How much did you miss out on the key market intelligence on July 8th?

Featured news

1. JD.com, Standard Chartered, Ant and many other institutions are preparing for Hong Kong stablecoin licenses, and the number of licenses is expected to be only in single digits

2. U.S. stocks rose pre-market crypto stocks, with Bit Digital up 14.66%

3. Binance Wallet BOOM TGE points threshold is 200 points

4. Hong Kong A-share digital currency stablecoin concept stocks rose significantly, and Jinyong Investment closed up 527.14%

5. Letsbonk.Fun announced that it had officially obtained the "bonk.fun" domain name

Trending topics

Source: Overheard on CT (tg:@overheardonct), Kaito

PUMP: Today's discussion about PUMP is focused on the upcoming token sale. The project, which is expected to go public on July 12 and is valued at up to $4 billion, has sparked widespread discussion about whether the valuation is reasonable, especially when compared to Bonk, which recently surpassed PUMP in several metrics, such as token issuance and market share. Despite doubts about its valuation and possible impact on the liquidity of other tokens, the overall enthusiasm and expectations remain high, with many predicting that the sale will sell out quickly.

MITOSIS:MITOSIS has been spotted for its partnerships with Yarm and Kaito, with market discussions focused on its potential in programmable liquidity and cross-chain DeFi solutions. The community is generally optimistic about its flexible cross-chain liquidity mechanism to promote the innovation of DeFi forms. The upcoming TGE (Token Generation Event) and integration with Yarm (which combines social interaction and liquidity) have also sparked heated discussions, with overall sentiment positive and anticipation of its innovative performance in liquidity management.

CYSIC:Cysic is making a lot of noise today with the launch of the Yapper Leaderboard, a mechanism that encourages users to discuss its innovative idea: turning GPUs, ASICs, and computing power assets into circulating yield assets. The project has received $18 million in investment from top investment institutions such as Polychain and Hashkey, focusing on the field of ZK (zero-knowledge) computing services, building a computing power-as-a-service platform with built-in economic models. Its "dual-token mechanism" and focus on ZK computing hardware acceleration have attracted widespread attention from the crypto and traditional technology communities.

HYPERLIQUID:The rise in HYPERLIQUID popularity stems from a number of key developments, including Kinetiq's launch on the HyperEVM mainnet, Etherscan's launch of the HyperEvmScan tool, and its $1.7 million in fee income in 24 hours, surpassing Solana, Ethereum, and Bitcoin. The community is excited about the launch of Kinetiq's liquid staking mechanism and Hyperliquid's integration with multiple protocols, believing that these developments will drive further growth and ecosystem penetration.

LOUD:Today's discussion at LOUD focused on its connection to the emerging project Yarm. Yarm has climbed in popularity on social platforms, with many users comparing it to earlier projects such as Loudio and Yapyo. KaitoAI's engagement with MitosisOrg has also been noted, with the community discussing whether it will introduce an AI-driven content quality assessment mechanism and a "Yap-to-Earn" model. Despite the cautious market, overall curiosity and potential expectations for Yarm continue to heat up.

Featured Articles

1. "When FTX's Chinese creditors are discriminated against, how to get back 380 million?" 》

As FTX's bankruptcy liquidation enters a critical phase, a highly controversial motion to address user claims in "restricted countries" has caused an uproar among creditors around the world. FTX's liquidators said they would first seek legal advice to determine whether assets could be distributed to these jurisdictions; If it is concluded that it is impossible to pay, the relevant claims may even be "legally confiscated" and transferred to the liquidation trust account. This means that not only may Chinese creditors not receive a penny, but even their assets will be reduced to "confiscated funds" in trust funds. BlockBeats sat down with Will, who is not only one of FTX's high-value creditors, but also a key sponsor who opposed and objected to the motion. He elaborated on why he came forward to lead the fight, the process of opposing the motion, the practical difficulties of the creditor community, and his in-depth observation of the motivation behind the motion.

2. "Review Bitchat: Twitter's founder's new work, is this the "TWTTR" moment in the crypto communication industry? 》

After 20 years, Twitter founder Jack Dorsey is back with a new product, bitchat, minimalist. The best thing about bitchat is that it doesn't rely on any infrastructure at all — no servers, no Wi-Fi, or no cell phone signal. Each mobile phone acts as both a "transceiver" and a "relay station", discovering each other using Bluetooth Low Energy (BLE). And what attracts the crypto industry is that all messages are end-to-end encrypted. Encryption technologies such as X25519+AES-256-GCM are used in private chats, and group chats can also add passwords, so only those who know the password can see the content. Messages are only saved locally, and disappear automatically when they exit or shut down, with no background traces. And compared with other encrypted communication products, Bitchat completely abandons the action of "login", and does not require a mobile phone number, email address or a long chain of keys. A random "user ID" will be generated every time you go online, and you can also change it at any time, so you don't have to worry about your identity being tracked.

On-chain data

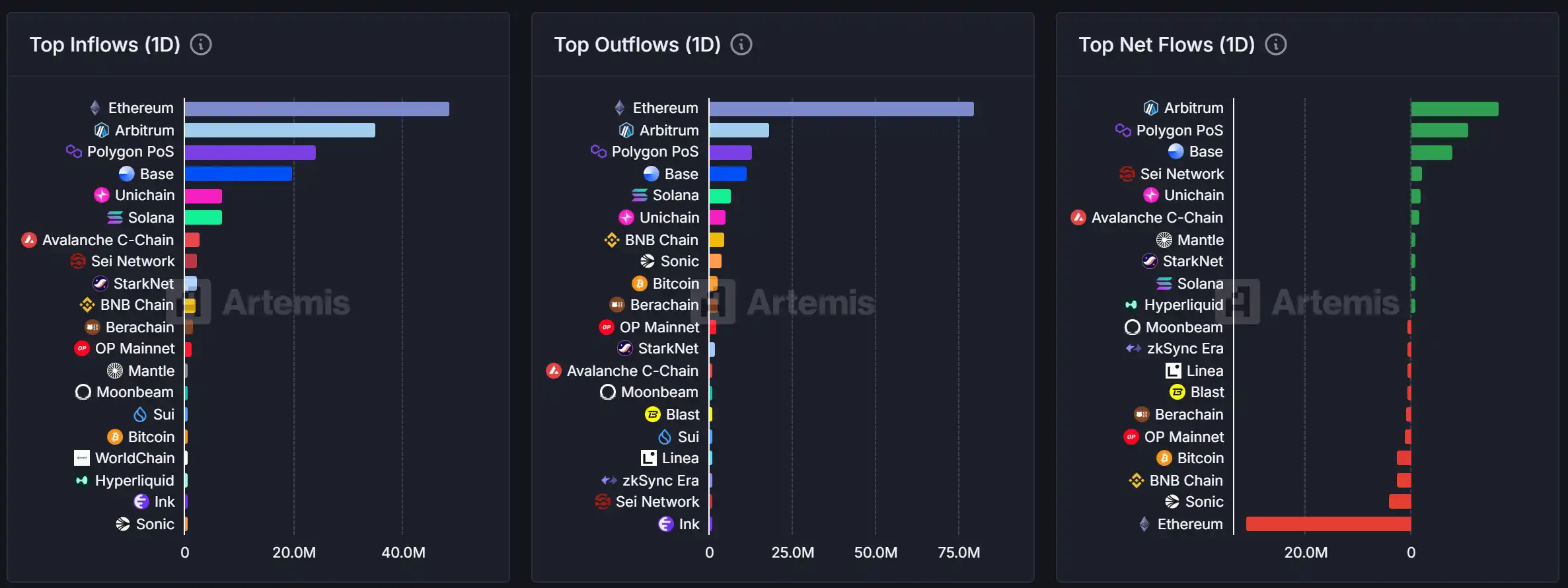

On-chain fund flows on July 8