What is Smart Allocator? USDD is starting to make money on its own

Today, I habitually opened the official website of USDD, and saw an update, and the homepage updated a navigation bar called: Smart Allocator, Smart Allocator, I still wonder, what is this? Later, after a closer look, Smart Allocator is a major change in the USDD economic model.

What is Smart Allocator?

In fact, the simple and easy-to-understand description is USDD's own income strategy, which invests part of the funds in the protocol into some stable Defi or lending protocols to obtain income, and this part of the income is given back to users, so the economic model will be more healthy and sustainable.

What are the advantages of Smart Allocator?

1/ Healthier economics: In the past, USDD's staking rewards were subsidized by TRON DAO, with the earliest 20% linearly adjusted based on the number of issuances to the current 6%. When USDD's smart allocation is launched, it will directly reduce the dependence on TRON DAO subsidies, forming a healthier and more sustainable tokenomics.

2/ More secure guarantee mechanism: Most of the Defi protocols or stablecoins in the market cannot afford to take risks without a guarantee mechanism, while USDD is different, because of its unique PSM mechanism, users can withdraw 1:1 at any time, and Smart Allocator promises that when extreme conditions occur, the user's principal will not be affected.

Where does Smart Allocator currently run?

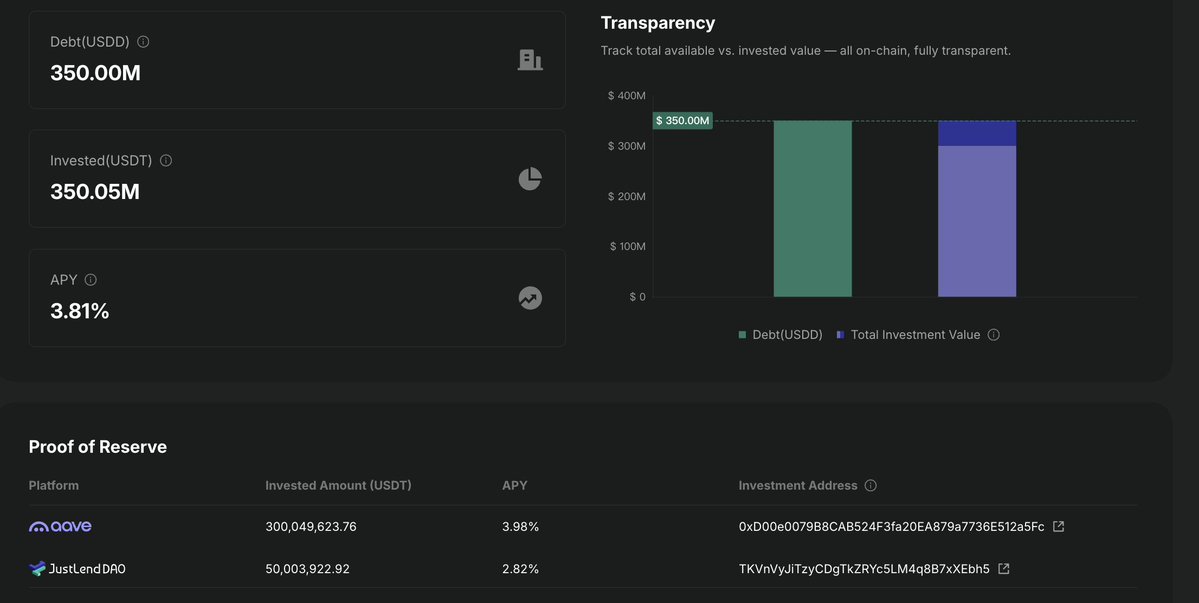

According to the data on the official website of USDD, a total of 350.05M USDT is currently allocated in this sector, of which 300M is allocated in AAVE and 50M is allocated in JustLend. At the same time, USDD promises that the allocation of this part is always conservative, giving priority to highly liquid, market-proven, and robust protocols, and adjusting strategies at any time.

What is the difference between Smart Allocator and other stablecoin strategies?

In fact, stablecoins will eventually move towards independent profits, and it is impossible to rely on any subsidies forever to achieve income, which is neither realistic nor healthy.

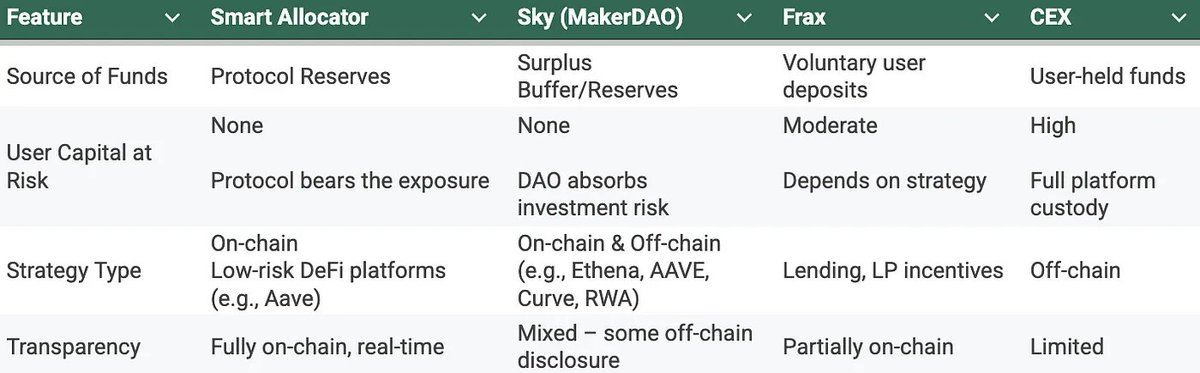

First of all, in terms of funding sources, both USDD and MakerDAO come from the protocol reserves, and both are borne by the protocol or DAO, and the user's principal will not lose anything, which is better than the strategies of Frax and some CEXs, but the protocol reward of USDD is higher than that of MakerDAO.

Secondly, in terms of strategy, USDD is completely open and transparent about the whereabouts of the protocol's reserve funds, which is completely on-chain and publicized on the official website, which is more transparent, secure and superviseable than MakerDAO's partial on-chain and Frax risk strategies and part of the on-chain and CEX's complete off-chain.

To put it simply, this is actually a change in tokenomics, by investing reserve funds into low-risk and high-liquidity Defi protocols, it provides USDD users with a sustainable income mechanism rather than self-subsidized gameplay, which also confirms the stability and security of USDD, as well as the upgrading and adjustment of market strategies.

@justinsuntron @usddio #TRONEcoStar

Show original

8.3K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.