🏘️⛓️ RWA Weekly News: TradFi Converges Onchain

BNY & Goldman bring money markets to the blockchain, @OndoFinance files the first RWA ETF with @21Shares, and $10B+ in real estate tokenization platforms are launching.

Here’s everything driving the tokenization wave this week 👇🧵

@plumenetwork @ColbFinance @trize_io @Polytrade_fin @multibank_io @FireblocksHQ @eulerfinance @aurora_mobile 🔎 DIA xReal: The Oracle Layer for RWAs

From tokenized stocks and bonds to FX and private credit, DIA delivers transparent, verifiable RWA data across 60+ chains, powering the infrastructure behind this new asset class.

Learn more ↓

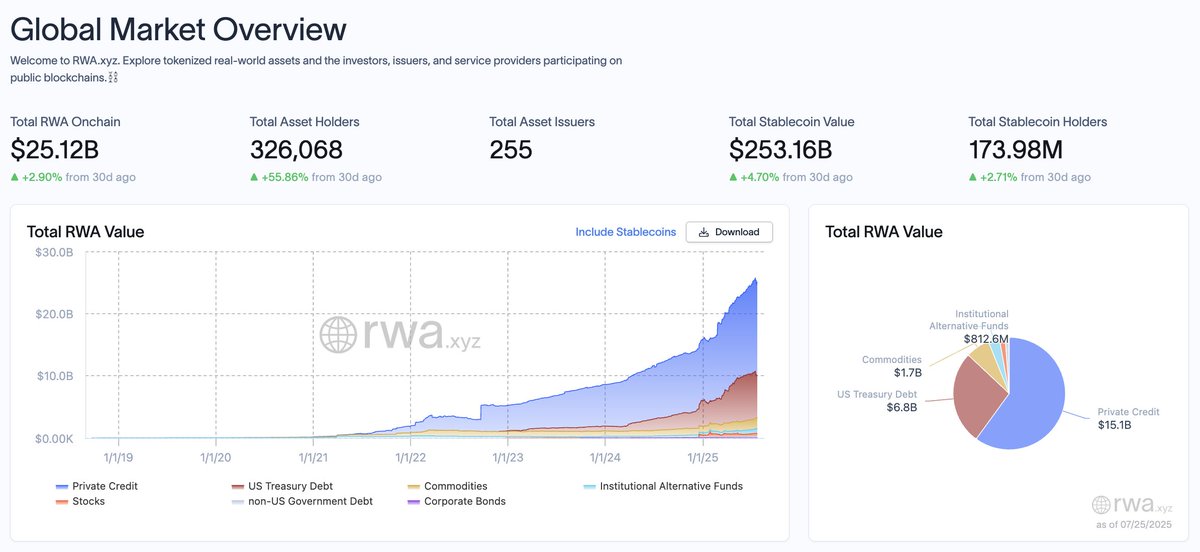

📊 RWAs in Numbers (July 26th)

• Total RWA On-chain: $25.12B

• Asset-backed stablecoin total market cap: $253.16B

• Total asset issuers: 255

• Leading RWA chains: Ethereum, ZKSync Era, Aptos, Solana, Stellar.

Learn more at

@RWA_xyz 🇺🇸 U.S. Trump Signs First Major US Crypto Law

The bipartisan GENIUS Act becomes law, marking the first major U.S. crypto regulation and a milestone for digital asset policy.

🤝 @plumenetwork & @ColbFinance Bring Pre-IPO Equities Onchain

The new partnership enables tokenized access to private market equity on public blockchains, boosting RWA accessibility.

🤖 RWA Meets AI as Rizenet Surges 280%

@trize_io gains traction by blending AI with RWA tokenization, leading performance among small-cap crypto assets.

🏘️ Polytrade Raises Capital for Real Estate Tokenization

@Polytrade_fin secures strategic funding, bringing total raised to $6M+ as it targets tokenized real estate market growth.

🏠 $10B Real Estate Tokenization Platform Launched

@multibank_io teams with @FireblocksHQ and @MavrykNetwork to launch a large-scale platform targeting global real estate onchain.

⛓️ BNY & Goldman Sachs Bring Money Market Funds Onchain

The two giants partner to tokenize part of the $7.1T money market industry, signaling massive TradFi-RWA convergence.

🌍 Euler Finance Joins Global Alliance for RWA Expansion

@eulerfinance enters a strategic alliance to accelerate global onchain RWA adoption and ecosystem collaboration.

💥 Onchain Equities Could 100x Blockchain Value

Nansen CEO @ASvanevik says tokenized stocks and RWAs are key to unlocking exponential value across crypto infrastructure.

🇨🇳 Aurora Mobile Eyes Strategic Entry into RWA Market

@aurora_mobile begins exploring partnerships and strategies to enter the real-world asset space and drive innovation.

🏦 Ondo & 21Shares File First RWA Tokenization ETF

@21Shares files for an ETF based on @OndoFinance's tokenized products, marking a milestone for institutional RWA exposure.

🌀 RWAs are no longer a niche, they’re becoming core financial infrastructure.

• TradFi giants entering onchain markets

• Real estate & money markets scaling tokenization

• ETFs & global alliances accelerating adoption

Back next week with more milestones reshaping on-chain finance.

20.23K

226

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.