Uniswap's V3 (I think it was announced in Paris about 2 years ago?? Hmm.. it's a bit hazy) Anyway, as always, it's Jay's sharp explanation!! In a way, I think it can be seen as the core of MMT @MMTFinance!!

Momentum Technology Series Part 1

In fact, I had been looking into the Sui ecosystem early on and had invested a significant amount when memes were trending, but due to the nature of memes, I ended up cutting all my losses and have kept my funds out of Sui for a while now.

Sui always feels close to all projects, and the reason I remain interested is probably due to my friendship with @theharrisonkim, who is in charge of Korea and Asia. Although we don't meet often, he always greets me warmly and we can have a conversation whenever we do.

So this time, I would like to start a technical series on momentum. It is structured into a total of 5 parts.

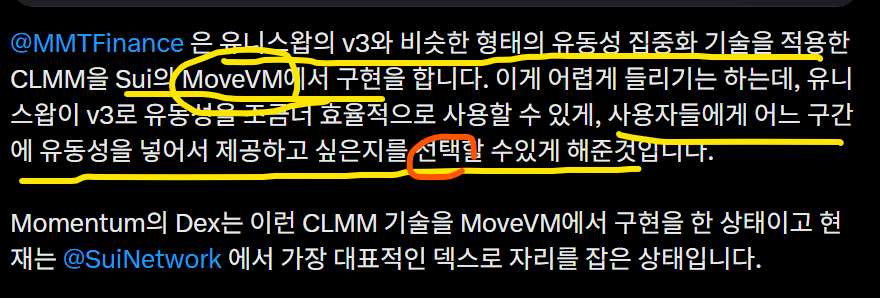

Analysis of the CLMM Structure

@MMTFinance implements a CLMM that applies liquidity concentration technology similar to Uniswap's v3 on Sui's MoveVM. This may sound complicated, but Uniswap's v3 allows users to choose which range they want to provide liquidity in, making liquidity usage more efficient.

Momentum's Dex has implemented this CLMM technology on MoveVM and has currently established itself as the most representative Dex on @SuiNetwork.

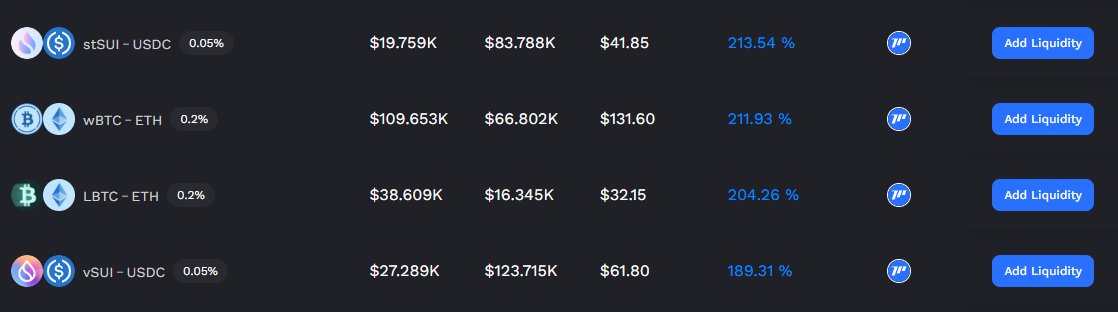

Currently, the TVL is about 160M, and some pools are offering up to 280% APR.

The monthly volume is currently growing rapidly at 2.3B$, making it a project with impressive growth.

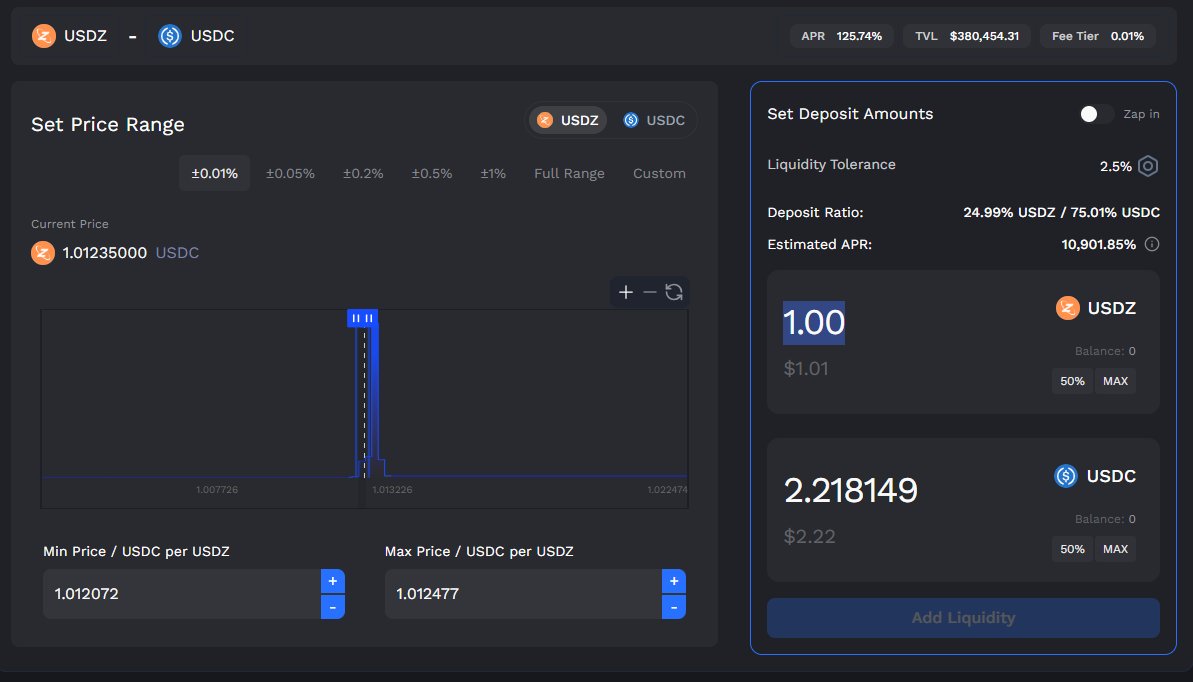

Personally, there are stable pools like USDC, and also unique stable pools like USDZ, which have high APRs, so I plan to take a closer look at them. It looks like I will be accumulating SUI again after a long time. Haha.

26.55K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.