. ݁₊ ⊹ . ݁˖ . ݁VAULT OF THE DAY. ݁₊ ⊹ . ݁˖ . ݁

Why are whales quietly parking tens of millions in vaults with 2% APY?

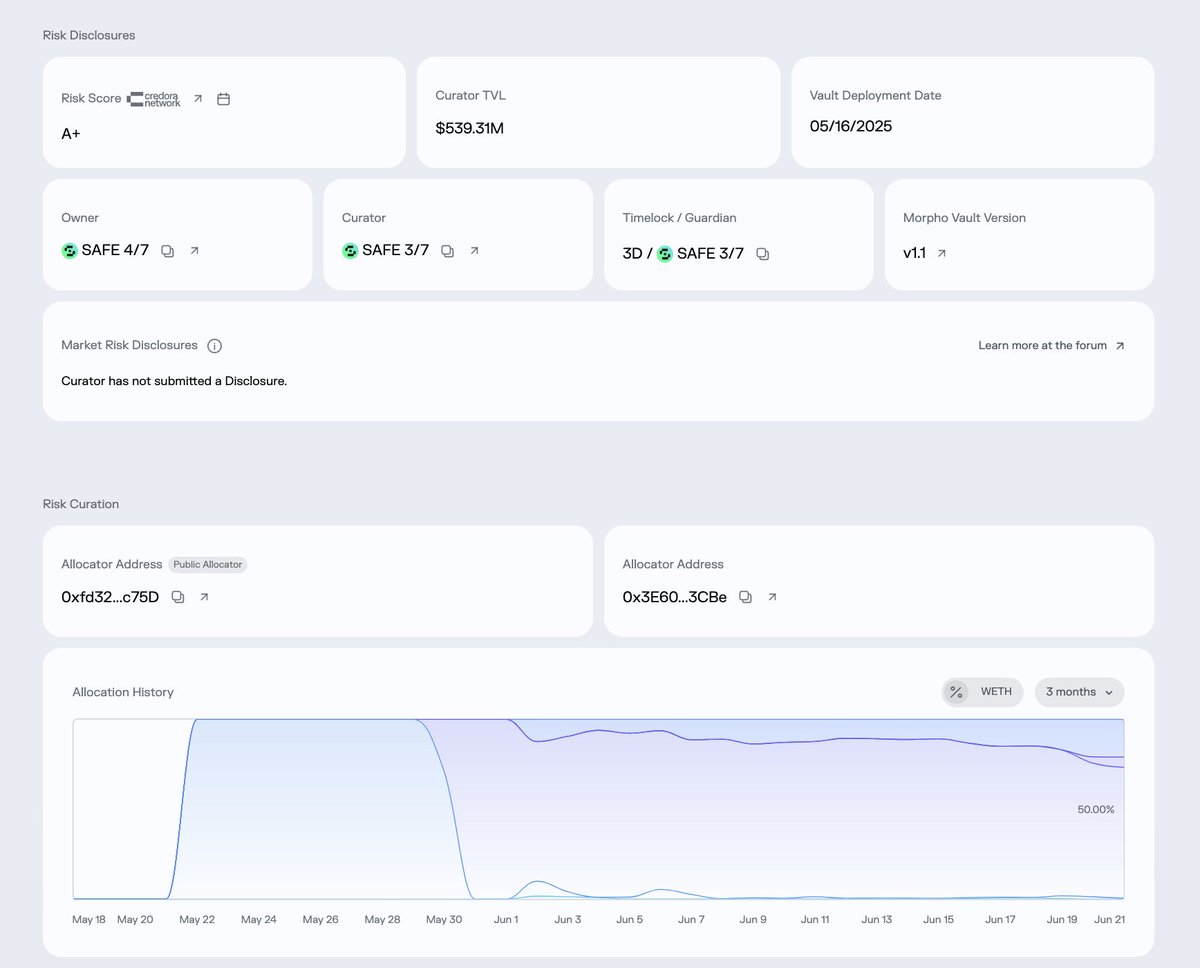

Today's @gauntlet_xyz vault of the day might look basic on the surface. However, it's one of the most powerful yield tools for passive capital in the market right now, powered with @MorphoLabs to endure and grow through various market conditions.

This is Vault Bridge WETH, launched in May 2025 by Gauntlet and live on Morpho. It currently holds over $38.9M in deposits with $21M in active liquidity.

It doesn’t rely on risky directional strategies or degen yield hopping. Instead, it aims to optimize risk-adjusted yield across large market cap and high liquidity collateral markets.

The strategy is simple, reliable, and capital-efficient.

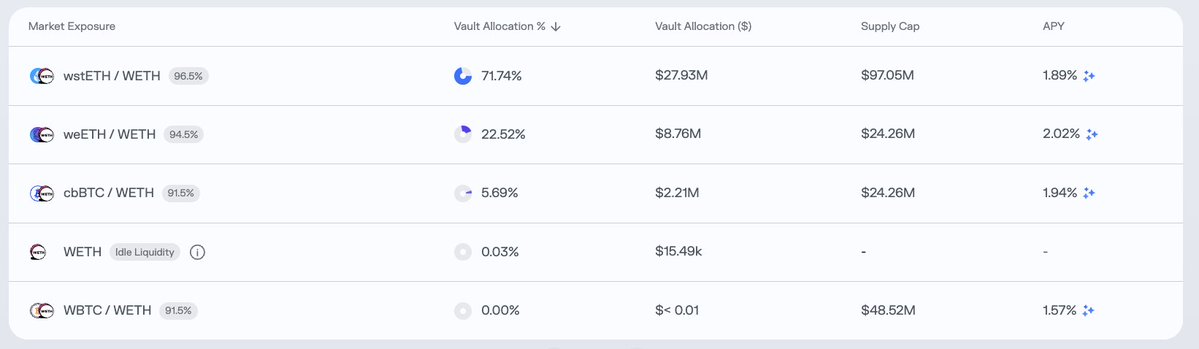

Users deposit WETH, which is lent out to borrowers using ETH LSTs (like wstETH and weETH) or assets like cbBTC as collateral. Yields are generated from interest paid by borrowers and rebalanced automatically based on risk.

Here's what matters:

→ Net APY is currently 1.83%

→ Zero idle capital

→ Top LTVs: wstETH 96.5%, weETH 94.5%

→ Major allocation to staked ETH collateral (94%+)

→ Full integration with Gauntlet risk simulations +

@MorphoLabs optimizer

This makes it ideal for users who want predictable, passive ETH denominated yield.

Vault supply has been climbing steadily since launch. From $0 on May 23 to $38.9M by June 21.

Utilization on key collateral markets like weETH and cbBTC is consistently over 90%, showing high capital efficiency without liquidity risk.

The vault is also protected by @gauntlet_xyz 's simulation engine, which stress tests loan health under thousands of volatility and correlation scenarios. Collateral is never unmanaged, and risk parameters are tuned daily.

This adds resilience to the strategy.

There’s no complex yield flow to follow. No need to worry about protocol hopping, impermanent loss, or depegs.

Users simply deposit WETH and earn yield from a diversified, overcollateralized, high liquidity lending market, auto-optimized by Morpho and Gauntlet.

What makes this vault special isn’t the raw APY, it’s the structure behind it. A vault like this is a cornerstone for sustainable passive yield in the Ethereum ecosystem.

Smart money isn’t always chasing the highest number. It’s chasing what lasts.

Explore the vault on @MorphoLabs

View allocations, metrics, and APY history on @gauntlet_xyz and discover other vaults

5

912

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.