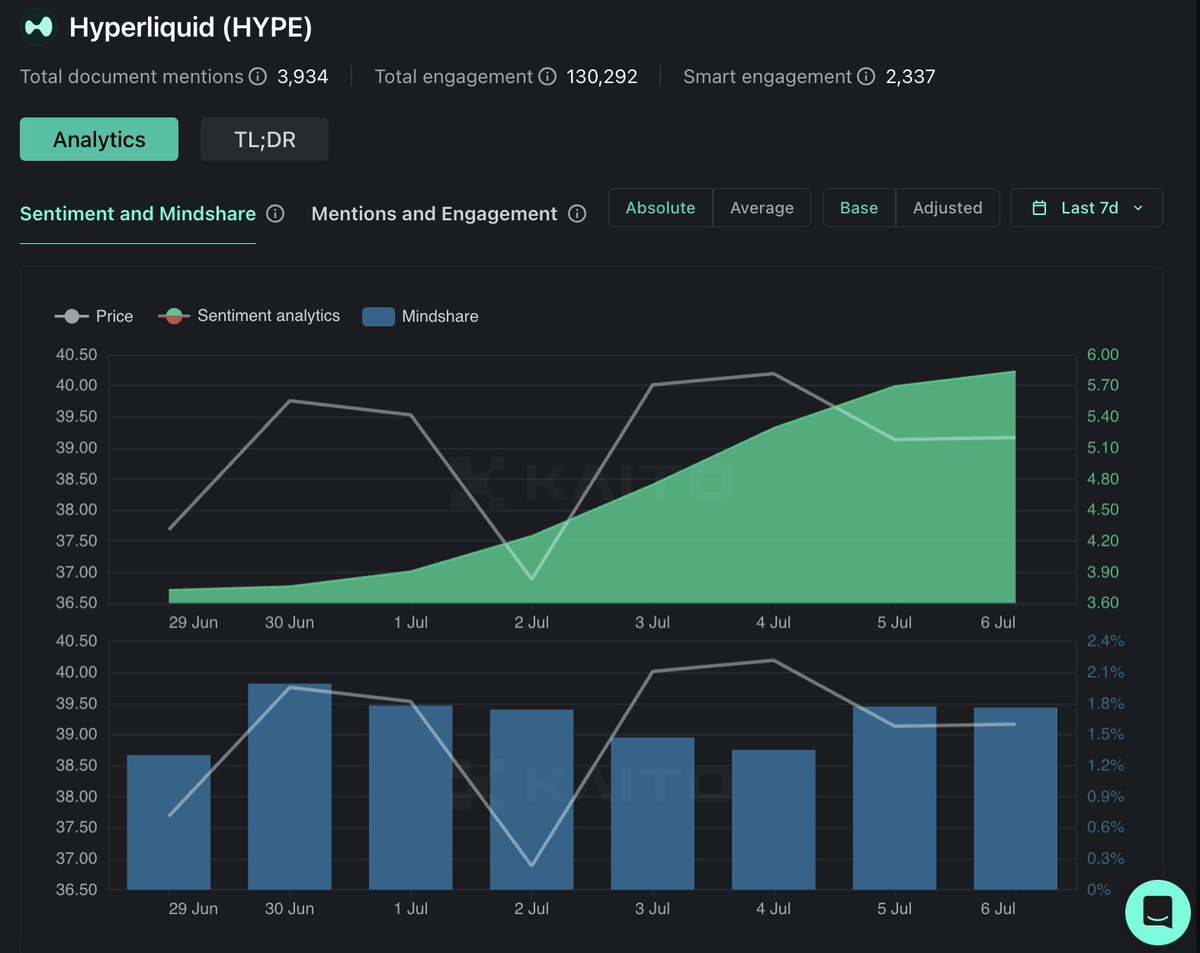

Recap of the past week in @HyperliquidX

CoreWriter Upgrade & Ecosystem Impact

Hyperliquid's CoreWriter upgrade, planned for the next mainnet release, lets HyperEVM smart contracts interact directly with HyperCore's central limit order book (CLOB). This allows decentralized apps, like lending protocols and yield strategies, to execute trades natively on Hyperliquid’s high-speed infrastructure. Analysts say this positions Hyperliquid as a vertically integrated chain with unique advantages over general-purpose L1s, potentially reshaping altchain economics.

$kHYPE Liquid Staking Token (LST) Launch

The eagerly awaited kHYPE LST, created with @kinetiq_xyz, will launch following the CoreWriter deployment. Expected impacts include:

- Millions of HYPE tokens shifting to kHYPE, boosting HyperEVM’s TVL.

- More decentralized stake distribution through Kinetiq’s validator performance metrics.

- Increased DeFi yields and stablecoin liquidity as whales deploy capital.

Mobile Trading Expansion

Hyperliquid's perps trading is now live on Mass, a mobile app for iOS and Android, enabling 24/7 on-chain trading with sub-second latency.

Revenue & Market Position

Hyperliquid ranked 4th among crypto companies in June 2025 with $60.6M in on-chain revenue, behind only Tether, Circle, and PancakeSwap. Its vertically integrated stack (custom L1, CLOB, HyperEVM) captured ~35% of on-chain perps volume, outperforming many mid-tier CEXs.

Vertical Infrastructure Dominance

Hyperliquid's vertically integrated infrastructure is considered its major competitive edge, featuring:

- High-speed execution: sub-second finality and 200k TPS, suitable for latency-sensitive strategies like HFT.

- Strong tokenomics: Real-yield fee distribution directly to stakers, achieving a lower P/S ratio compared to dYdX or GMX.

- Potential risks include token unlocks, regulatory pressures on leverage trading, and competition from platforms like dYdX v4 and Aevo.

Hypurr NFTs Gain Traction

Original Hyperliquid NFTs (@hypurr_co), distributed to top pre-TGE users, now trade OTC around $55k–$60k, highlighting strong community recognition.

Bullish Opinions 🐂

@Lamboland_ "HyperEVM builders are driven not just by financial incentives but genuine engagement. A strong community inspires continuous protocol development."

@KookCapitalLLC "Hyperliquid is reshaping blockchain economics. Thanks to exceptional product-market fit, it has the potential to render other altchains obsolete."

@blknoiz06 " $HYPE has grown by 300% since April, positioning it as one of the most promising high-yield investments. The token remains undervalued and could outperform BTC in returns."

@Sanlsrni "We're entering an era of "smart speculation," where investors leverage sophisticated models and memetic behavior, making speculation more meaningful and scalable."

@PixOnChain "User tools for HyperEVM have shown active engagement - we're seeing strong traction and continued ecosystem growth."

@lukecannon727 "kHYPE will become the leading LST token within the Hyperliquid ecosystem, decentralizing staking and boosting both yields and TVL on HyperEVM."

@Grantblocmates "Currently analyzing top HyperEVM products for an educational video - demonstrating confidence in platform innovation."

@arndxt_xo "Hyperliquid infrastructure provides CEX-level execution combined with decentralized incentives - a unique market offering in DeFi."

@RedactedRes "HIP-3 could transform Hyperliquid into a permissionless financial infrastructure, enabling numerous perpetual markets. This could significantly increase adoption and revenue."

Bearish Opinions 🐻

@bkiepuszewski "The community should critically assess centralized data architectures in DeFi and address issues around price volatility and user education, especially regarding data withholding attacks."

@PixOnChain "Despite high expectations for a large airdrop, user activity on HyperEVM remains very low - raising concerns about genuine engagement."

@ThogardPvP "Criticism of Hyperliquid's one-way bridge: inefficient use of a for loop in precompile on a chain limited to 2M gas - an architectural misstep."

@0xaioli "HyperEVM's order execution method is inefficient; directly leveraging Hypercore liquidity would offer a smoother user experience."

@stevenyuntcap "If @cobie's speculation proves true and Robinhood enters the DEX market, it could quickly overshadow Hyperliquid, despite myths around its foundation on Arbitrum."

@ayyyeandy "Hyperliquid is unfairly excluded from revenue rankings despite industry buzz and notable profitability."

@SweetcheeksReal "Why focus on Hyperliquid when @PancakeSwap generates higher revenue but has a significantly lower market and fully diluted valuation?"

@DidiTrading "Overall activity on HyperEVM remains low, highlighting the need to strategically identify quality opportunities through effective sybilling."

Tagging some Hyperliquid chads:

@Henrik_on_HL

@crypto_adair

@xulian_hl

@kaiynne

@skewga_hyper

@mlmabc

@smartestmoney_

@0xlykt

@MBXXVV

@0xOmnia

RT & like if you want to see more Recap like this ☺️

26.33K

128

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.