Sustainable yields will be the backbone of DeFi.

$FLOCKS by @FlamingoFinance is one of the few products quietly building toward that future.

Here’s why this could scale into something massive🧵:

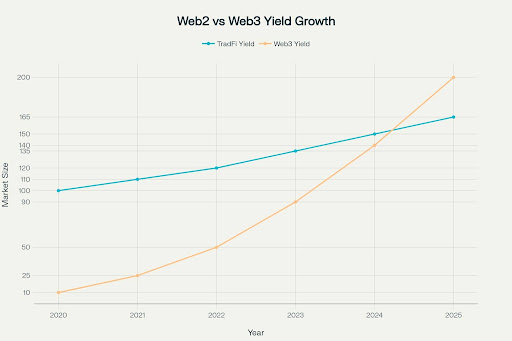

Over time, one key difference between Web2 and Web3 has become clear: sustainability.

Most Web2 yield assets like stocks, treasury bills, and bonds have shown years of steady, sustainable growth.

In Web3, yields are often higher but rarely sustainable.

Many protocols start with high APRs that drop quickly, as most participants act as extractors rather than contributors. This leads to incentives that can't be maintained over time.

This lack of sustainability is what led Flamingo to shift from FLUNDS to FLOCKS.

A quick backstory...

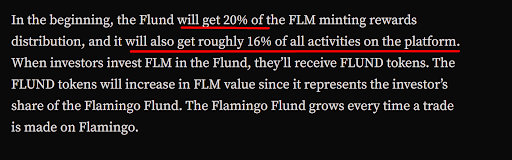

Flamingo initially launched FLUNDS, a single-stake, DEX-traded fund where $FLM holders earned 20% of minting rewards and 16% of platform revenue.

While it was lucrative, the model attracted opportunists who came in to pump and dump $FLM.

This pushed the team to rethink the structure and introduce FLOCKS as a more sustainable approach.

Like FLUNDS, FLOCKS is a dividend-bearing asset that lets users own a piece of Flamingo Finance and earn a share of its revenue.

It stands out from most yield assets because it gives users the best option for capturing native yields. You don’t have to worry about staking, locking, or vesting.

Once you hold Flocks, you’re eligible for a part of Flamingo's revenue.

In addition FLOCKS introduces key changes that make it more sustainable:

➡️ Burn mechanism

Minting 1 FLOCKS burns 1 FLM. The more people choose to own FLOCKS and earn from Flamingo's revenue, the more deflationary FLM becomes. Additionally, 25% of all FLOCKS revenue is burned, sourced from multiple income streams.

➡️ No withdrawal option

Once you convert FLM to FLOCKS, your FLM is burned. There’s no going back. The only way out is to sell FLOCKS. This discourages short-term farming and filters in long-term believers.

➡️ Transfer fees + diversified yield

FLOCKS charges a fee on transfers, and its yield is paid in multiple tokens. This reduces sell pressure and adds durability to the rewards model.

So, how does it work?

FLOCKS operates much like FLUNDS—you simply buy it with FLM or any other asset.

Once you hold FLOCKS, you start earning dividends from a share of all platform fees, similar to how a company distributes profits to shareholders.

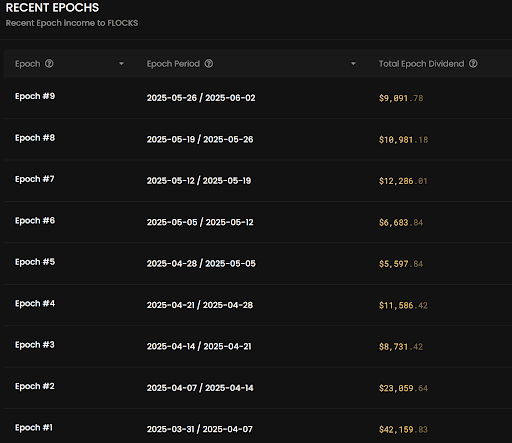

For FLOCKS, this happens every week, with fees coming from multiple sources, as shown below.

At the same time, 5% of newly minted FLM is distributed to FLOCK holders, boosting their APR.

You can also toggle the diversity option to choose to earn rewards in other tokens besides FLM.

From there, you can sell your earnings, reinvest them, or sell your FLOCKS on the open market.

The best part—more FLOCKS in circulation means more FLM is burned, increasing FLM’s scarcity. And that’s it.

Since the migration in April, Flamingo Finance has:

✅ Paid over $140K in dividends across 10 weeks

✅ Burned more than 100 million FLM

✅ Maintained consistent two-digit APRs

If you want to get involved, there are several ways to acquire FLOCKS.

Below is a list of options—just pick the entry point that works best for you and join the winning train.

As a flagship product on @Neo_Blockchain, Flamingo has strong potential to grow and dominate the ecosystem, which means more revenue and yield for FLOCK holders.

If you’re looking for a diversified and sustainable yield asset, FLOCKS is worth a close look and you can stay updated by following them @FlamingoFinance.

That's all for now.

NB: This piece is made in partnership with the Flamingo team.

6.05K

95

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.