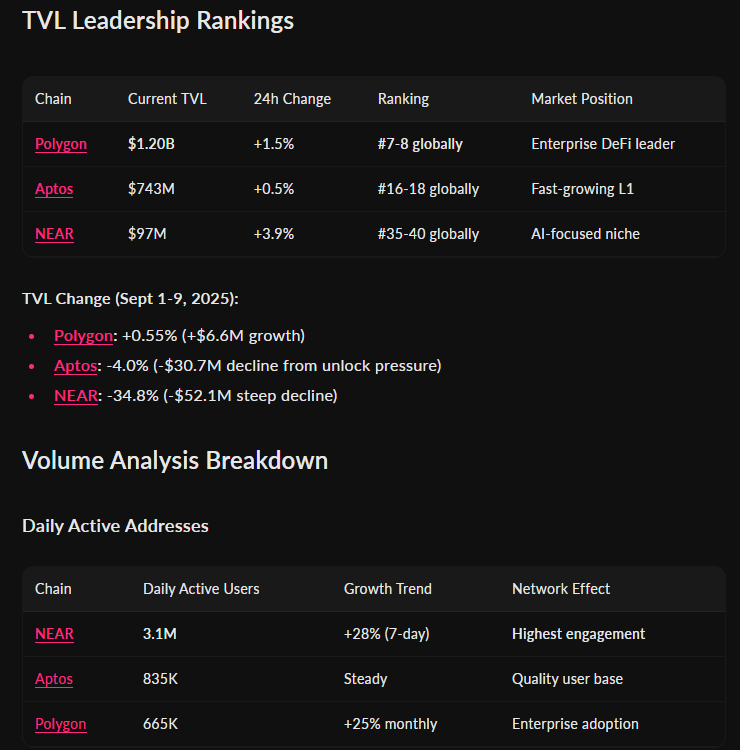

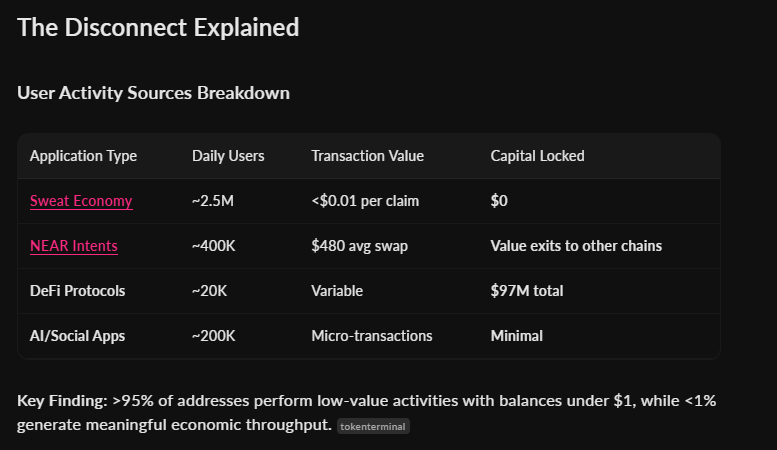

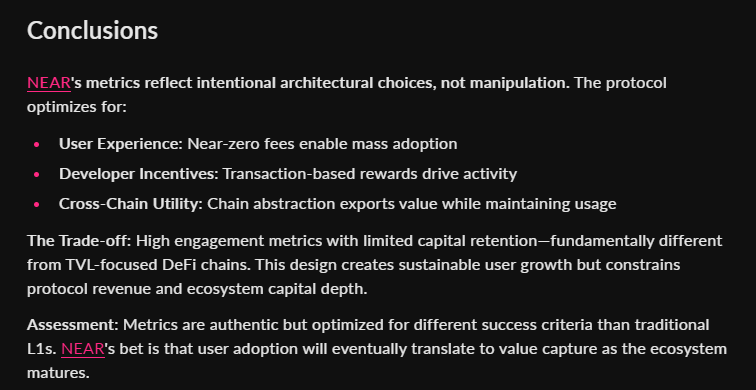

Curious why @NEARProtocol has even less than $100M Total TVL but still has up to 3.1M DAU Even @0xPolygon with $1.2B TVL and @Aptos with $743M TVL aren't reaching 1M DAU Those metrics sponsored by @Surf_Copilot Here's why... NEAR is optimized for users, not capital 2.5M users are from Sweat Economy claiming rewards under $0.01 each Average fee per user? $0.003. While Polygon captures $1.2B TVL with enterprise DeFi, NEAR subsidizes micro-transactions through developer fee rebates and gas sponsorship. > The chain abstraction play: 400K users doing cross-chain swaps via NEAR Intents they count as DAU but value settles on destination chains $956M in swap volume but zero TVL retained. It's not fake metrics, it's intentional design. > TVL concentration risk: 95% locked in just 2 protocols Rhea Finance and Meta Pool One protocol fails, the entire ecosystem shakes Compare that to established chains with diversified protocols > The bet: NEAR thinks user adoption comes first,...

Show original

10.11K

45

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.