I calculated the valuation model

$CRCL should have significantly exceeded many expectations

I will consider shorting once competitors follow up with compliance operations and start gradually lowering the USDC interest rates in CB's Perp accounts.

There are several main considerations:

1. The issuance of stablecoins is closely related to the crypto industry cycle.

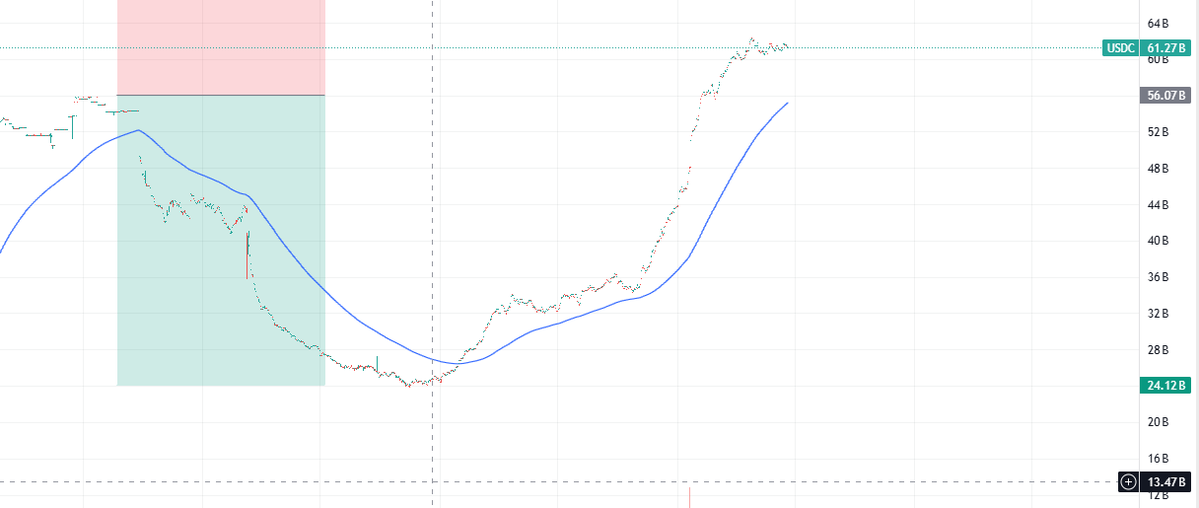

From around August 2022, the issuance peaked, and by the end of 2023, the USDC issuance had dropped by 56%.

At the same time, there is a hypothesis that as mainstream crypto assets like BTC become more integrated with the US stock market and ETFs, the volume of crypto transactions settled in U will decrease in the future.

2. Circle launched an incentive plan in the Q2 report to maintain its issuance, but the growth has been minimal.

The issuance only saw less than 5% growth, indicating that even with high interest rates to maintain issuance, there was no explosive growth in Q2. It remains to be seen whether the current issuance can be sustained after losing the interest rate support.

3. The market is a voting machine in the short term, questioning whether the compliance scarcity touted by the market is a core barrier.

From the perspective of competitors, if Paypal and Stripe want to participate in stablecoins in the future, will their compliance capabilities be weaker than Circle's? USD1 is led by Trump's son, USDT has support from Rutnik's son, who doesn't have a good father?

If Tether moves closer to compliance in the future, the competitiveness and scarcity of the first stablecoin may not be sustainable under this ebb and flow.

4. Starting from July 5, retail investors will be allowed to trade newly issued stocks, and most restricted stocks will be limited for 180 days after issuance.

5. As for USDC's participation in commercial flow, its capability is negligible and basically not worth considering.

Currently, the biggest player is CB, which is stronger than Stripe and Paypal in terms of commercial flow settlement, even JD.com is better than it; I don't know how the concept of settlement will be implemented.

Show original

3

12.55K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.