🚨 U.S. JUST ATTACKED IRAN BASES...

$BTС going to $50K and alts are dumping

I have analyzed all data and LEAKED reports...

Here's everything you NEED to know and how it will change #crypto 🧵👇

(and when things will turn around)

Other influencers will charge you $1,000+ for this info, but I'm here to share a lot of alpha for FREE.

If you can please: like, repost, and bookmark the FIRST tweet 👆

It will help me create even more alpha for you 🫶

I'll also choose the best replies under FIRST tweet

And send $1,000 $USDT to the most active followers

P.S.: Must be following me on X and TG

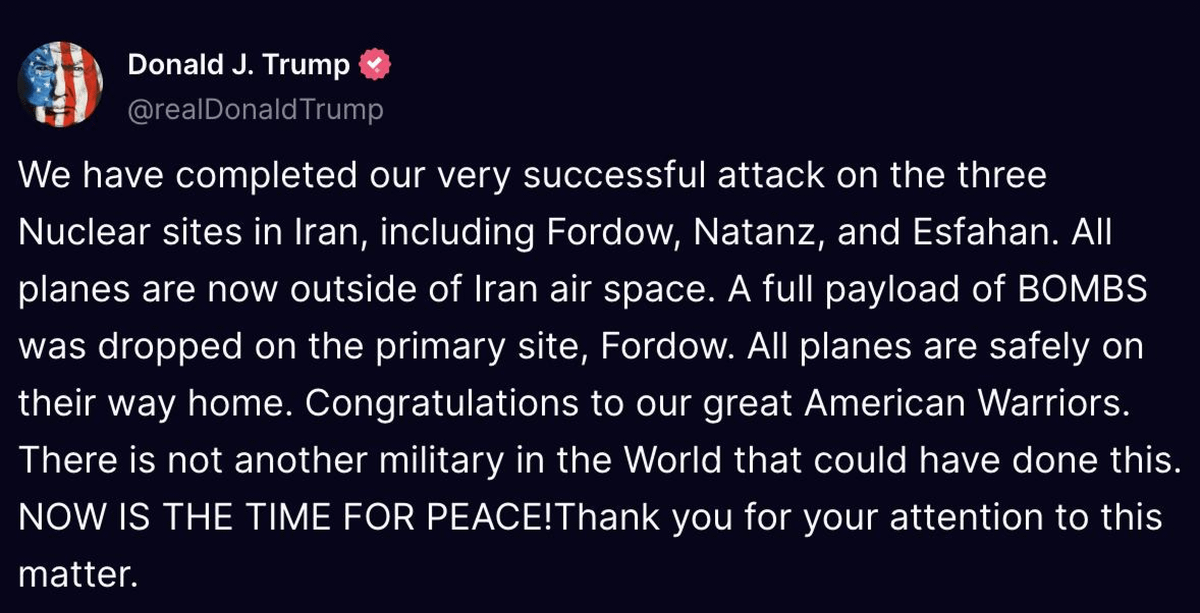

Today didn’t start with coffee but with loud headlines

The US attacked Iran’s nuclear facilities - the crowd fears WW3

Everyone’s yelling about a $BTC correction but this is just the beginning of its test as digital gold

What’s next and how will it hit Crypto?

For those who aren’t tracking the news - let me break it down

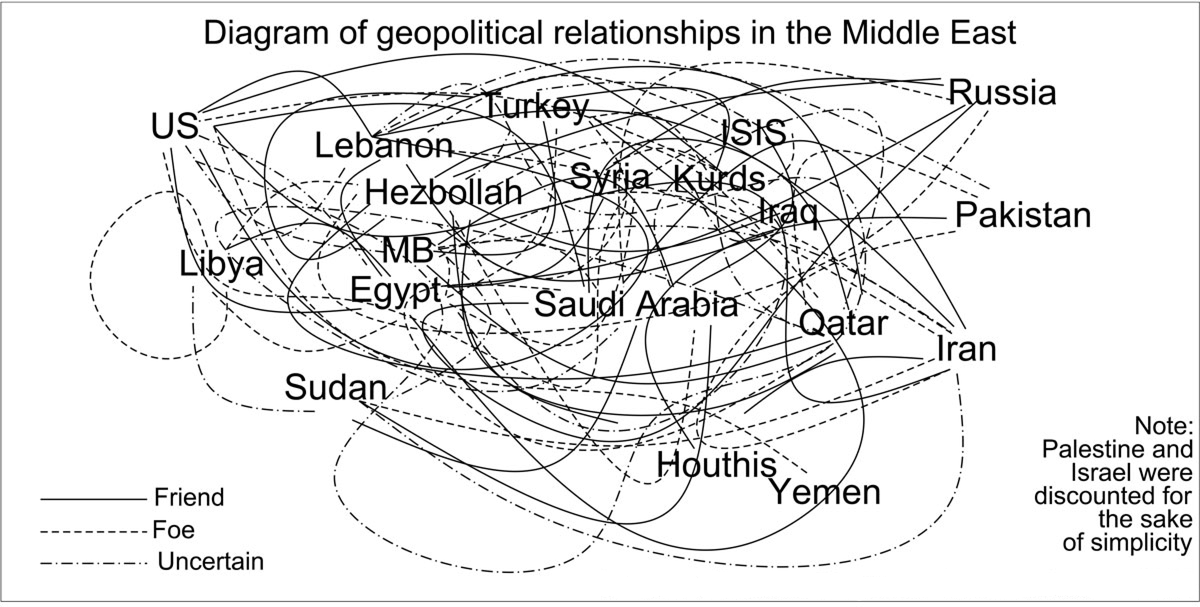

The roots of the US-Iran conflict go all the way back to 1953 and the coup in Iran

Since then they’ve been at it non-stop over fears of Iran getting nukes

Lately things escalated fast - Israel (US ally) and Iran started shelling each other

Nuclear deal talks between the US and Iran hit a dead end

There was only one way forward - take out the nuclear facilities, and that’s what happened today under Operation Midnight Hammer

With that uncertainty $BTC started correcting

Result - three nuclear sites and the actual core of the conflict in Iran were completely destroyed

NOW IT’S TIME FOR PEACE

The US got what it wanted - a century-long geopolitical standoff may be nearing its end

Uncertainty is now circling around two points:

- Fear of Iran striking US bases (unlikely)

- Closure of the Strait of Hormuz

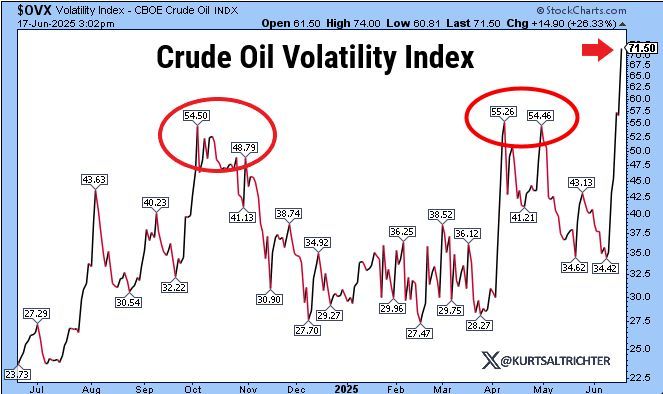

We can’t really predict military moves but the Strait of Hormuz is already shut

That’s where 20% of global oil supply flows through

If there’s no deal we risk a full-blown crisis and oil at $90

$BTC is already reacting to this heat

The market runs on emotions and with every conflict we replay the same pattern:

Escalation -> strike -> retaliation -> panic sell -> negotiations

Iran couldn’t just stay quiet - they had to show their hand before sitting at the table

Diplomacy after airstrikes - sounds paradoxical, but in global politics it’s almost a classic by now

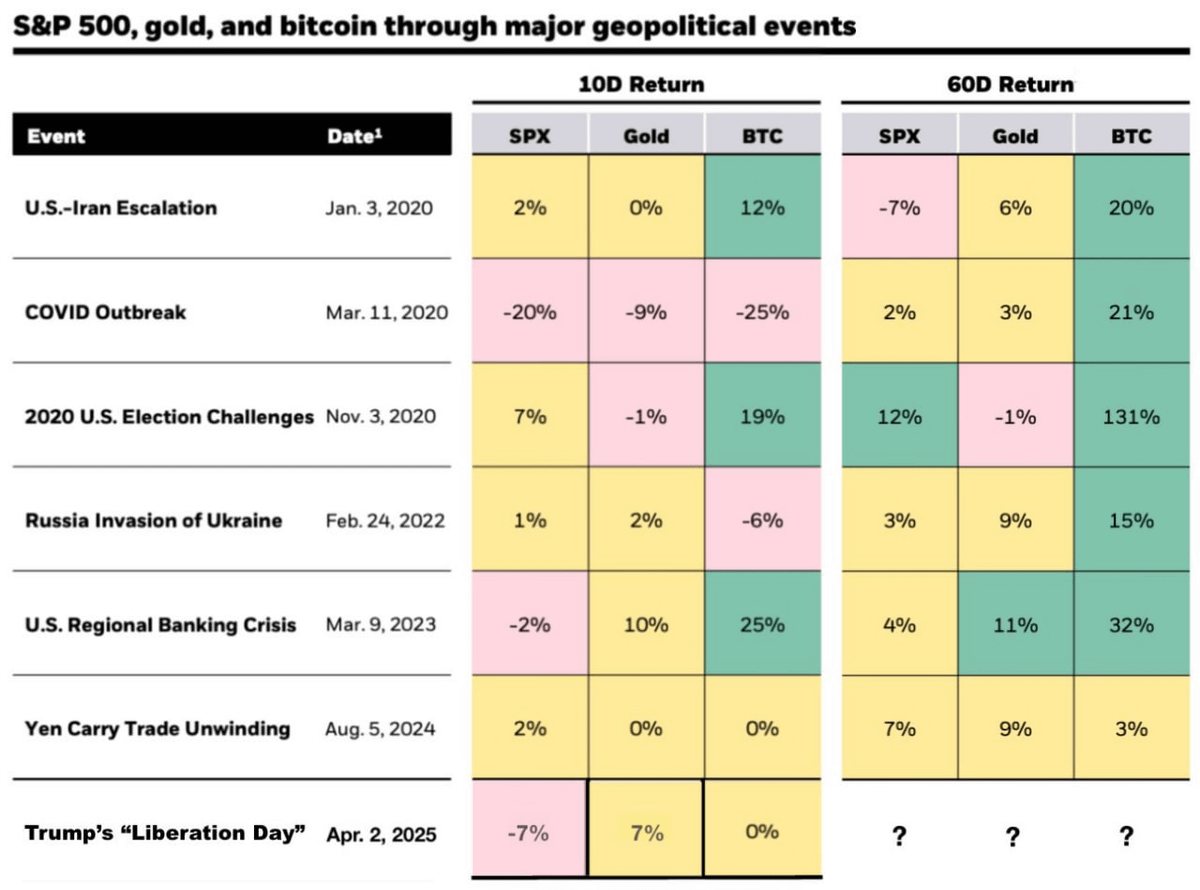

There’s actual stats on what happens post every global crisis:

- After US elections in 2020: +131%

- After US banking crisis: +32%

- After COVID started: +21%

This time will be no different - WAKE UP

We’re at the climax of the conflict - and that’s usually the bottom

The crowd is panicking while smart money is scooping up this bloody dip - a perfect setup

$BTC will survive and is already proving itself as digital gold - you can literally see it in the chart

That’s my take - I don’t buy into the BLACK MONDAY narrative, too many are waiting for it

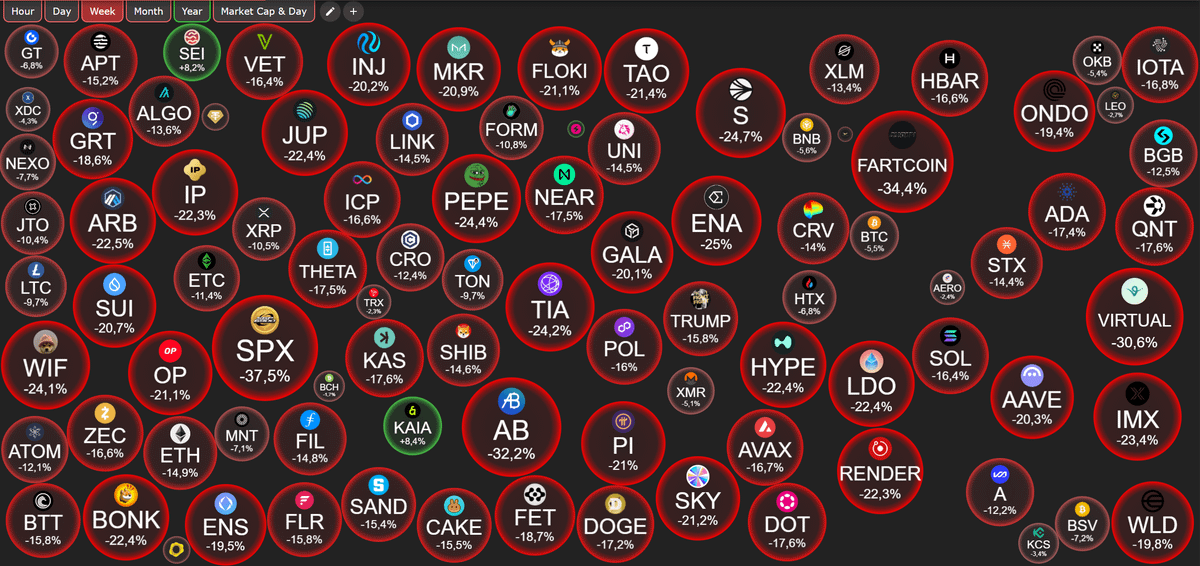

As for ALTS - they’re hurting and BTC.D is breaking records which makes total sense

But this ain’t the time to reshuffle your bags - there’s more volatility and more headlines ahead

I’m getting ready to scoop up $SOL and $ETH on dips using spare stables

By fall it’s an easy +100% - screenshot this and hang it on your wall

I share my calls and host $1,000+ giveaways in my TG

People inside made #FARTCOIN (218x), $TRUMP (289x), $BOME (85x) and more

Follow while it's FREE:

If you loved this thread, don't forget to:

• Follow me @DeFiTracer for more exciting content!

• Like, retweet, and leave a comment 👾

11.21K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.