The second project combining SOL and JAM is Polana @polana_network

Porting Solana to the JAM protocol: large-scale parallel execution

The following content is excerpted from the Polana white paper

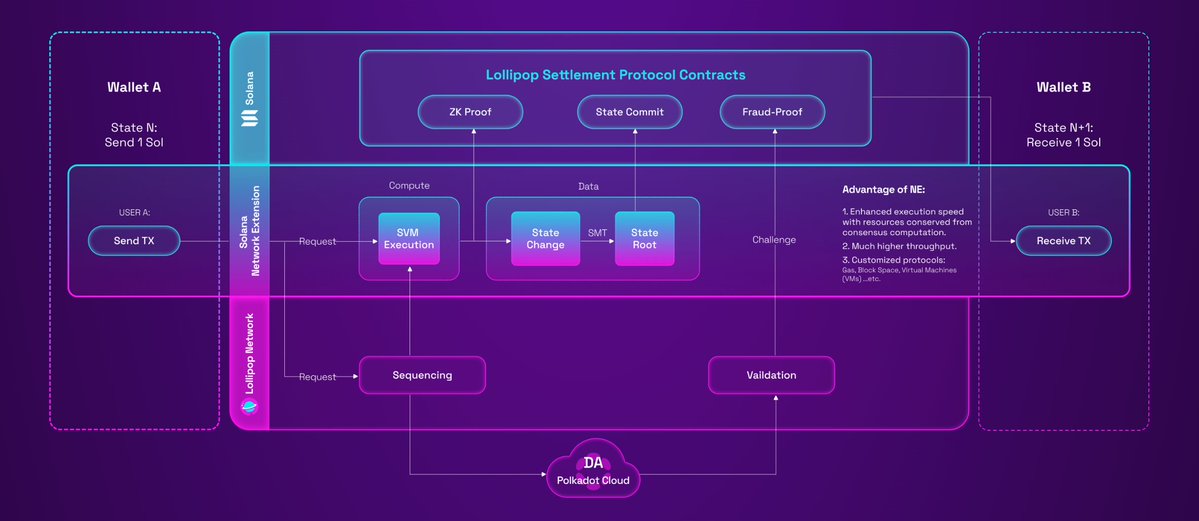

Polana expands Solana using the JAM protocol. By combining Solana's account-based architecture with JAM's high parallel processing capabilities, Polana achieves unprecedented transaction throughput while maintaining full compatibility with the Solana ecosystem.

A blockchain ecosystem that combines the developer experience of Solana with the parallel processing capabilities of JAM, achieving millions of transactions per second without fragmentation or compromising security.

Despite Solana's innovative architecture, it still faces some limitations:

Hardware requirements: 128GB RAM, validators need 12-16 CPU cores

Reliability issues: multiple outages since 2020, including a 17-hour outage

Single-machine bottleneck: parallelization is limited by the capacity of a single server

Validator centralization: about 1,700 validators, while Ethereum has over 8,800

Polana meets key needs in the blockchain ecosystem:

Scalable performance: enterprise-level throughput for high-frequency trading, gaming, and institutional use cases

Unified experience: liquidity and user experience are not fragmented

Cross-ecosystem value: new opportunities for the Solana and Polkadot communities

Polana offers three complementary methods to execute Solana programs:

sBPF runtime service

Embedding Solana's Berkeley Packet Filter (sBPF) runtime in PolkaVM

Solana programs can be executed without modification

Tracking and verifying state transitions before commitments

Bytecode transpilation

Recompiling Solana programs from sBPF to LLVM intermediate representation (IR)

Converting LLVM IR to PVM bytecode

Leveraging RISC-V performance optimizations

Native PVM compilation (preferred method)

Directly compiling Solana programs into optimized PVM bytecode

Eliminating translation overhead for optimal performance

Achieving the highest throughput and lowest latency

Future JAM ecosystem plans

Solana's unique programming model requires developers to declare all accounts that transactions will read from or write to in advance. This "pure" approach is well-suited for large-scale parallelization:

Pre-declared access: enables conflict detection before execution

Non-overlapping execution: transactions accessing different accounts run simultaneously

Multi-core utilization: JAM's architecture distributes execution across hundreds of cores

Solana achieves parallelization within a single machine (theoretically 65,000 TPS), while Polana scales it to hundreds of cores on the JAM network, potentially reaching:

TPS for simple transactions of 500,000 to 1,000,000

100,000-250,000 TPS for complex smart contract interactions

Future JAM Grid expansions will bring millions of TPS

Continuous execution model

A groundbreaking feature of Polana is its support for continuous execution—this is a paradigm shift from traditional discrete transaction models:

How it works

Persistent process state: programs can maintain execution state between transactions

Long-running operations: processes can continue executing across multiple blocks

Event-driven architecture: programs can respond to on-chain events without manual triggering

Resource efficiency: eliminating redundant initialization and computation

Continuous execution unlocks new DeFi primitives and use cases:

Automated market making: liquidity pools that adjust automatically based on market conditions

Algorithmic trading: on-chain trading strategies with continuous execution

Dynamic NFTs: digital assets that evolve autonomously over time

Autonomous agents: automated execution programs managing assets

Real-time risk management: continuous monitoring and adjustment of positions

Developer experience

Same programming model: existing Solana code requires no changes.

Native tool compatibility: compatible with Anchor, Solidity via Solang, and other tools.

Language flexibility: supports application development languages beyond Rust.

Interoperability: enables interaction with other services within the JAM ecosystem.

Scalability: existing Solana protocols with JAM execution layers allow pure JAM layers to run on top of current Solana execution.

User experience

Seamless wallet integration: fully compatible with Phantom, Solflare, Backpack, Glow, and all major Solana wallets

Same RPC interface: projects can use the same RPC endpoints and methods

Familiar tools: can be used with Solana CLI, Explorer, and development frameworks

No account switching: users continue to use their existing Solana addresses

No bridging: direct interaction with other JAM services without cross-chain messaging

Cross-ecosystem value

pSOL: connecting ecosystems

The introduction of pSOL (the bridged version of SOL in the Polkadot ecosystem) creates significant value:

New asset class: bringing Solana's liquidity and active community into Polkadot

Expanded use cases: enabling Solana assets in Polkadot DeFi applications

Cross-ecosystem development: facilitating collaboration between developer communities

Shared security model: leveraging Polkadot's robust validator set

Use cases

Continuous trading algorithms

Polana's continuous execution model supports complex trading strategies that autonomously run on-chain. Unlike traditional blockchain architectures that require discrete transactions, continuous algorithms can maintain persistent states and respond instantly to market changes, enabling real-time arbitrage, automated rebalancing, and complex DeFi protocols that continuously adapt to market conditions.

GameFi and Metaverse

The continuous execution model allows complex game logic to run directly on-chain, with state progression occurring autonomously.

Institutional DeFi

Performance, reliability, and security make Polana suitable for institutional-grade financial applications that require regulatory compliance.

Cross-chain applications

Integration with Solana and Polkadot ecosystems enables a new type of cross-chain applications with unified liquidity and shared security.

White Paper:

14

6.18K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.