Lending has always been the biggest PMF outside of trading.

Growth does not necessarily rely on disruptive innovation; it may just need to serve a specific demand.

@MorphoLabs started with interest rate optimization.

@0xfluid integrates lending and trading to enhance efficiency.

Gearbox is regaining momentum with no-slippage looping loans.

In my opinion, this wave of gains for Gearbox is more sustainable than the Restaking and points frenzy of 2024. Taking this opportunity, let’s discuss some thoughts on the @GearboxProtocol product:

1⃣ Bond-backed repurchase and looping loans.

Looping in traditional financial markets actually has a counterpart—bond-backed repurchase, also known as Repo.

In the interbank market, banks and institutions use highly liquid government bonds as collateral for financing, then buy similar bonds, and repeat the process until they reach their target leverage.

This is essentially a strategy to amplify returns.

Due to the excellent liquidity of government bonds and the highly active interbank lending market, this behavior is basically the norm, and the market size is in the trillion-dollar range, representing a validated demand for decades.

This demand translates to the crypto market, corresponding to looping loans and leveraged mining.

Here, there are both the most original ETH staking yields (3–4%) and nearly 10% funding rate arbitrage, as well as various yields derived from trading and lending. Although the scale is not as large as the traditional market, it is growing rapidly.

As interest rates decline, the spread between borrowing costs and strategy yields will become more attractive, increasing the demand for looping leverage.

2⃣ Pain points of looping loans.

Taking ETH's LST assets as an example, the conventional looping loan process is:

Collateral → Borrow → DEX buy LST → Re-collateralize…

Until the target leverage is reached.

Closing out is the opposite process.

The entire process requires multiple transactions (although most platforms support one-click looping, the backend execution logic remains unchanged), incurring slippage, occupying liquidity, and being forced to close out when LST unpegs. When the market panics, insufficient depth in the secondary market can amplify price deviations, leading to a significant increase in liquidation risk.

3⃣ Contract-based looping loans.

The uniqueness of Gearbox's looping loans lies in two points:

- Credit Account

- Contract-Based Looping

Unlike other lending platforms where funds are lent to external accounts, in Gearbox, both the collateral principal and borrowed funds are aggregated into a Credit Account that complies with the ERC-4626 standard, and all leverage operations are completed within that account.

This means that financing can be completed in one step: for example, if a user deposits 1 ETH as principal and chooses 10x leverage, the protocol will directly match them with 9 ETH, and the funds will always remain in the contract account during subsequent operations.

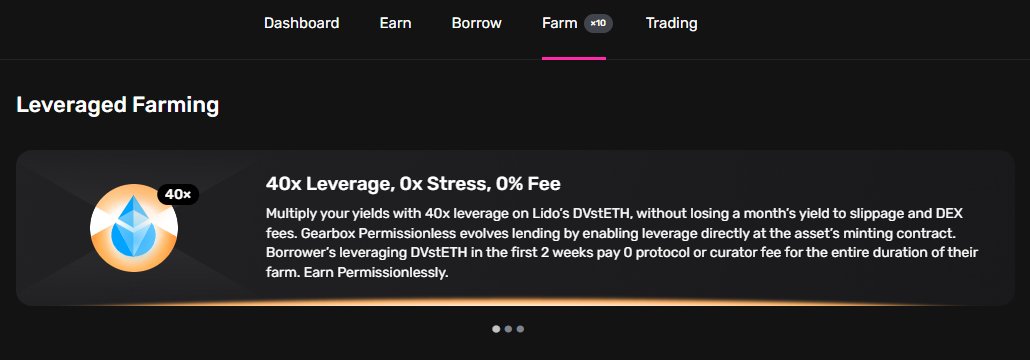

Moreover, Gearbox does not use borrowed funds to buy on DEX; instead, it directly calls the minting contract to obtain asset exposure. For example, with DVstETH, which has almost no DEX liquidity, users can still directly call the @LidoFinance minting contract to mint DVstETH in Gearbox's Credit Account without trading in the secondary market.

The entire process uses the protocol's fundamental oracle to convert at the pegged ratio, rather than relying on market price oracles for matching. Similarly, when closing out, the Credit Account calls the redemption contract to exchange stETH back to ETH, settling at the on-chain redemption price (Reserve oracle), avoiding market sell-offs entirely, thus completely mitigating slippage and unpegging risks.

Additionally, since lending and investment are homogeneous (ETH and DVstETH are both ETH-based), even if redemption requires a 7-day wait, it merely extends the liquidation time without weakening the effectiveness of liquidation, and it does not amplify risks.

4⃣ Gearbox is a modular credit account.

Since all lending funds remain in the credit account and are not transferred to the user's wallet, Gearbox resembles a lending account service rather than a traditional lending platform. This has a natural appeal for institutional funds:

The limitations of traditional lending protocols are:

- Once funds are withdrawn, their use cannot be restricted.

- Lack of compliance control.

Gearbox inherently solves the first problem: funds always remain in the contract account and can only be directed towards pre-approved targets. For institutions, this is equivalent to an on-chain "custodial trading account," allowing for leveraged investment in target strategies while clearly tracking the flow of funds.

This is also one reason why Morpho's Curation model is favored by institutions and B-end users: the yield structure and risk exposure can be defined by curators. Gearbox is essentially following a similar path to the Curation model but taking it a step further: it not only allows for strategy customization but also enables immediate leverage.

One can even imagine that in the future, Morpho's curation treasury might also call Gearbox as the underlying leverage execution engine, eliminating the inefficiencies and risks of manual looping, and further meeting compliance needs with permission management, on-chain KYC whitelists, etc.

At that time, the narrative ceiling for Gearbox will be lifted.

5⃣ In conclusion.

As one of the most OG teams in DeFi,

with 0 attacks and 0 bad debts since launch,

$3M+ in security/risk control investment, and over 10 audits,

with tokens fully circulating,

Gearbox currently has a TVL exceeding $400 million, while its FDV is only about $40 million, of which about 35% is held by the DAO.

Given this scale and valuation, in a protocol that has already achieved core PMF and whose narrative is gradually extending from DeFi players to institutional funds, I believe there is long-term allocation and imaginative space.

Gearbox TVL has now surpassed $400M, surging by $240M this year.

Up Next: More markets, networks, curators and Permissionless growth. The road to tres commas gets closer. ⚙️🧰

10.4K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.