Cat is a close friend of mine and a rare example of a normal guy who's down to Earth. Never boasting, never rude (unless provoked), always honest and humble.

He laid out his very simple strategy and displayed why having one in combination with perseverance is, regardless of how long it takes, the best approach to winning.

#respect

December 18, 2020, around $3,500.

That’s all I had left from the previous bear market. Lost everything in shitcoins (sold around 500k DOGE). I only held ETH and BTC.

April 8, 2021, $300.

Lost almost everything doing leverage, following stupid KOLs.

So, I started aping shitcoins on BSC with a few bucks ($5-10).

No bots, no AI, no snipers for plebs... Just open PooCoin, check the explorer, and pray. Good old good times!

“OK, boomer, why this post ❓”

Because I have many new crypto friends who got burned in 2024/2025, going from three figures to five/six figures and back to one in the last few months.

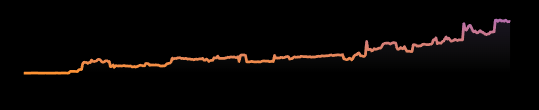

I’m probably too conservative, but look at the picture, it's my portfolio

❗️Manifesting ❗️

Set Clear Intentions: Visualize specific, realistic goals—e.g., recovering to a stable $10k portfolio or building a diversified bag with 50% blue chips, 30% farming, and 20% calculated shitcoin bets. Write it down to solidify your focus.

Preserve Capital (Your Key Rule): Mentally commit to never risking more than 5-10% of your portfolio on high-risk plays (like BSC shitcoins). Picture your $3,500 growing steadily by avoiding leverage traps and KOL hype.

Diversify Strategically:

Farming: Seek low-risk yield farms with audited protocols (check DeFiLlama for TVL and safety). Manifest steady 10-20% APYs rather than chasing 1000% scams.

Airdrops: Hunt under-the-radar airdrops (e.g., check X for niche L2 or DeFi projects, not overhyped ones like Monad). Visualize finding one gem that 10x’s your $5-10 entry.

Blue Chips: Picture buying BTC or other solid projects during dips (e.g., when fear dominates X sentiment). Avoid ETH if you’re wary of foundation selling—focus on assets with strong fundamentals.

Small Gambles: Allocate $5-10 for fun, high-risk bets on BSC or similar chains, but imagine cutting losses quickly if they don’t pan out.

Avoid Past Mistakes: Reflect on your losses. Manifest discipline by steering clear of FOMO and unverified KOLs. Check X for community sentiment.

Take Breaks: Visualize stepping away from charts to recharge. A clear mind helps you spot real opportunities (like that next undervalued airdrop) without emotional trades.

Practical Rituals: To reinforce your manifestation:

Check one new project daily focusing on utility or tech (e.g., cross-chain bridges or DeFi with real use cases).

Track your portfolio weekly to stay grounded.

Save a small “win fund” for when a trade hits—e.g., take 20% profits to treat yourself, reinforcing positive momentum.

Be a good person: don't scam, don't rug, picture yourself as a crypto “fren” who lifts others up, not tears them down

7.77K

15

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.