RWA is the key pillar for the @arbitrum DeFi Stack

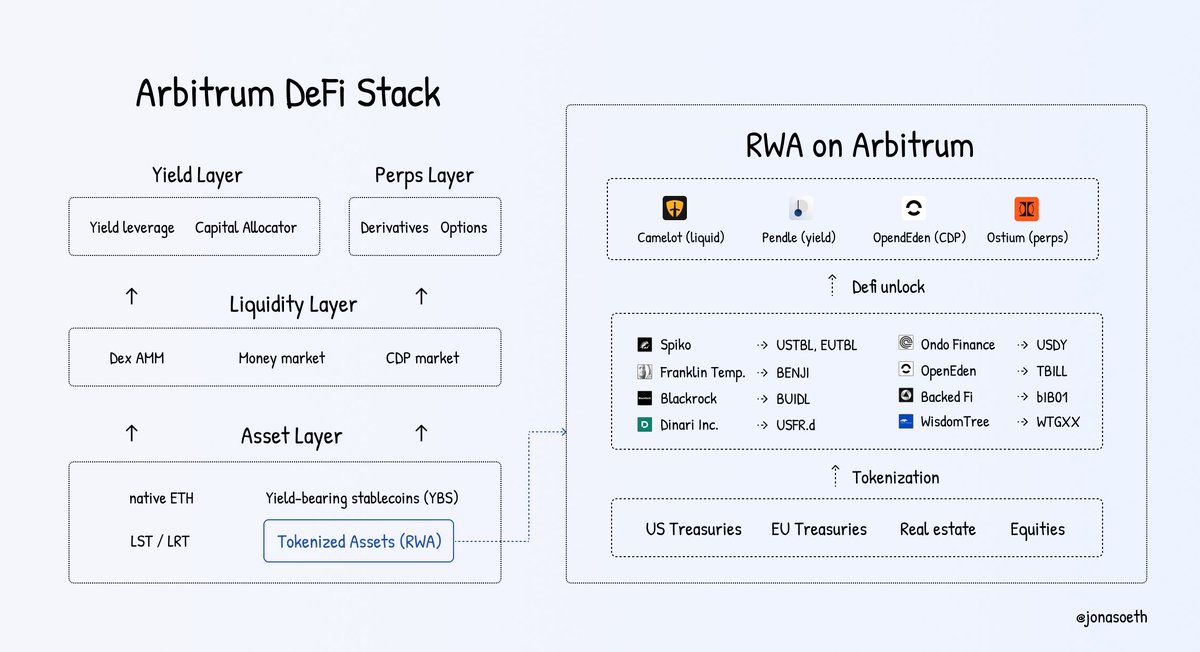

The evolution of DeFi can be viewed as a series of capital layers:

Native assets → Staking derivatives → Yield-bearing tokens

Now, RWA is the Endgame 🧵

2 - Arbitrum’s RWA Growth Potential

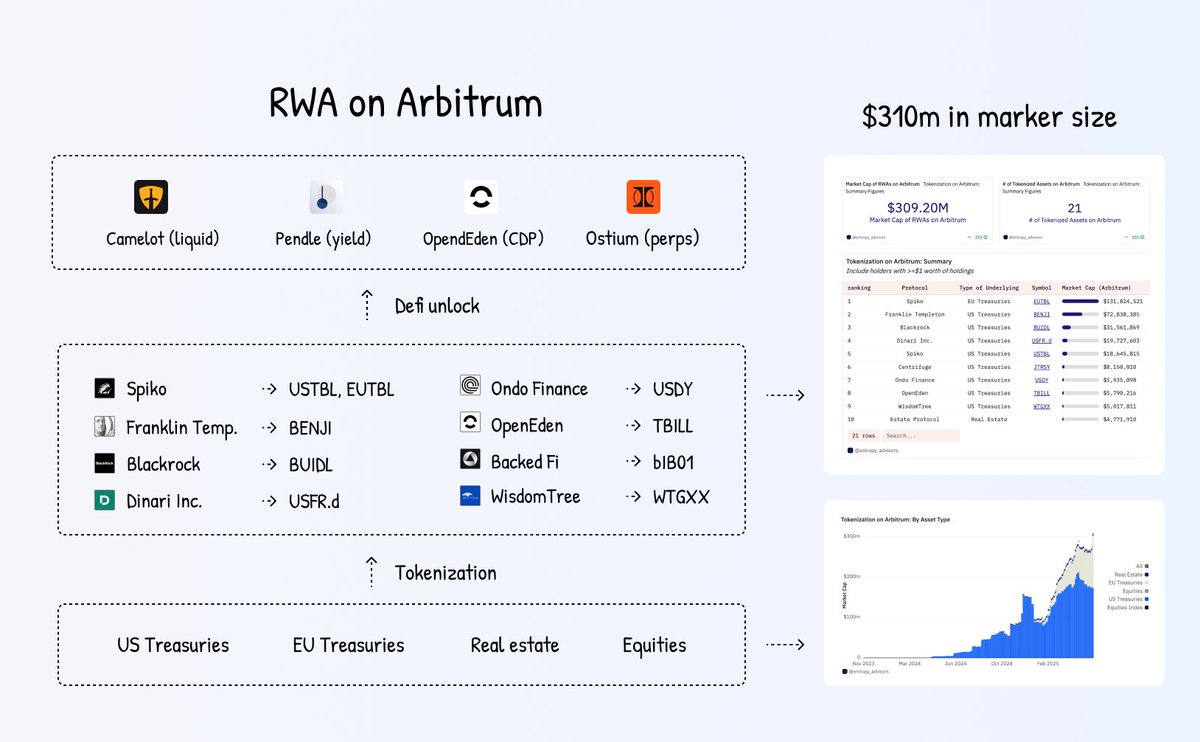

Arbitrum has rapidly positioned itself as the second most important blockchain after Ethereum for RWA development

▸ $300M in RWA TVL→ A 30x increase year-over-year

▸ $4.7B in circulating stablecoins on Arbitrum → This deep liquidity provides a strong foundation for RWA collateralization, on-chain bond markets, and yield-generating strategies

Among L2s, Arbitrum is one of the few to explicitly define RWA as a core component of its DeFi roadmap

Through its STEP, Arbitrum has committed serious capital to this thesis:

▸ 85M ARB allocated in STEP 1.0 to support yield-bearing and stable RWAs

▸ STEP 2.0 recently approved an additional 35M ARB specifically for tokenized U.S. Treasuries

With the global RWA market expected to grow from $24B today to over $18 trillion by 2033, Arbitrum is in a prime position to capture the next wave of institutional capital flowing on-chain

→ Arbitrum is becoming a serious on-chain venue for regulated assets

3 - Key RWA Components on Arbitrum

The majority of RWA value on Arbitrum comes from US Treasury-related assets, reflecting strong institutional interest and stability

➢ Tokenization Layer: The Foundation of On-Chain Real Assets

This is where traditional financial institutions tokenize real-world assets — bringing instruments like U.S. Treasuries, European sovereign bonds, real estate, and equities onto Arbitrum

Key Issuers ↓

▸ @Spiko_finance

▸ @FTI_US

▸ @BlackRock

▸ @OpenEden_X

▸ @OndoFinance

▸ @DinariGlobal

➢ DeFi Unlock Layer: Activating RWA Capital

RWA tokens alone are not useful unless they can be integrated into DeFi primitives. This second layer consists of protocols enabling that integration:

Key Protocols ↓

▸ @CamelotDEX : deploys RWAs into liquidity pools

▸ @pendle_fi : unlocks future yield from RWAs via PT/YT mechanics

▸ @OpenEden_X : provides CDP structures using RWAs as collateral

▸ @OstiumLabs : Enables trading of synthetic assets linked to RWAs

These protocols represent the composability layer, where tokenized bonds or real estate can be collateralized, lent, farmed, or speculated on effectively turning static RWA exposure into productive DeFi capital

4 - The untapped potential of RWA in Arbitrum DeFi

RWAs are booming, but beneath the surface of this rapid growth lies a critical bottleneck:

→ More than 91% of RWA tokens are currently held in EOAs, not deployed into protocols.

This means that while the infrastructure for tokenizing real-world value is evolving rapidly, the actual utilization of these assets in DeFi remains extremely limited.

The turning point will come when these dormant RWAs start flowing into DApps, whether as collateral in Aave or Morpho, as yield strategies in Pendle’s PT/YT, or as liquidity on Uniswap.

→ At that moment, RWAs shift from a narrative to becoming the backbone of DeFi.

RWAs hold massive potential. But until they become truly composable and are actively integrated across DeFi, we’re only halfway there.

Tokenization is just step one. Activating that capital is the next step.

5 - Big thanks to the @EntropyAdvisors team for sharing the data and insights that helped make this article possible

Your work gave us a clearer view of the RWA space and added real depth to the analysis

6 - Follow these CTs to stay ahead of the game

▸ @sgoldfed

▸ @BFreshHB

▸ @daddysether

▸ @MarcinPress

▸ @CupOJoseph

▸ @Churro808

▸ @Deebs_DeFi

▸ @0xCheeezzyyyy

▸ @thelearningpill

▸ @YashasEdu

▸ @tomwanhh

▸ @yotamha1

Don’t miss valuable insights and alpha on Arbitrum, these voices are leading the conversation

36.78K

38

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.