Prediction market arbitrage is free money.

I tried it for a month and it worked pretty well, but there’s a lot you need to know.

It’s not hard, it just takes time and focus. 🧵🔽

For those who’ve been following me in 2022/2023, you know I spent a long time profiting from arbitrage opportunities between CEXs and DEXs, or just between DEXs.

To be honest, DEX arbitrage has become so complex lately that it’s way beyond my comfort zone now haha.

But there are still fresh arbitrage opportunities in new markets like prediction markets.

It’s still an emerging market with lots of different players, plenty of volatility, and advanced bots haven’t fully taken over yet.

So it’s perfect for manual arbitrage.

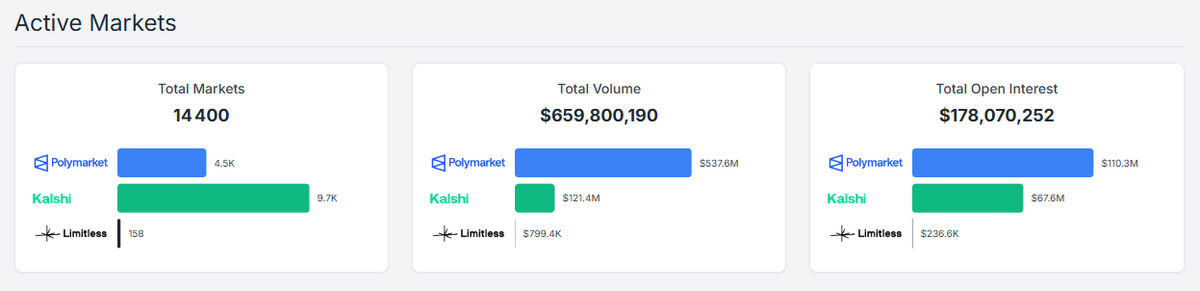

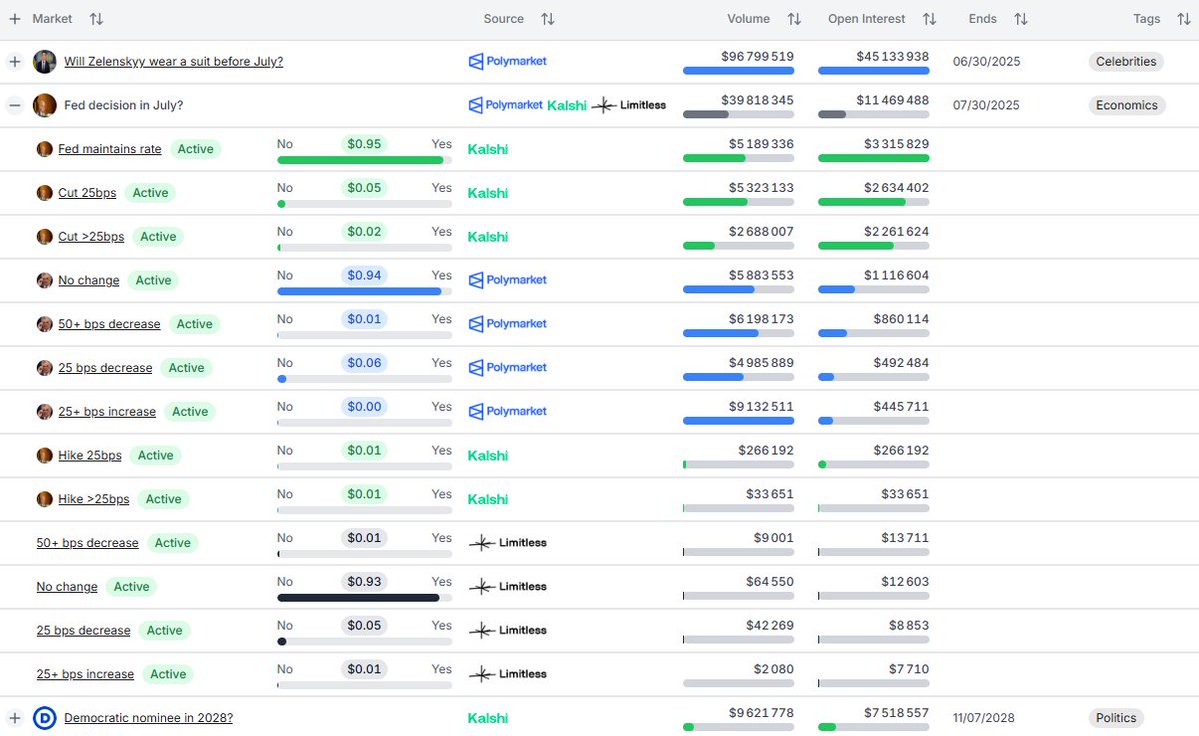

The prediction market scene is basically dominated by three big players.

You know @Polymarket, but there’s also @trylimitless and @Kalshi.

Polymarket has the highest volume and open interest, but Kalshi actually offers more markets and has been growing fast since its launch.

If you spend some time exploring these prediction markets, you’ll find arbitrage opportunities.

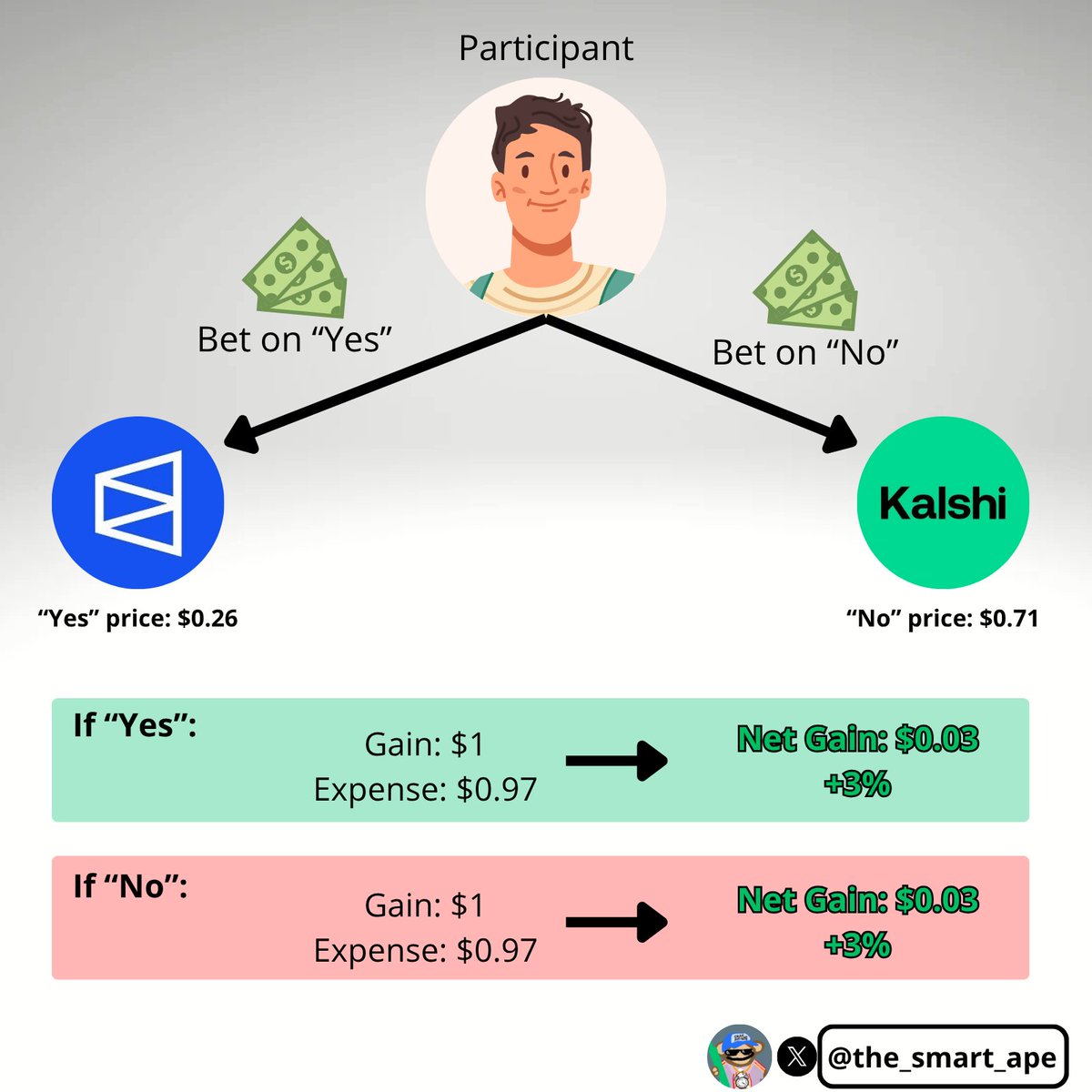

The idea is simple: look for price gaps between different platforms.

You “buy Yes” on one market at price X and “buy No” on another market at price Y. If X + Y is less than 1, you lock in a profit.

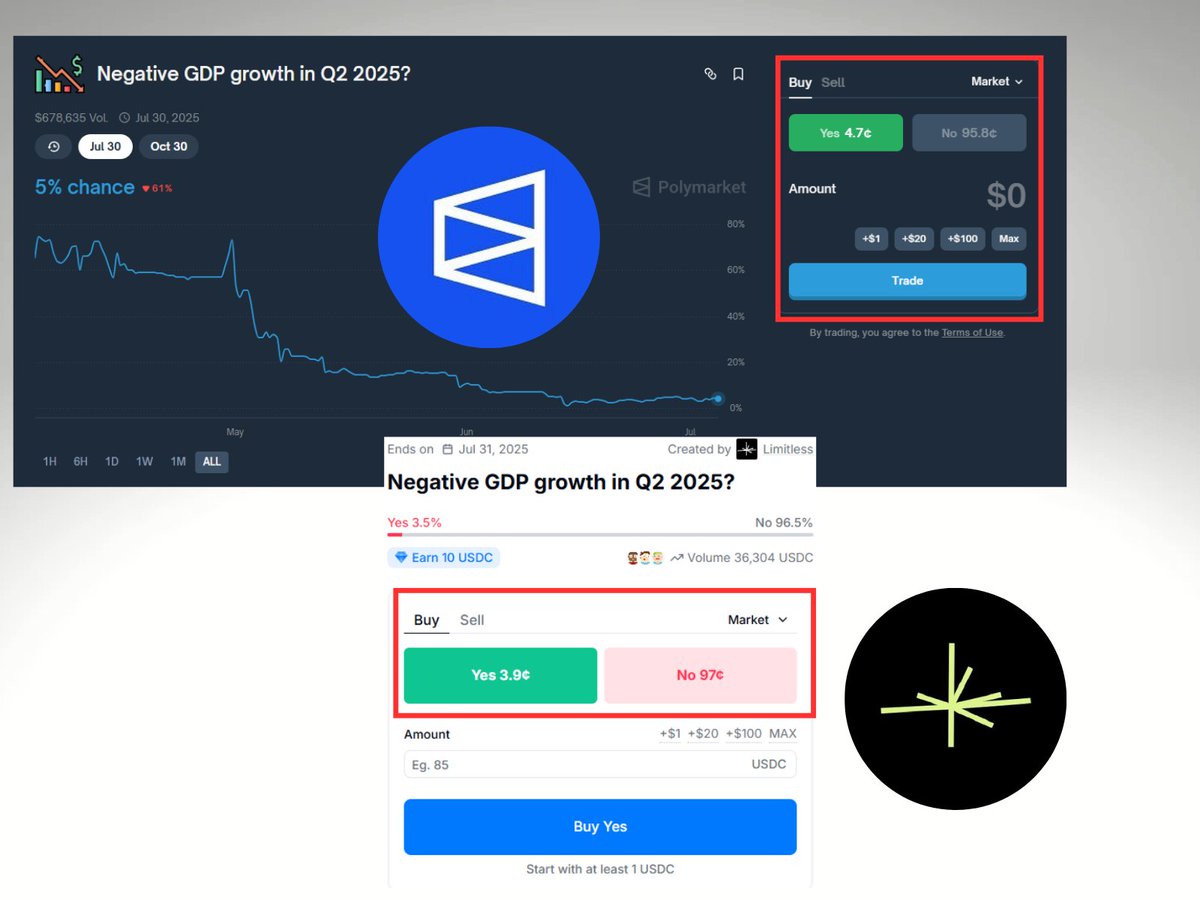

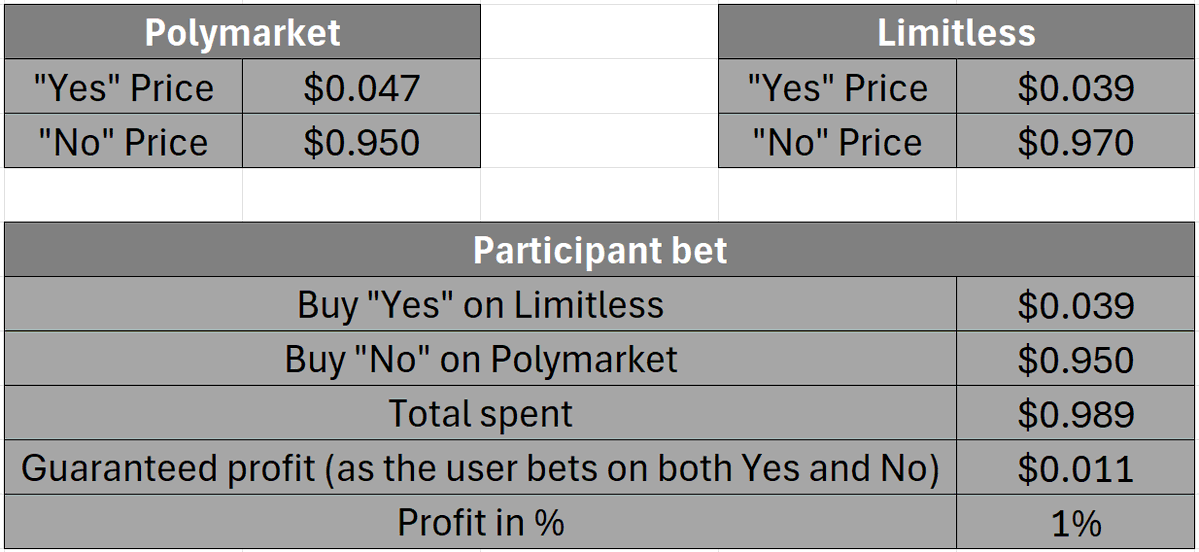

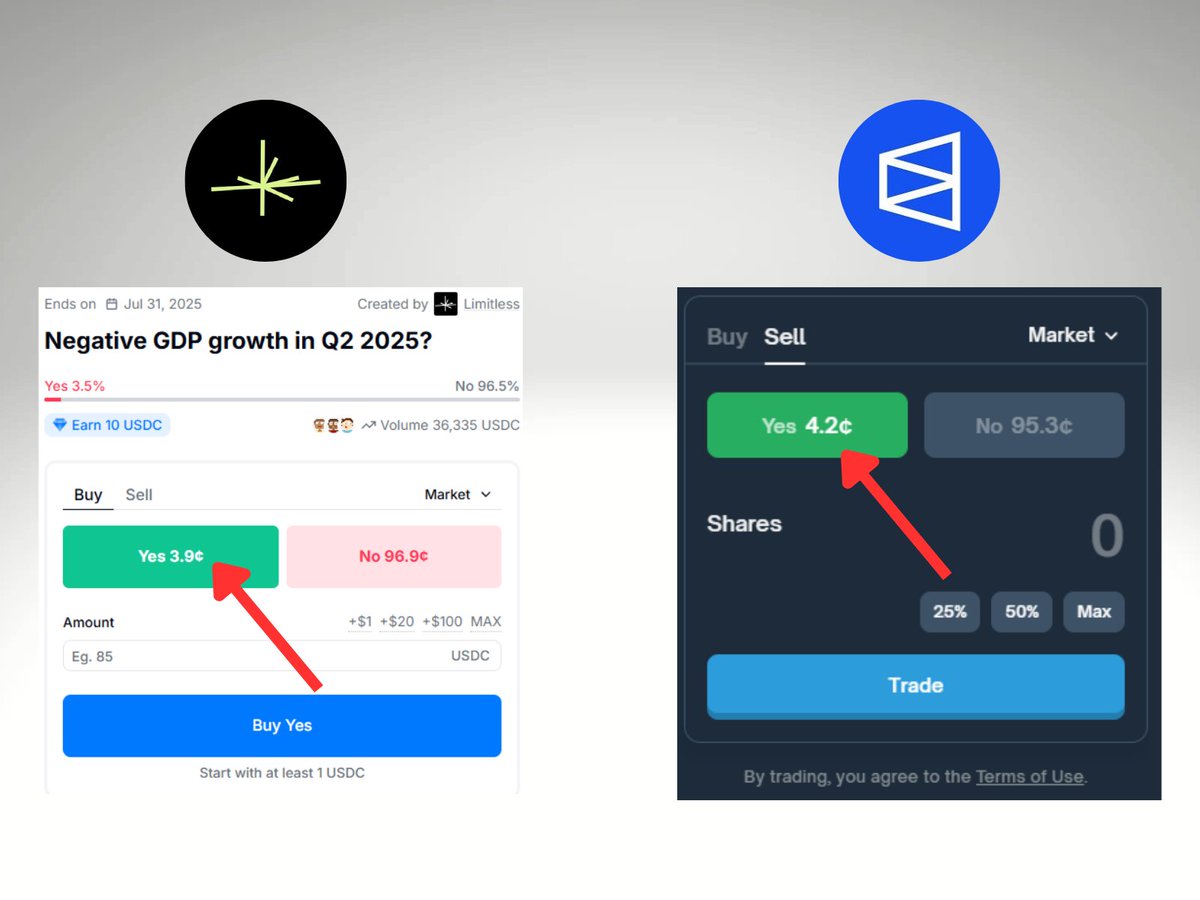

In five minutes of searching, I found this example: an arbitrage between Polymarket and Limitless on the “Negative GDP growth in Q2 2025” market.

On Limitless, the “Yes” is priced at $0.039 and the “No” at $0.97. On Polymarket, the “Yes” is $0.047 and the “No” is $0.95.

To capture the arbitrage, you buy the cheapest “Yes” and the cheapest “No”, so you’d buy the “Yes” on Limitless and the “No” on Polymarket.

0.039 + 0.95 = 0.989, which is under 1.

So there’s an arbitrage spread.

The net profit for this example is about 1%.

So if you bet $10K, you lock in $100 profit.

It only took me a few minutes to find this while writing this thread, if you dig deeper, you can easily find higher yields.

Also, you don’t have to wait for the market to settle to make profit.

If the spread is tight, you can buy a “Yes” on Limitless at $0.039 and flip it on Polymarket at $0.042, that’s an instant 7% gain.

To save time, you can use tools like polymarketanalytics(dot)com.

For each bet, it shows you all the markets offering that bet and the current prices.

It’s way faster than switching between tabs manually.

37.99K

224

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.