Bitcoin rejected near $102.2K and is now hovering around $101.4K.

The bounce from sub-$98K was strong, but the rally is now losing steam under supply pressure. Bulls must defend $101K to keep the structure intact.

Full liquidation and trend breakdown below 👇

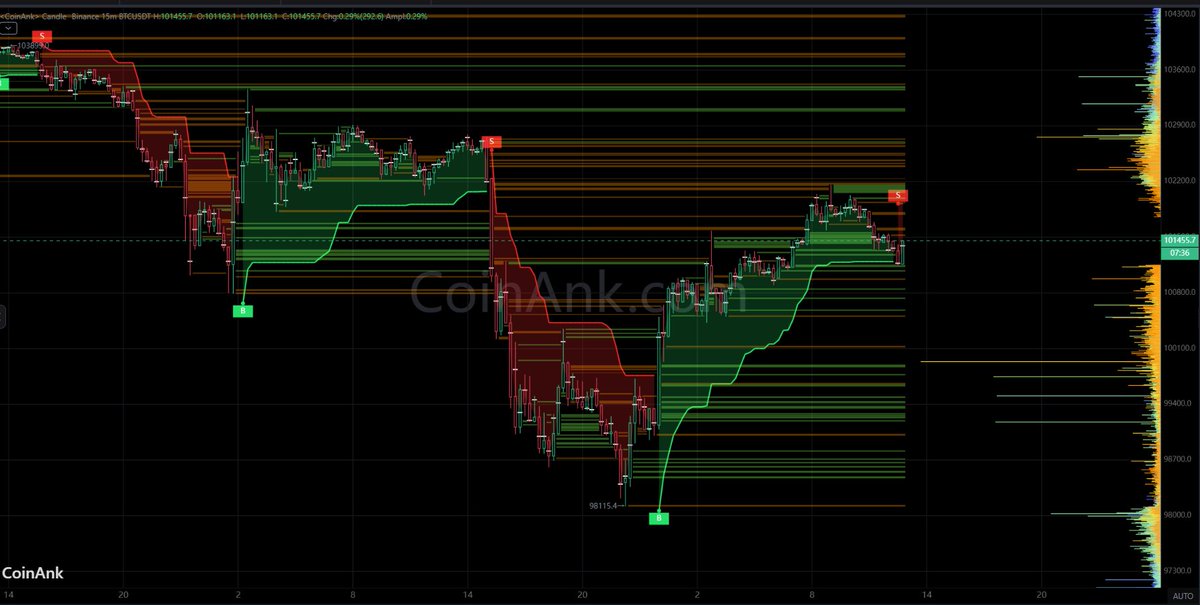

📊 Bitcoin (BTC/USDT) Liquidation & Price Analysis – Binance 15m. Current Price: $101,455

🔄 Trend & Market Structure:

📈 Rebound from $98.1K to $102.2K

📍SuperTrend flipped green during the rally

📍Multiple sell signals near $102K area

📉 Price pulling back after rejection at supply

💥 Liquidation Zones:

🔴 Short Liquidation Zones (Resistance Above):

• $102,000 – $102,400 → Heavy resistance and short trap zone

• $103,000+ → Next breakout level if bulls push through

🟢 Long Liquidation Zones (Support Below):

• $101,000 – $100,200 → Local support zone

• $99,500 – $98,200 → High volume base and demand cluster

📢 Market Sentiment & Summary:

🔸 Bulls still in control structurally, but fading momentum

🔸 Sell signals stacking up under $102K

🔸 Holding $101K is key, it’s the pivot to maintain the trend

🔸 SuperTrend support barely holding — volatility ahead

🔥 Key Takeaway:

Strong recovery, but fading at resistance.

If $101K fails, price may retest the $100K zone.

Break above $102.4K? Then we might see a fast move to $103K.

📡 Follow @IT_Tech_PL for daily $BTC liquidation updates & on-chain analysis.

Show original

16

4.54K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.