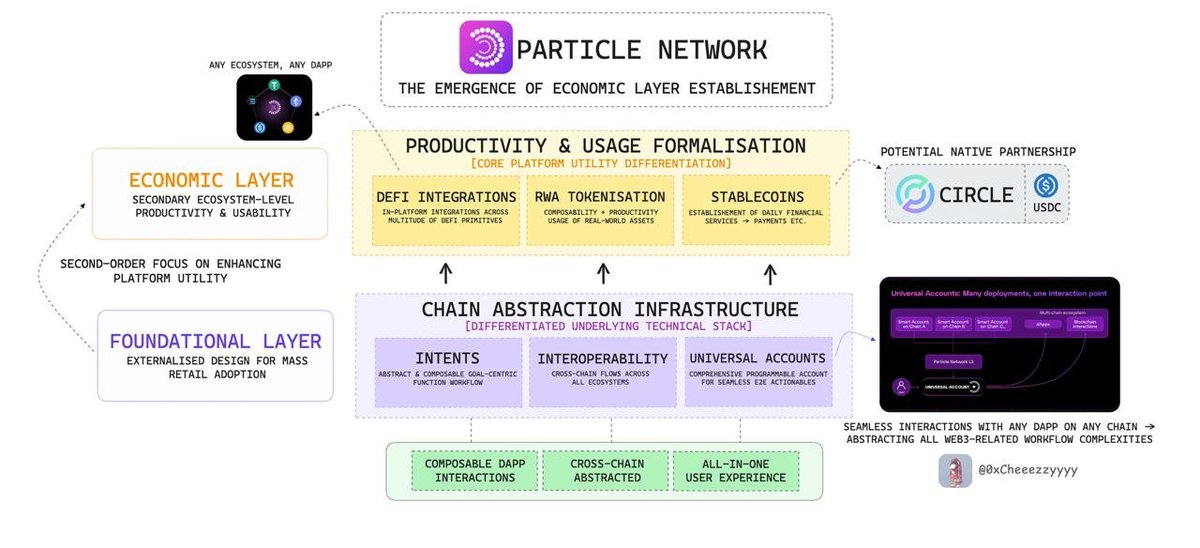

It’s clear that @ParticleNtwrk has established a fairly robust distribution channel & is now shifting focus to the next frontier: activating the Secondary Economic Layer.

This means formalising productivity & utility that directly reinforces the platform’s long-term value proposition.

This includes some major strides like:

🔸 Deep DeFi integrations across multiple native chains 🔸 RWA tokenisation efforts aimed at meeting institutional-grade demand

🔸 The institutionalisation of accredited stablecoin rails (like @circle $USDC) for real-world utility + compliance-ready flows

But none of this sticks without solid foundational distribution.

That’s exactly what Particle’s UniversalX app was built for.

This essentially goes back to first principles with chain abstraction as a GTM lever: designed to lower UX friction & extend reach far beyond DeFi-native users.

Here, frictionless onboarding becomes the gateway to mass retail distribution alongside with its strategic partnerships.

This infrastructure upgrade unlocks compounding value through:

1⃣Intent-based architecture for smoother transaction flow

2⃣Cross-chain interoperability w/o the need to manage multiple networks

With universal accounts, users gain seamless access to composable dApp interactions which abstracting away Web3’s complexity into an intuitive, all-in-one UX.

I see this latest move as more than a tactical upgrade. It’s a foundational step toward their broader vision of enabling wide-scale platform distribution + LT user retention.

At the core of it all is $PARTI → the native asset powering the underlying settlement infra of Parti Chain.

As more platform activity gets formalised, the demand for $PARTI will compound naturally as its structurally tied to the network's value accrual.

Big milestone imo, and many more to come 🫡

TRANSCENDING ONCHAIN: ANNOUNCING THE UNIVERSAL LAYER FOR RWAS, STABLECOINS & DIGITAL ASSETS

The stage is set for Trillions of dollars to come into Web3.

Stablecoins may hit a $3.7T supply by 2030.

Onchain RWAs are projected to be worth $30T by 2034.

Tokenized real‑estate points at a $380T TAM.

The world is ready. Is Web3? Yes, because Universal Accounts exist.

As the only solution making Web3 feel like a single ecosystem, Universal Accounts are here to stay. They’ve already cleared $670 M via @UseUniversalX, and are the only way a multi-chain, multi-Trillion asset ecosystem can find its way to the masses—whether by accelerating Web3 or upgrading Web2.

So today, we’re announcing the culmination of our tech: The Universal Transaction Layer: a retail‑ready settlement rail for RWAs, stablecoins and all other digital assets.

Through the next weeks, we’ll also progressively announce the partners that will aid us in this mission, starting with @Circle. With the integration of Circle Gateway, we’ll be setting the stage for stablecoin settlements to occur across chains for Universal Accounts, unlocking the entire world’s economy for anyone using Universal Accounts.

When every property, dollar, or asset becomes a token, Universal Accounts become the default rails for them.

Crypto is ready. Let’s transcend onchain.

📝 Read the full vision at:

4.36K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.