I've always been puzzled by these >9% loans... who's borrowing at those rates? Is it purely from looping+mining?

Panoptic's yields come from a healthy borrowing demand from Uni LPs and options traders to access leverage, so yields scale with trading/LPing returns.

What are the best DeFi yield opportunities right now?

@Aave's GHO on @0xfluid stands out with the best 7D Avg supply APY at 9.07%.

Followed by USDS and USDC on Aave Prime and the sUSDe/DAI @MorphoLabs pool.

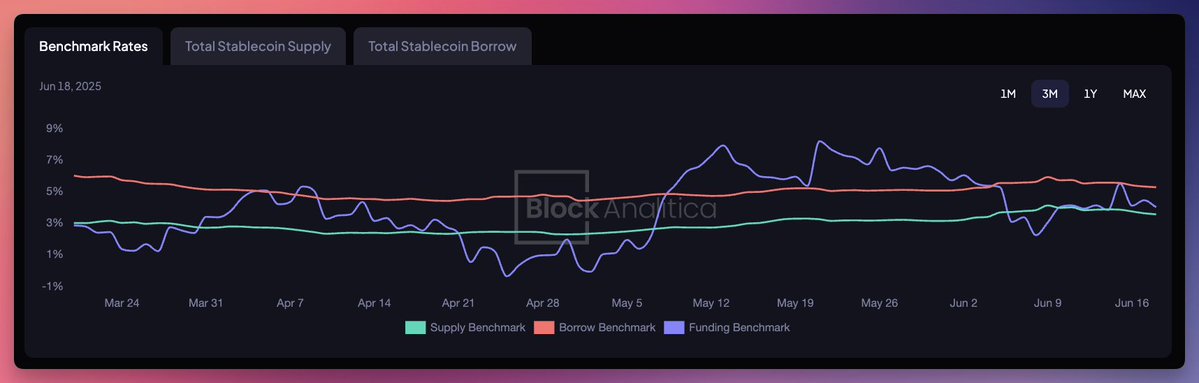

All these pools are above the supply rate benchmark, currently 3.55%.

6

3.49K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.