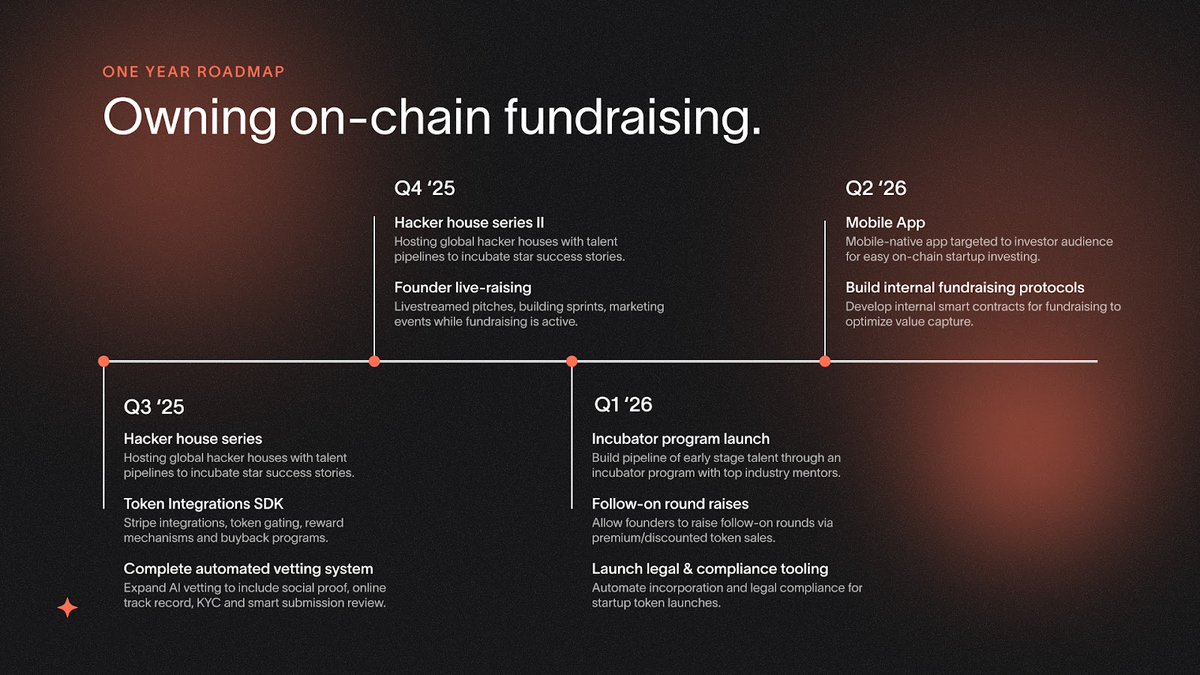

Upcoming Milestones / Roadmap

Short-term Milestones

🔸June 30th - $STAR sale closes

🔸June 30th - Next founders start raising.

Roadmap

Star’s roadmap focuses on owning on-chain fundraising over the next year. Key steps include global hacker house events to build talent pipelines, token integrations SDK and a fully automated AI vetting system. In 2026, star will launch an incubator program, follow-on round raises and legal launch & compliance tooling. Lastly, a mobile app to make on-chain investing easier and internal fundraising protocols to optimize value capture will be built.

Founding Team

Founder

🔸@adamcreates - founder (serial entrepreneur, previous exit)

Creative

🔸@donfullermo - creative (award-winning designer, past clients include BMW, Lamy, Nike)

Developer

🔸@promptpapi - developer (AI research fellow, MsC Artificial Intelligence)

TLDR

🔹 .Star.fun ($STAR) is a new launchpad for public token sales, focused on technical founders and real community funding.

🔹It uses AI to vet GitHub profiles, offers flexible fundraising models (Bonding Curve & Pro Rata), and gives projects revenue from swap fees.

🔹Holders get access to premium sales, analytics, and buyback-driven value.

🔹The current fundraiser for star ends June 30.

------------------------------

Note. This project introduction is purely informational and is no financial advice. You should always do your own research before investing. For more project introductions, head over to my community on X, which can be found on my profile.

P.S. Shoutout to @MeteoriteCol for pushing launchpad tech forward.

------------------------------

Discussion for in the comments

How do you think Star differentiates from launchpads like Believe?

5.69K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.