MasterYii

MasterYii

0Following

5Followers

The self-owned account has been running for more than 500 days, and the overall capital size is more than 200,000 US dollars. My investment style is based on prudence, combining the winding theory with the Dow theory. He is proficient in various K-line indicators, and is used to hold medium and long-term positions on BTC and ETH.

In order to diversify the risk and optimise the return, I recommend splitting the funds into 20-25 shares so that I can flexibly follow my margin call strategy. Given the large size of the account, I have adopted a more cautious strategy, and the risk is properly controlled, so investors do not need to worry too much about the risk. The trading period is usually 2-3 weeks, and the main holdings are spot rather than contracts. After selecting the target, it is recommended to be patient and avoid frequent operations to reduce the waste of fees.

Show original

Overview

Spot trades

Performance

Ongoing orders

History

Copy traders

Trading performance

Days w/ profit192Days w/ loss173

Win rate

52.60%Profit/Loss ratio

1.45:1Average order value

2,077.88Lead trader overview

Days leading trades

406Lead trade assets (USDT)

22,440.50AUM

0.00Current copy trader PnL (USDT)

0.00Copy traders0/50

Profit-sharing ratio

8%Copy traders

Cumulative total2

Change in last 7 days

1

k

koj***@gmail.com+0.00

c

chr***@yahoo.com-0.12

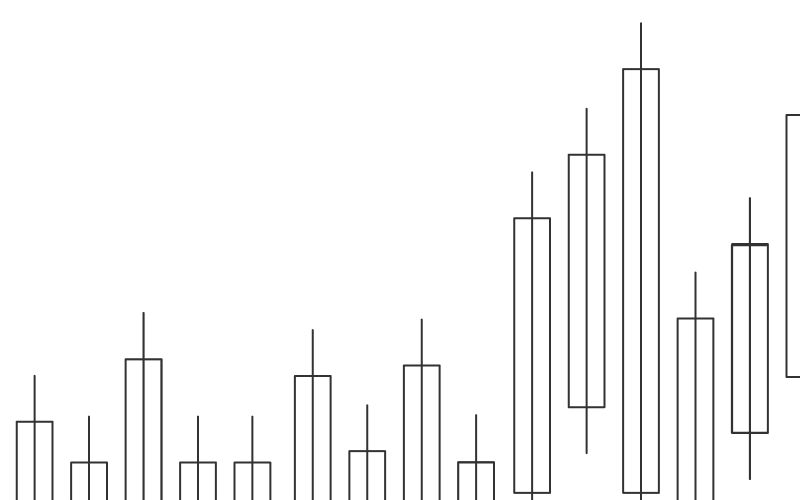

Weekly PnL

PnL%

PnL

PnL%

PnL%

PnL

Crypto preferences