Celestrix

CelestrixAPI

0Following

161Followers

Last night, program 2 stop-loss fused and triggered a drawdown, which is a program defect, the parameters need to be readjusted, and program 1 is normal.

Trading characteristics: quantitative + ultra-short-term + high yield + low drawdown

Trading target: 50% monthly return, 10% maximum daily drawdown, 0 weekly drawdown.

Historical backtest results: win rate 86.5%, win-loss ratio 9:1, monthly return 50%+

1: Quantitative trading: 24h real-time millisecond trading, no manual intervention in operation, no anxiety for opening and closing positions.

2: Ultra-short-term: The holding time is a few seconds to a few minutes, and it will not exceed 1 hour.

3: Low drawdown: The maximum drawdown is controlled within 10%. The maximum drawdown since the launch of the quantification program occurs in the startup stage, and the maximum drawdown after that is within 10%.

4: Order amount: In order to pursue low drawdown, the single amount will not exceed 10% of the lead amount.

Show original

Overview

Futures trades

Performance

Ongoing orders

History

Copy traders

Trading performance

Days w/ profit7Days w/ loss1

Win rate

87.50%Profit/Loss ratio

1.52:1Average position value

1,962.90Lead trader overview

Days leading trades

16Lead trade assets (USDT)

8,236.57AUM

8,383.49Current copy trader PnL (USDT)

838.69Copy traders17/50

Profit-sharing ratio

10%Copy traders

Cumulative total95

Change in last 7 days

4(+4.40%)

+509.57

+129.46

1

187***3066+27.25

4

+23.85

5

+21.52

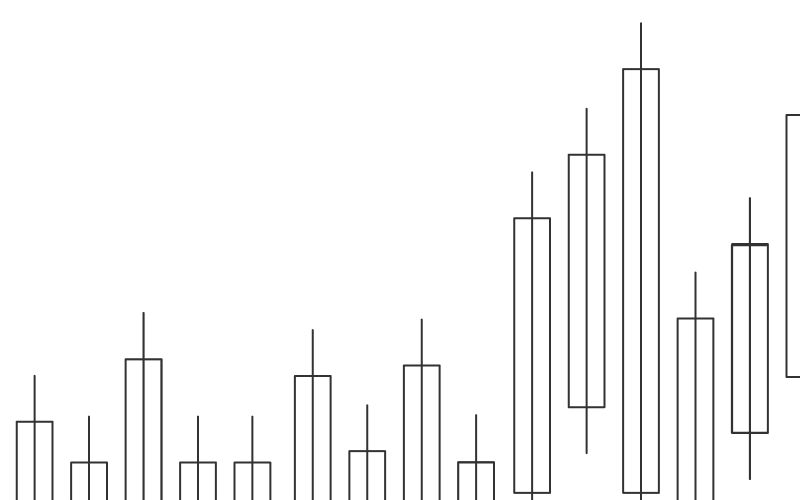

Weekly PnL

PnL%

PnL

PnL%

PnL%

PnL

Crypto preferences