Ethereum, a ten-year narrative metamorphosis record

By Ada, David, Deep Tide TechFlow

On July 30, 2015, at 3:26 PM, Ethereum's first block was successfully mined.

With that moment of creation, known as "Frontier," an ambitious prophecy was born – the "World Computer." Vitalik and early developers believed that they were not building an upgraded version of Bitcoin, but a global computing platform capable of running any decentralized application.

Today, ten years later, it is the 10th anniversary of the Ethereum mainnet.

When we examine the trajectory of Ethereum, we find that this "world computer" has not run various decentralized applications as expected, but has evolved into a settlement layer dominated by financial applications.

DeFi protocols account for the vast majority of gas consumption, with trillions of dollars in assets circulating on this network, and applications such as decentralized social, gaming, and storage, which were once highly anticipated, have either disappeared or migrated to other chains.

Is this narrative shift a compromise or an evolution?

Looking back at this node, Euner's narrative changes over the past decade are not only a story about Ethereum, but also a story about how technical ideals find a foothold in the real world.

World Computers, The Golden Age of Idealism (2015-2017)

To understand Ethemum's narrative origins, one must go back to the winter of late 2013.

Vitalik Buterin, then 19, was traveling in Israel when a bold thought came to his mind: what if blockchain could not only transfer money, but also run arbitrarily complex programs?

The revolutionary aspect of this idea is that for the first time, it expands blockchain from a dedicated value transfer tool to a universal computing platform.

But behind this initial vision, there is a deeper cultural motivation.

The early Ethereum community was a group of technical idealists who believed that "code is law". They are not just building a new technology platform, but trying to create a new social paradigm - a digital utopia that does not require centralized authority and is run entirely by code rules.

The narrative at that time was "decentralized" and in the "world computer" where code was law.

This is not only a technical ideal, but also a political declaration and philosophical position. Early proponents of Ethereum believed that through smart contracts, they could reconstruct the rules of society and create a fairer, more transparent, and trustless world.

This technical idealism was evident throughout Ethereum's early design. Turing's complete virtual machine, gas mechanism, account model - behind every technical choice, there is a value orientation of "maximizing decentralization" and "maximizing versatility".

On April 30, 2016, less than one year after the Ethereum mainnet was launched, The DAO (Decentralized Autonomous Organization) officially launched crowdfunding.

This project perfectly embodies the idealism of the early Ethereum community: no management, no board of directors, and an investment fund completely controlled by code. In just 28 days, The DAO raised 11.5 million ETH, representing 14% of the total ETH supply at the time, worth over $150 million.

However, the ideal soon encountered a cruel test of reality. On June 17, an attacker exploited a recursive call vulnerability in The DAO's smart contract to steal 3.6 million ETH.

The ensuing argument tore the entire community apart. One side argues that since code is law, ETH obtained through code vulnerabilities is "legal" and that any human intervention violates the core spirit of blockchain. The other side argues that a hard fork is necessary to correct mistakes when the results are clearly against the common will of the community.

In the end, the majority, represented by Vitalik, opted for a hard fork to return the stolen ETH to the original holders. This decision led to the first major split in Ethereum, with the minority adhering to the "Code is Law" principle continuing to maintain the original chain, which is today's Ethereum Classic (ETC).

This crisis reveals the inherent contradiction of technological idealism: complete decentralization can lead to unacceptable consequences, while any form of human intervention may be seen as a betrayal of the principles of decentralization.

This contradiction runs through the entire development process of Ethereum and also lays the groundwork for future narrative changes.

ICO Coin Issuer, Lost in the Bubble (2017-2020)

At the end of 2016, no one could have foreseen how the upcoming ICO frenzy would change everything for Ethereum.

In the summer of 2017, the crypto world ushered in an unprecedented capital carnival. The simple concept of ICO (Initial Coin Offering) – raising funds by issuing tokens – has ignited the imagination of speculators worldwide. In 2017 alone, more than $6 billion was raised through ICOs, and by the first half of 2018, that number had soared to $12 billion.

Ethereum, on the other hand, is the coin issuer that carries many ICOs.

Write contracts, design payment rules, and compile token names and quantities, and tokens that do not require realistic commitments appear:

A white paper that seems grand enough, a story that triggers FOMO (fear of missing out), and a seemingly plausible tokenomics model.

At that time, Ethereum faced an unexpected identity crisis --- was originally designed as a "world computer" and suddenly found that its biggest use was to issue tokens.

This vast gap between reality and vision constitutes the first major break in Ethereum's narrative.

Vitalik and the early core developers envisioned a global computing platform to run decentralized applications, but the answer was that we only needed a simple ERC-20 standard to issue coins.

This simplification is not only technical but also cognitive. In the eyes of investors, Ethereum is no longer a revolutionary computing paradigm but a money printing machine.

The deeper problem is that this label of "token issuance platform" is starting to shape Ethereum's direction in reverse. When 90% of activity in the ecosystem is token-related, development priorities inevitably tilt in this direction. There is far more discussion about token standards in the EIP (Ethereum Improvement Proposal) than other application scenarios, and developer tools mainly revolve around token issuance and trading, and the entire ecosystem is stuck in a kind of "path dependence".

If the previous The DAO event was a philosophical debate within idealism, the ICO craze was the first head-on collision between idealism and market reality. This collision exposes a fundamental contradiction in Ethereum's narrative: the vast gap between the technical vision and market demand.

In 2018, there was a bear market.

For Ethereum, this is not only a price collapse, but also a narrative collapse. When the ICO bubble bursts, when the slogan of the "blockchain revolution" is no longer believed, Ethereum must answer a fundamental question:

If not the world's computer, then what are you?

The answer to this question is gradually emerging in the ordeal of the bear market. A new narrative is taking shape: Ethereum is first a financial settlement layer before it can become a general-purpose computing platform.

The transformation is also reflected in the technology roadmap. Ethereum 2.0 is designed to take more into account the needs of financial applications - faster finality, lower transaction costs, and higher security. Although the official discourse still emphasizes "universality", the actual optimization direction has clearly pointed to financial use cases.

The correctness of this choice will be tested in the next stage.

DeFi Victory, When Finance Becomes Ethereum's Vocation (2020-2021)

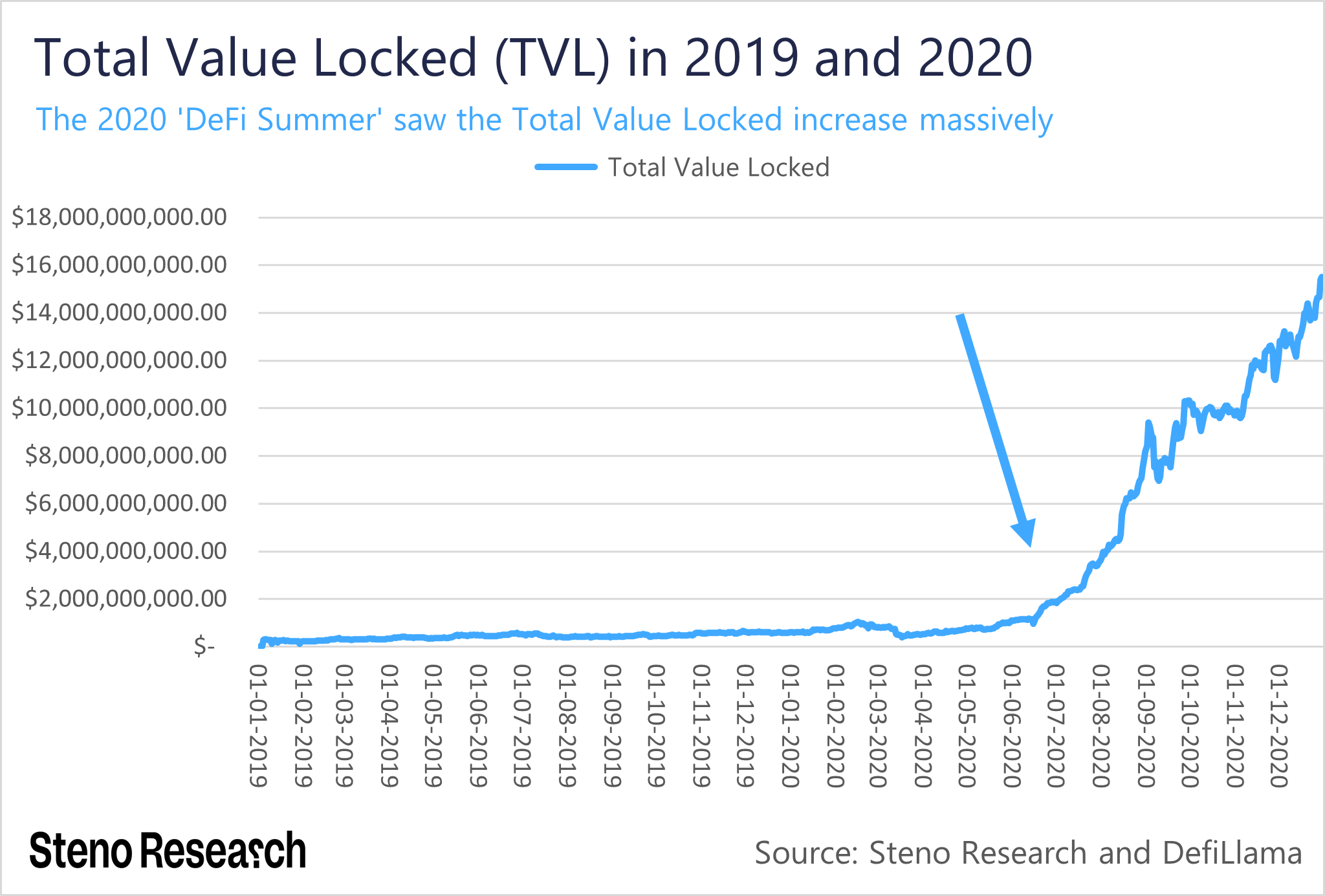

DeFi Summer in 2020 was not only an explosion of the application layer for Ethereum, but also a complete change in identity.

If the 2017 ICO made Ethereum an unexpected token issuance platform, the success of DeFi has made the entire ecosystem realize that finance may not be a compromise choice for Ethereum, but its natural mission.

This shift in perception is gradual.

At first, DeFi was seen as one of many experiments, juxtaposed with gaming, social, supply chain, and other applications. But when Compound's yield mining ignites market enthusiasm, when tens of billions of dollars pour into various DeFi protocols, and when gas fees hit new highs due to DeFi activity, an undeniable fact lies ahead: Ethereum has found its product-market fit.

In the past, positioning Ethereum as a financial platform seemed like a "dimensionality reduction" and a betrayal of the grand vision of a "world computer." But DeFi shows another possibility: finance itself is the most complex and valuable form of computing.

Every transaction, every liquidation, and every derivative is a complex calculation process. From this point of view, becoming a "world financial computer" is not contradictory to becoming a "world computer", but a different expression of the same vision.

The explosion of DeFi has created a powerful positive feedback loop that continues to reinforce the narrative of Ethereum as a financial infrastructure. With the surge in usage, the gathering of developers, and the gradual shift in voice, DeFi project parties are getting louder.

However, the success of DeFi also brings a serious practical problem: Ethereum's performance bottleneck.

When a simple token swap requires paying gas fees of tens or hundreds of dollars, Ethereum faces an existential crisis. This is no longer the ideal question of "how to be the world's computer", but the practical question of "how to keep DeFi running".

This urgency has revolutionized Ethereum's technological priorities. In the past, scaling was seen as a long-term goal, and the most elegant solution could be slowly researched. But the explosion of DeFi has made expansion an urgent need. The Ethereum community has had to accept a reality:

The perfect solution can wait, but the market won't.

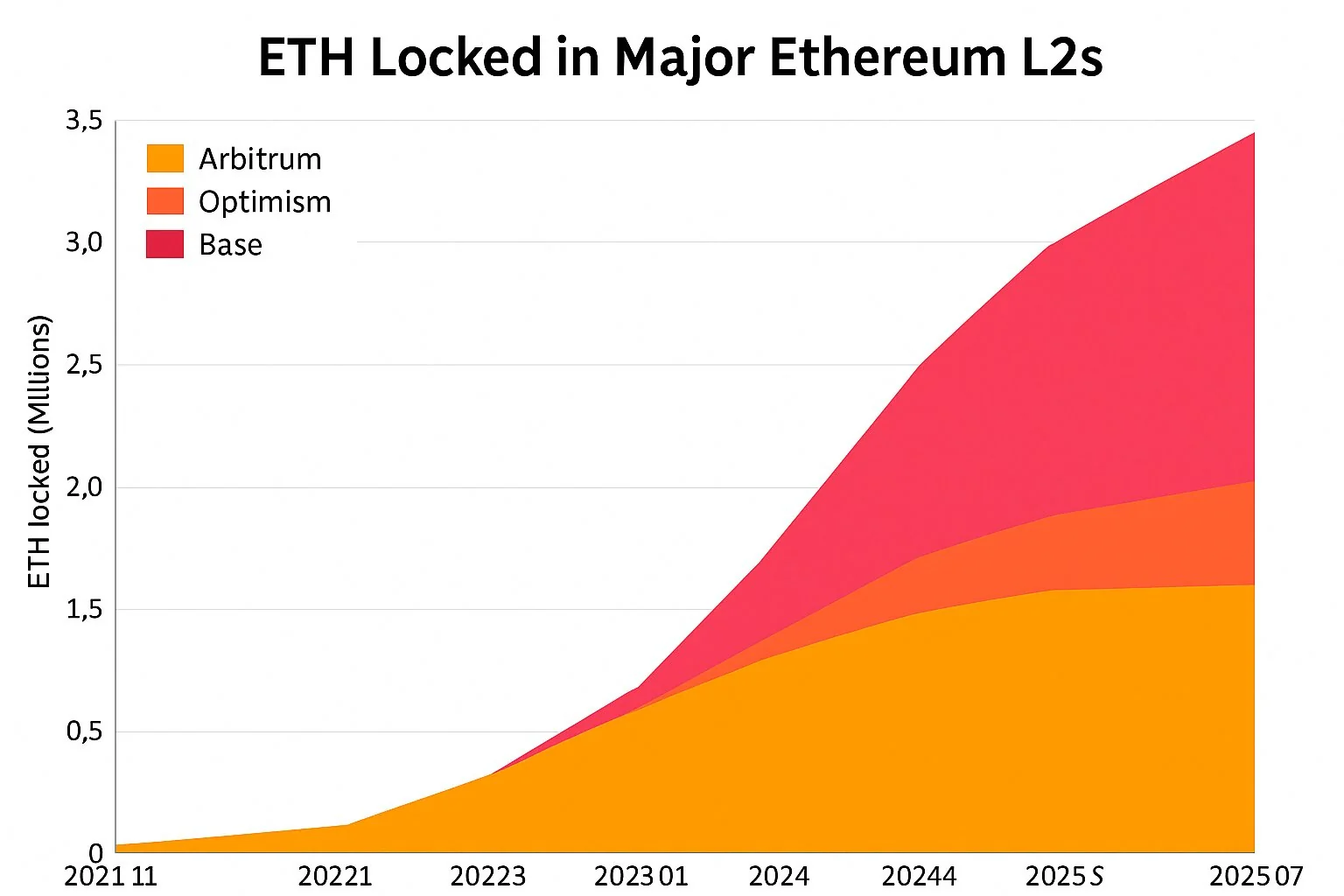

So we see a series of pragmatic options. Layer 2 is no longer a distant concept, but a contingency solution that must be deployed immediately. Although Rollup technology is not decentralized enough, it can quickly alleviate congestion, so it has received full support from core developers. The roadmap for Ethereum 2.0 has also been realigned, prioritizing the most helpful features for DeFi.

This adjustment of the technical route is essentially a concrete embodiment of the narrative shift. When Ethereum accepted its position as a financial infrastructure, all technical decisions revolved around this core.

L2 rises, sovereign transfer and parasitic (2021-2023

Ethereum in 2021 faces a harsh reality: DeFi success is killing Ethereum.

When a simple transaction requires waiting for minutes, when ordinary users are squeezed out by high costs, Ethereum's narrative faces a new crisis. The positioning of the "global financial settlement layer" is beautiful, but if only the rich can afford it, can this narrative still be established?

The deeper paradox is that Ethereum's success has instead exposed fundamental flaws in its architecture. As a monolithic blockchain, Ethereum tries to handle everything on the same layer: perform calculations, validate transactions, store data, and reach consensus. This "all-round" design was an advantage in the early days, but became an Achilles heel in the scale stage.

Faced with this dilemma, the Ethereum community has undergone a painful cognitive shift. The real world computer should be a modular, hierarchical system, like the Internet.

This shift is most clearly articulated in an article by Vitalik: "The future of Ethereum is modular. "

This statement marks another significant turn in Ethereum's narrative. From "one chain rules everything" to "multi-layered collaborative ecosystem", Ethereum has begun to accept the reality that --- a single blockchain cannot meet all needs, and the future will be a specialized division of labor.

So when rollup solutions like Arbitrum and Optimism began to carry more and more transactions, the fundamental problem emerged. If most of the activity takes place on Layer 2, what is the Ethereum mainnet?

In 2022, this issue showed more pronounced tension in data availability. As projects like Celestia propose specialized data availability layers, the balance between Ethereum's openness and control is unfolding around the data availability (DA) battle.

Ethereum has always touted itself as open and decentralized, but the community's reaction is complicated when this openness could threaten its own position. Some people started using the concept of "Ethereum Alignment" to try to maintain some form of control while being open.

What's even more interesting is that this debate has changed the definition of success.

In the past, success meant that all activities took place on Ethereum. Now, success is redefined as: even if activities are carried out elsewhere, as long as Ethereum's security is ultimately needed, it is a victory for the Ethereum ecosystem. This change in definition reflects Ethereum's shift in thinking from "monopoly" to "symbiosis".

The Hundred Chains War and the "Legitimacy" Narrative Defense (2023-2024)

The blockchain world in 2023 has seen a subtle but important change: the new generation of public chains is no longer trying to be a "better Ethereum" and is starting to tell a completely different story.

Instead of emphasizing itself as a "faster smart contract platform," Solana is positioned as the "Nasdaq of blockchains." Aptos and Sui do not talk about "decentralization" but emphasize "Web2-level user experience".

For Ethereum, this change is both a relief and a challenge. The relief is that there is no need to get caught up in the arms race of performance parameters; The challenge is that Ethereum's traditional advantages may become irrelevant as competitors open up new battlegrounds.

The deeper question is: how attractive is Ethereum's proud core value when "decentralization" is no longer the only value criterion?

The complexity of this narrative competition is most evident in Solana's recovery.

After the FTX collapse in 2022, everyone thought Solana was over. But in 2023, it made a strong comeback with meme coins and low-cost transactions. This phenomenon reveals a fact that unsettles the Ethereum community that the --- market may not care as much about decentralization as they think.

In the face of the rise of new public chains, the first reaction of the Ethereum community is to emphasize "legitimacy".

Ethereum supporters point to the centralization issues, security risks, and technical compromises of these chains. But the market's reaction was surprisingly lukewarm. When users are able to complete transactions for a few cents, they don't seem to care if the network is "decentralized enough."

When Ethereum tries to explain its value in pragmatic language, it loses its original moral high ground. "We are safer" sounds far less appealing than "We are building a decentralized future." This secularization of the narrative, while potentially attracting more mainstream users, may also alienate core supporters.

To complicate matters, the new public chain began to define "decentralization" in reverse.

They argue that true decentralization should allow ordinary people to participate, rather than an elite network that only the wealthy can afford. When Solana users used this to criticize Ethereum's high gas fees, Ethereum fell into a moral trap of its own making.

By early 2024, a troubling trend became evident as Ethereum's narrative became increasingly defensive. Most of the discussion is not about "what are we going to build" but "why we are better than other chains". This shift from offense to defense exposes the innovation dilemma faced by Ethereum.

This defensive stance is manifested in many ways.

Technology roadmaps are increasingly responding to competitive pressures rather than intrinsic visions, and community discussions are filled with criticism of other chains rather than self-reflection. Even Vitalik's article is increasingly explaining and defending rather than proposing bold new ideas as it did earlier.

More seriously, this defensive mentality is beginning to affect the innovation vitality of the ecosystem. Instead of asking "what's possible," developers ask "what's safe." Instead of looking for breakthrough innovations, investors are looking for "killers of Ethereum killers." The entire ecosystem has fallen into a state of involution, busy with internal competition rather than external expansion.

The root of this situation lies in the exhaustion of narratives. When the "world computer" proves too grandiose, the "DeFi settlement layer" is too narrow, and the "modular blockchain" is too technical, Ethereum lacks a new narrative that can spark the imagination.

Narrative Reconstruction and the Future (2024-)

In 2024, as the crypto market once again looks for new growth drivers, RWA (Real World Assets) emerges as the new savior. For Ethereum, this is not only a new application scenario, but also an opportunity for narrative reconstruction. From "changing finance" to "connecting reality", Ethereum tries to tell a story that is more pragmatic and closer to the mainstream world.

The appeal of Ethereum's RWA narrative lies in its specificity.

It is no longer abstract "decentralized finance" but "turning your US bonds into tradable tokens". It is no longer "permissionless innovation", but "reducing the friction cost of cross-border trade". This shift from idealism to pragmatism reflects the Ethereum community's renewed understanding of market needs.

More subtly, the RWA narrative changes the definition of success. In the past, success meant creating a new, native crypto economy. Now, success has turned into serving the existing financial system.

Old money on Wall Street rushed to enter the ETH ETF, and the Ethereum co-founder jumped to the US stock market to close the shell of listed companies... Assets are out of the circle, currency stocks are linked, and Ethereum is gradually returning to $4,000 in the new market cycle.

The gameplay has changed, and so has the narrative.

In the past, the community was always looking for "that" to define Ethereum's grand narrative; Now, more and more people are beginning to accept the reality that perhaps there is no single answer at all.

Instead of pursuing a unified, all-encompassing story, multiple narratives are allowed to coexist. For DeFi users, Ethereum is the financial infrastructure; For businesses, it is a crypto transformation tool; For creators, it is a copyright protection platform; For idealists, it remains the future of decentralization.

Make Ethereum services more widely needed and attract more diverse users.

It's just that we don't know if this diversification is a manifestation of maturity or a symptom of loss. A healthy ecosystem should indeed embrace diversity, but a platform that lacks a core vision can lose momentum moving forward.

But in any case, the marginal effect of technological innovation is decreasing, and narrative innovation must continue.

When technology is decoupled from narrative, it is better to solve real problems than to invent new words. Instead of promising to change the world, improve the user experience first. This pragmatic approach, while not exciting enough, could be more sustainable.

The peach and plum spring breeze is a cup of wine, and the night rain in the rivers and lakes has been a ten-year lamp.

From idealism to realism, from revolution to reform, from subversion to integration. Ethereum's decade is not necessarily a betrayal of its original intention, but may be the price of growth. After all, when the old story is told, the new story begins.

Perhaps, it's not just what it can do that really brings Ethereum to billions of users, but what the real world chooses to do with it.

From vision to reality, from promise to delivery, this could be the ultimate direction for Ethereum's narrative evolution. The gains and losses, advances and retreats, persistence and compromises in this process will define not only Ethereum, but the future of the entire crypto industry.