The Half Mountain KOL Club's recommended items for this week✨#Issue 70

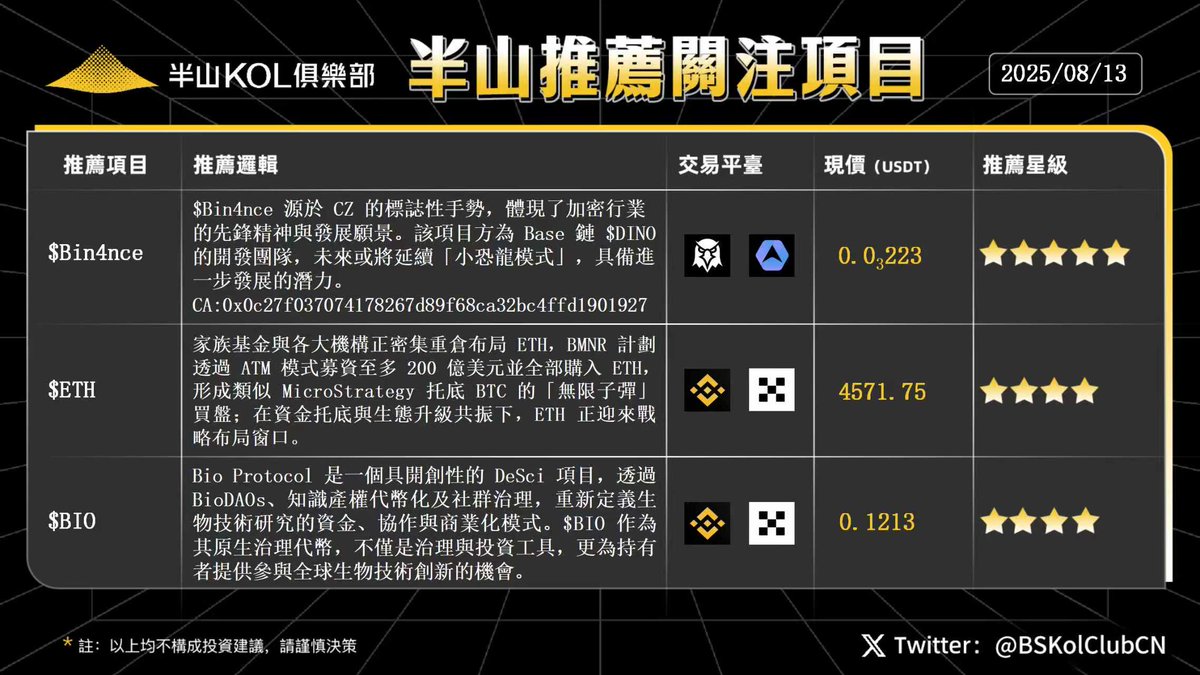

This week's recommended items: $Bin4nce, $ETH, $BIO.

Today, Bitcoin is maintaining a high-level fluctuation, trading around $119,500, with an intraday range between $119,000 and $120,200, showing an increase of less than 0.5%; in contrast, Ethereum is showing a significantly strong trend, breaking through the $4,500 mark intraday, reaching a high of $4,674, with an increase of nearly 8%. Market sentiment has significantly warmed due to institutional buying and favorable funding conditions.

Additionally, Vance Spencer, co-founder of Framework Ventures, stated that Bitmine and Sharplink are expected to jointly purchase $20 to $40 billion worth of ETH in 2025, most of which will be directed towards the on-chain lending market, attracting stablecoin circulation or mining, potentially becoming the largest active capital injection in DeFi history.

At the same time, Solana's officials announced that China’s leading asset management company, CMB International, successfully brought its flagship fund on-chain to Solana with the support of DigiFT and OnChain, becoming the world's first publicly offered fund on the Solana blockchain, issued to qualified investors in Singapore; this token product is also deployed on Solana, Ethereum, Arbitrum, and Plume public chains, supporting fiat and stablecoin redemptions, and enabling real-time redemptions through smart contracts.

On the macro front, Nomura economists predict that due to a weak labor market and declining inflationary pressures, the Federal Reserve will begin to cut interest rates by 25 basis points in September, followed by another 25 basis points cut in December and March next year; although there are differences regarding the timing of the rate cuts, the market generally believes that a loosening cycle is imminent, which is expected to bring new liquidity support to the cryptocurrency market.

#cryptocurrency #memecoin #BTC #ETH #Solana #DeFi

Show original

52.89K

27

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.