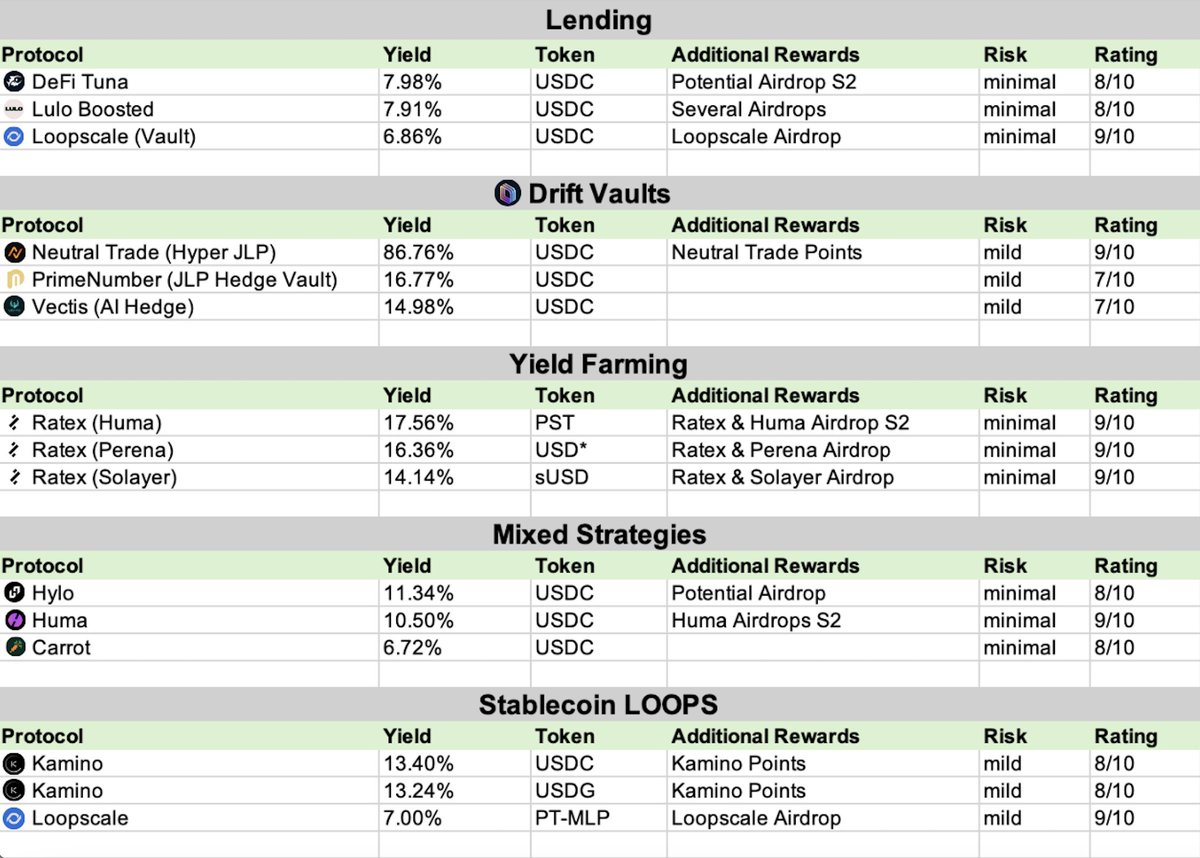

Fabiano is one of the accounts that is digging into stable yields on Solana.

I've just used his list to have a good overview of Solana stable opportunities and locked some assets into Loopscale.

Due to the fact that most of my altcoins (about 25% of my portfolio) are just suffering in this cycle, I am currently using my stables to gain as much on yield and point rewards as possible.

This is not a recommendation to copy it, but just to show that you can also earn without having too much exposure to very volatile altcoins.

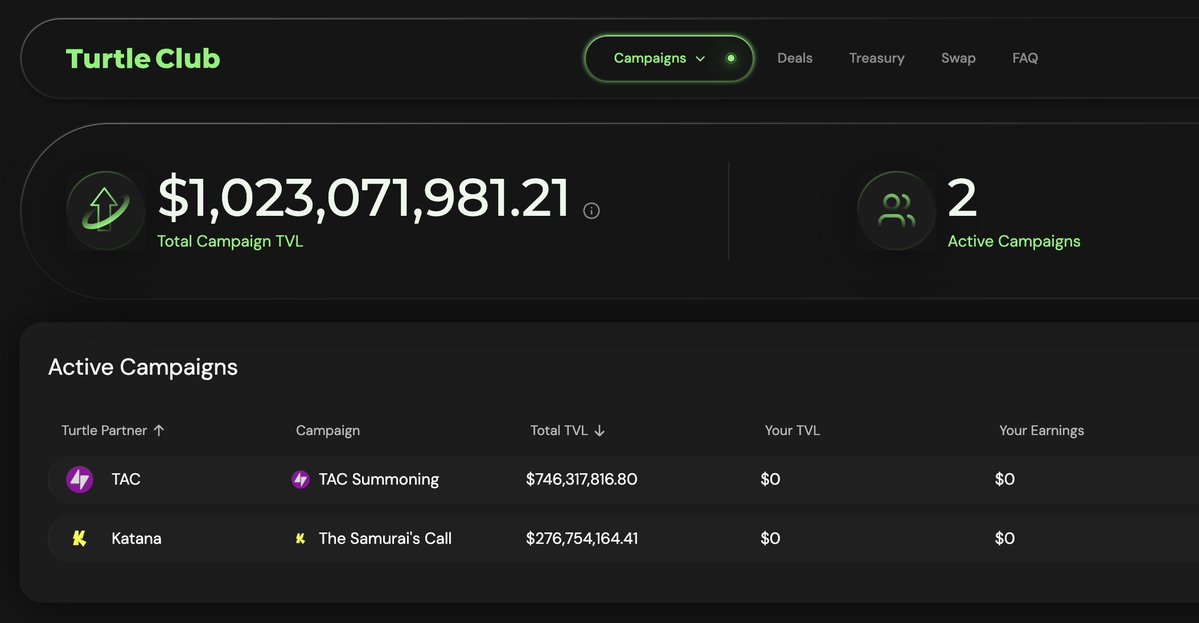

1. Turtle Club

With @turtleclubhouse, you can expose yourself to different kinds of assets like stables or BTC in vaults and earn a variety of points. These points should later convert into tokens. Turtle Clubhouse currently has two campaigns running, with TAC and Katana. I've put my stables into TAC, and it is earning a 4% APY based on sUSDS and another estimated 20% on TAC tokens. You also get VEDA points and Turtle points, which are not included in that total of 24%. The only downside is that if you withdraw your assets from the vault, you need to redeposit them before TGE; otherwise, you will lose your points.

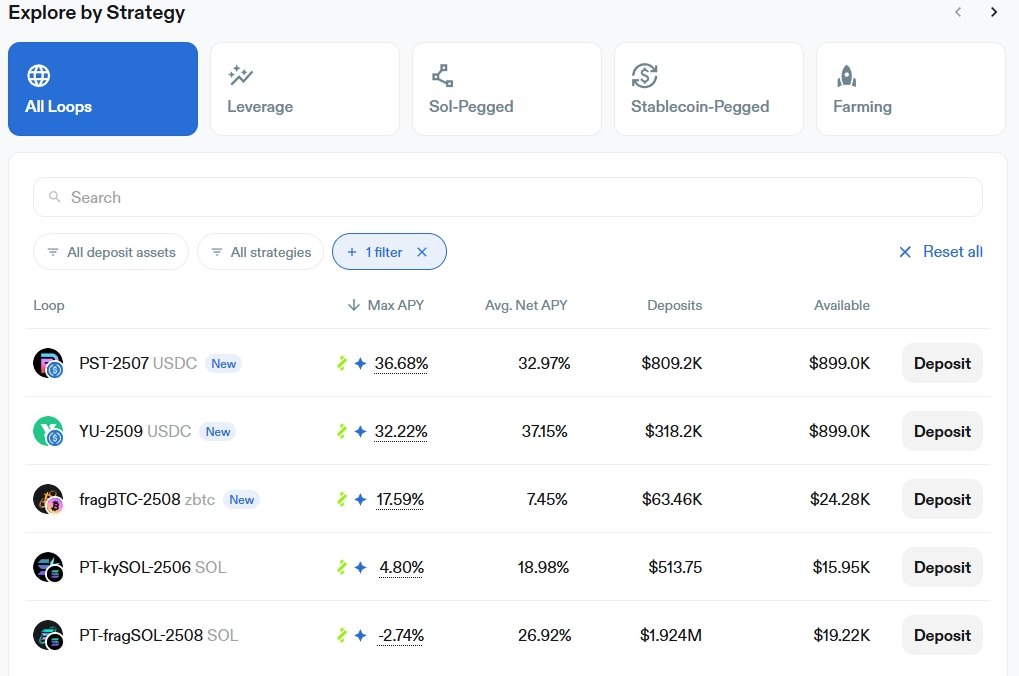

2. Loopscale

Solana-based lending platform with loop functions included. It has a 10M USDC Genesis Vault with currently 8.1% APY. Depositing your stables here will give you about 0.2 USDC yield per day per 1K USDC deposited. Additionally, you will get Loopscale about 12.5 points per dollar per day.

There are also higher-risk involved strategies on Loopscale like PST-2507 and YU-2509 and looping with up to 30%, but looping always comes with the risk of getting liquidated. (Even if the risk itself may be low)

3. Spark

I like using Pendle LPs to expose my stables for some trading fees and, if possible, for additional points. Spark USDS while holding LP on Pendle just does that.

You will get some rewards from the LP on Pendle and additionally will be able to earn some Spark Points. The only downside for me personally is that I have no idea where these Spark points could be used, as the $SPK token is meant to be airdropped for Spark Points. So at the moment, I have no idea if farming Spark Points could give you some SPK airdrops or other perks.

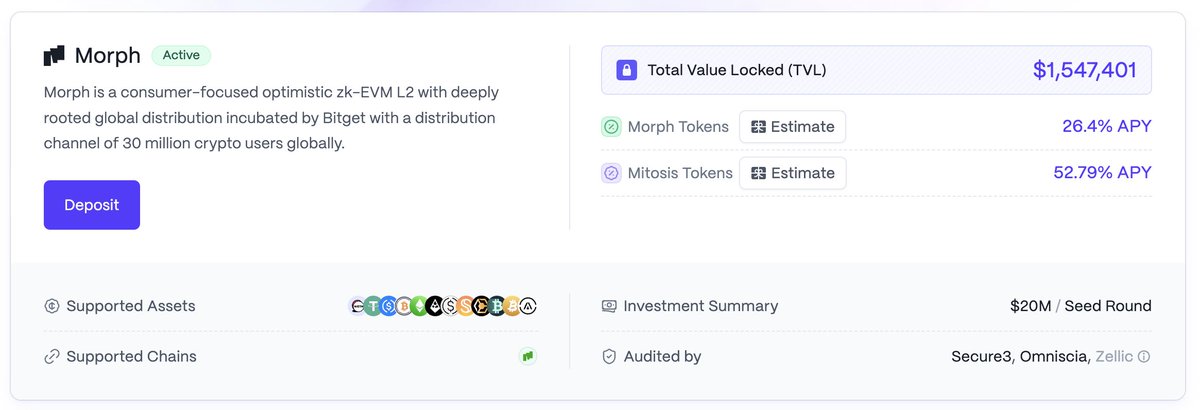

4. @MitosisOrg

Mitosis has a Matrix Campaign with Morph, where you can deposit stables into their vault on the Morph chain. You will need to bridge your stables and ETH from Ethereum to Morph and then stake them directly on the Morph Chain. You will get both Morph and Mitosis Tokens, but you can't really withdraw your assets here before TGE. So that is one of the reasons that the TVL here is not increasing that fast, as you can only deposit assets that you will not need directly.

These are at the moment my main stablecoin strategies, but I am changing them quite often, depending on the reward structure, points I am after, and also general yield opportunities.

@MirraTerminal

4.93K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.