✍️ @FalconStable just crossed $1B in USDf circulating supply, becoming one of the top 10 stablecoins on DeFiLlama and the fastest-growing synthetic dollar since 2025.

But that stat alone doesn’t tell the full story ⬇️

Originally built to mint an overcollateralized dollar using crypto assets like ETH, USDT, and BTC, Falcon is now evolving into something much more ambitious, a universal collateral engine that spans crypto, real-world assets, and even traditional finance.

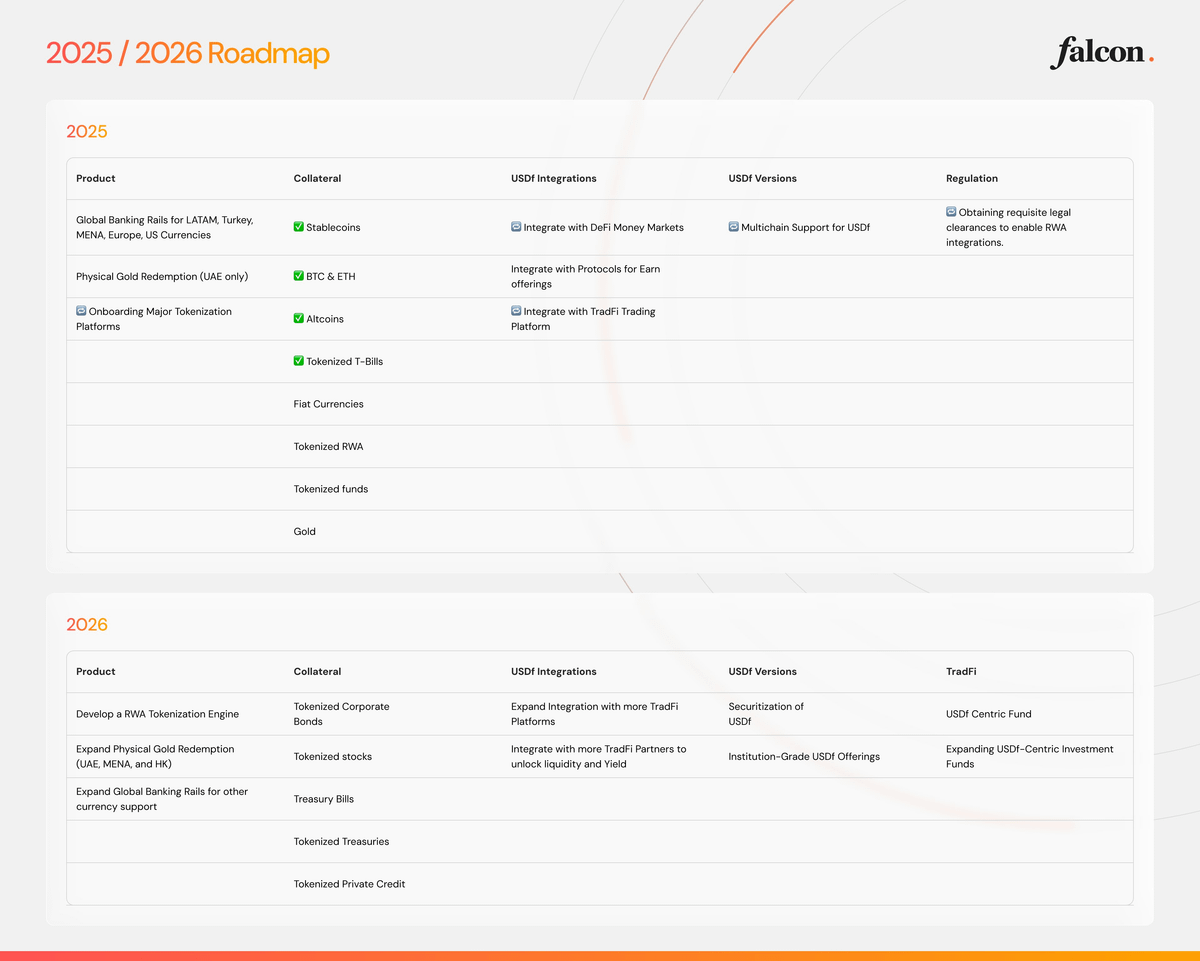

The new Roadmap outlines a vision that pushes far beyond stablecoins.

They’re building infrastructure that lets you tokenize and use everything from treasuries and corporate bonds to private credit as onchain collateral.

At the same time, they’re rolling out fiat onramps and gold redemption, starting in the UAE and expanding to regions like MENA, LATAM, and Hong Kong, blending digital and physical settlement in a way few protocols even attempt.

Falcon is also scaling outward, currently on major DeFi ecosystems like Curve, Pendle and PancakeSwap, while laying groundwork for broader exposure through a Nasdaq listing of their token treasury.

It’s a bold attempt to turn any liquid asset into usable, transferable liquidity that flows between DeFi and traditional markets without friction.

All of this still revolves around USDf, it’s the core, not a relic. But now, what backs it, where it moves, and who can access it is set to change.

This isn’t a pivot, it’s a full expansion into a new category, collateral infrastructure for a programmable, multi-market future.

You can check out the roadmap and get involved through their Miles program here 👇

If DeFi is ever going to connect with the real world at scale, this is the kind of bridge that will make it happen.

Show original

35.73K

116

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.