A graphic tutorial for the Crydit crypto debit card launched by DBS Bank, established in 1968: can be used for withdrawals, unlimited spending, and can be used to buy houses and cars.

1. What is the Crydit Visa Card?

Crydit is a UK-based Web3 fintech company with compliance financial licenses in multiple regions, such as the MSO (Money Service Operator) in Hong Kong and the VASP (Virtual Asset Service Provider) in Europe.

They have launched a Visa debit card that supports multiple stablecoins (such as USDT, USDC, DAI, USD₁), allowing users to spend crypto assets in the real world without needing to convert them into fiat currency in advance.

2. Key Features and Advantages

Globally Available: Supports spending at all online and offline merchants that accept Visa worldwide.

Fast and Efficient: Using smart contract technology, stablecoins are transferred from the custody account to the spending account in real-time, achieving instant deposits and settlements.

Supports High-Value Payments: Suitable for large spending scenarios such as real estate, cars, luxury goods, and the official promotion states "no limit on single transactions."

Multi-Channel Payments: Compatible with Apple Pay, Google Pay, Alipay, WeChat, etc.; also supports contactless Visa payment methods (NFC).

3. Issuing Institutions and Partners

This card is issued by Singapore's DBS Bank as a USD Visa physical card, with the bank providing account and fiat conversion services.

Assets are managed by compliant custodians such as Cobo and Ceffu, and Crydit itself does not directly handle user funds, enhancing security.

4. Security Compliance and User Experience

KYC & Security Mechanisms: Supports Visa KYC processes, 3DS dynamic verification, and has a dual notification mechanism with app notifications and SMS alerts to protect user security during transactions.

VIP System: Crydit has an 8-level VIP identification system, with different membership levels enjoying various cashback and benefits.

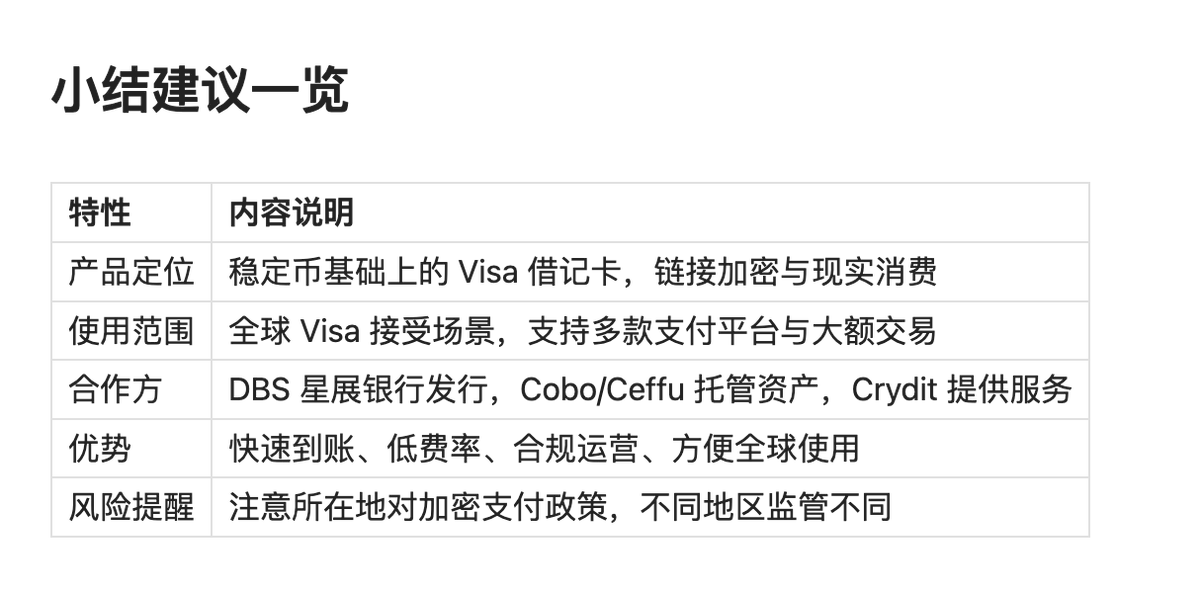

Summary and Recommendations Overview.

Show original

6.73K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.