Trump's $3.3 TRILLION spending bill just passed

Everyone's screaming "Bitcoin to the moon"

But they're missing the REAL story

Short-term euphoria → long-term DISASTER

Here's the timeline + 5 altcoins to watch🧵👇

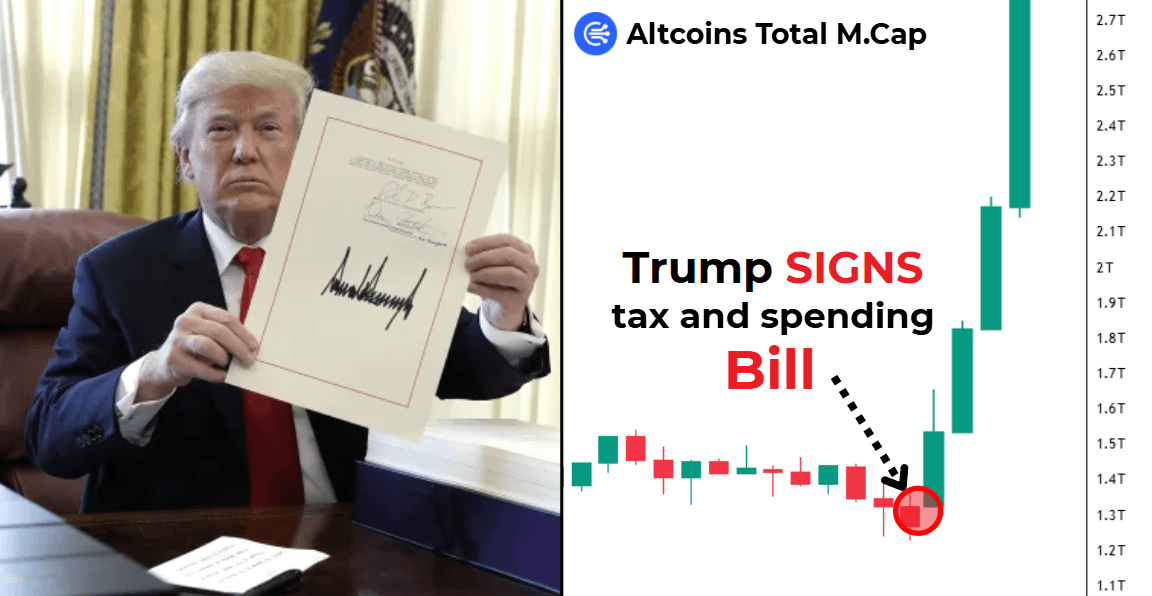

Yesterday, the US House passed Trump’s “One Big Beautiful Bill”

Retail investors are excited - what's next?

Most people see just one thing: money printing and a Bitcoin pump

But it's not that simple. There’s more to the story

The legislation entails:

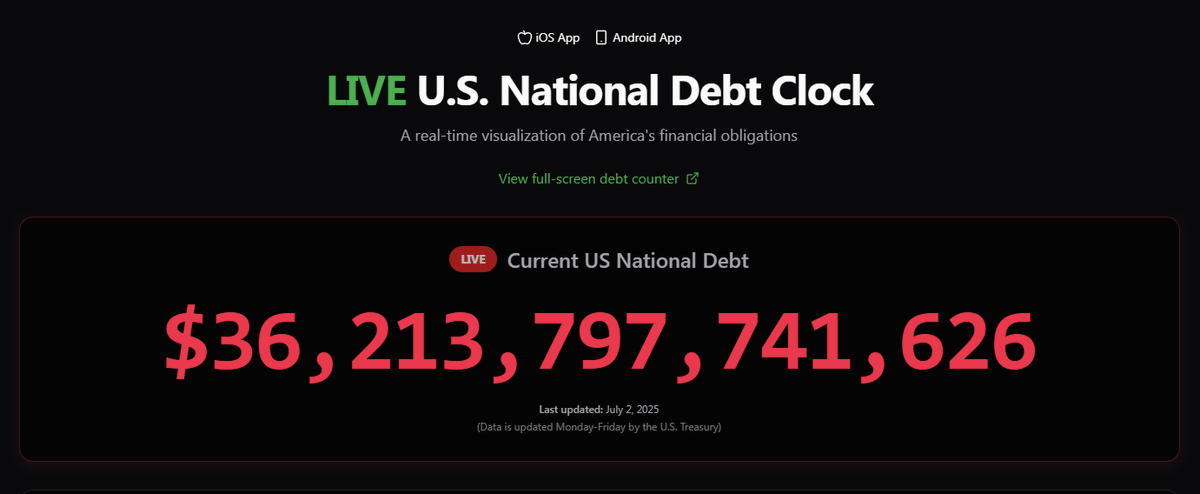

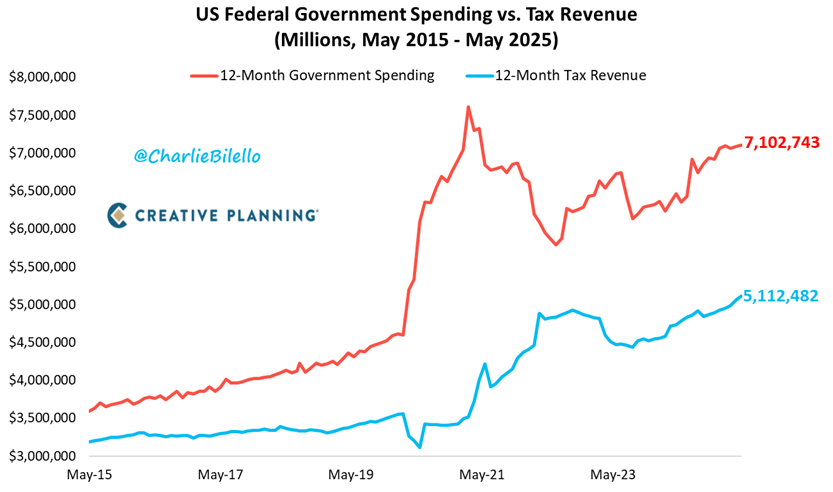

An increase of $3.3 trillion in national debt

$5.1 trillion in tax reductions

Elimination of spending limits across multiple areas

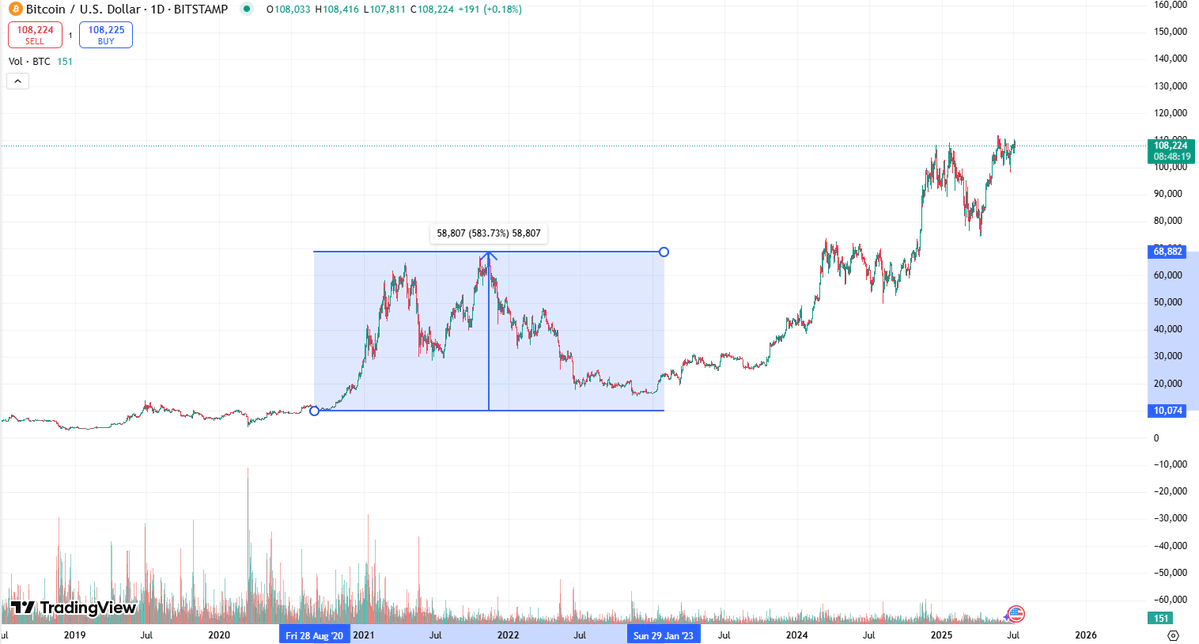

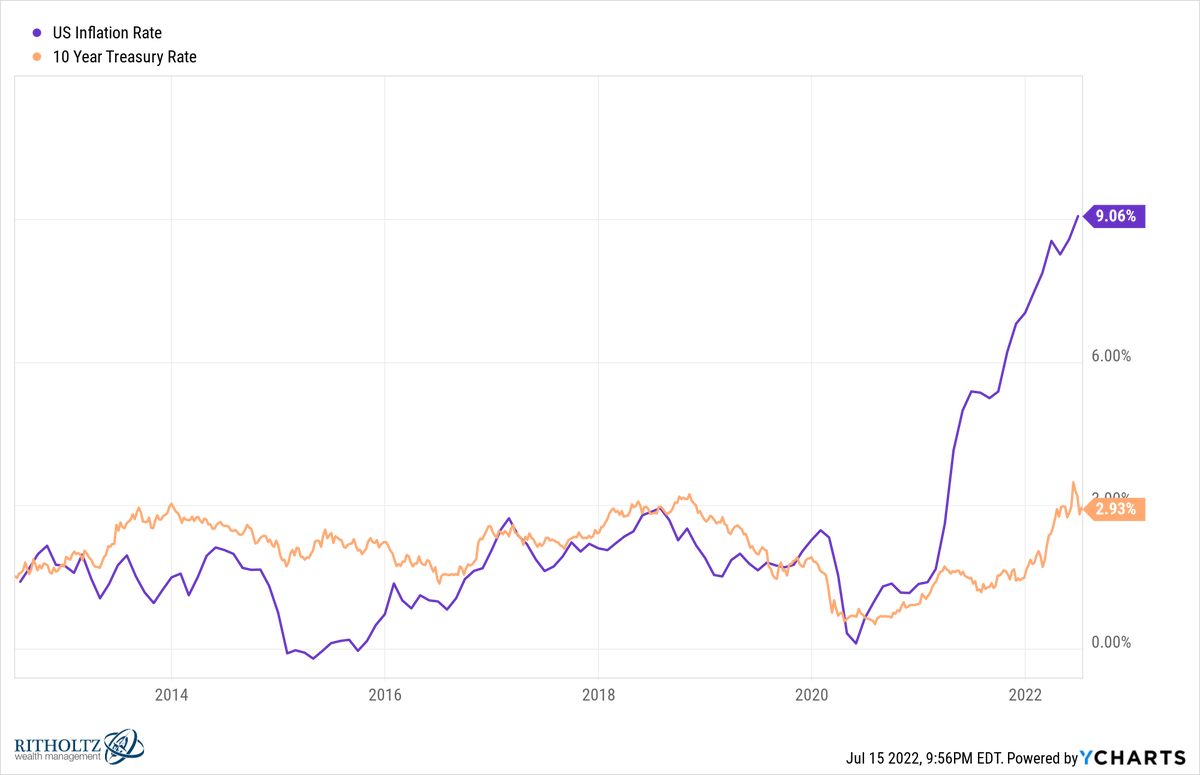

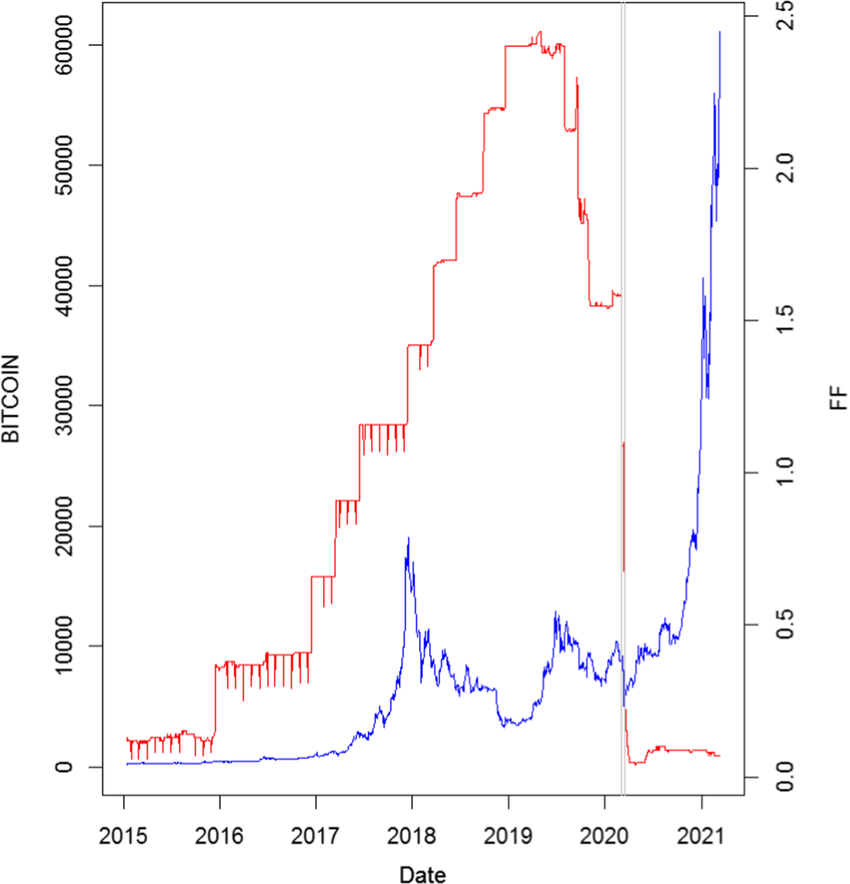

The same script we saw in 2021:

Government spending → budget deficit → increased bond issuance → Fed steps in → liquidity floods the system

This fuels a short-term market rally & investor euphoria

But inevitably, inflation rises, rates are hiked & deficits worsen

Growing budget deficit

Gov spends more than it earns → deficit

• To fill the gap, it sells more treasuries

• More spending = more demand = short-term economic boost

• Short-term bullish for $BTC, nothing long-term

Higher inflation leads to:

Deficit → more money → higher inflation

Fed responds by raising interest rates

But markets rally before inflation hits

Surging goverment spendings:

This is wildly positive for crypto markets

Why? It injects momentum into the economy, even if temporarily

More government contracts = more business activity = job creation

Bitcoin and the broader crypto space are set to thrive

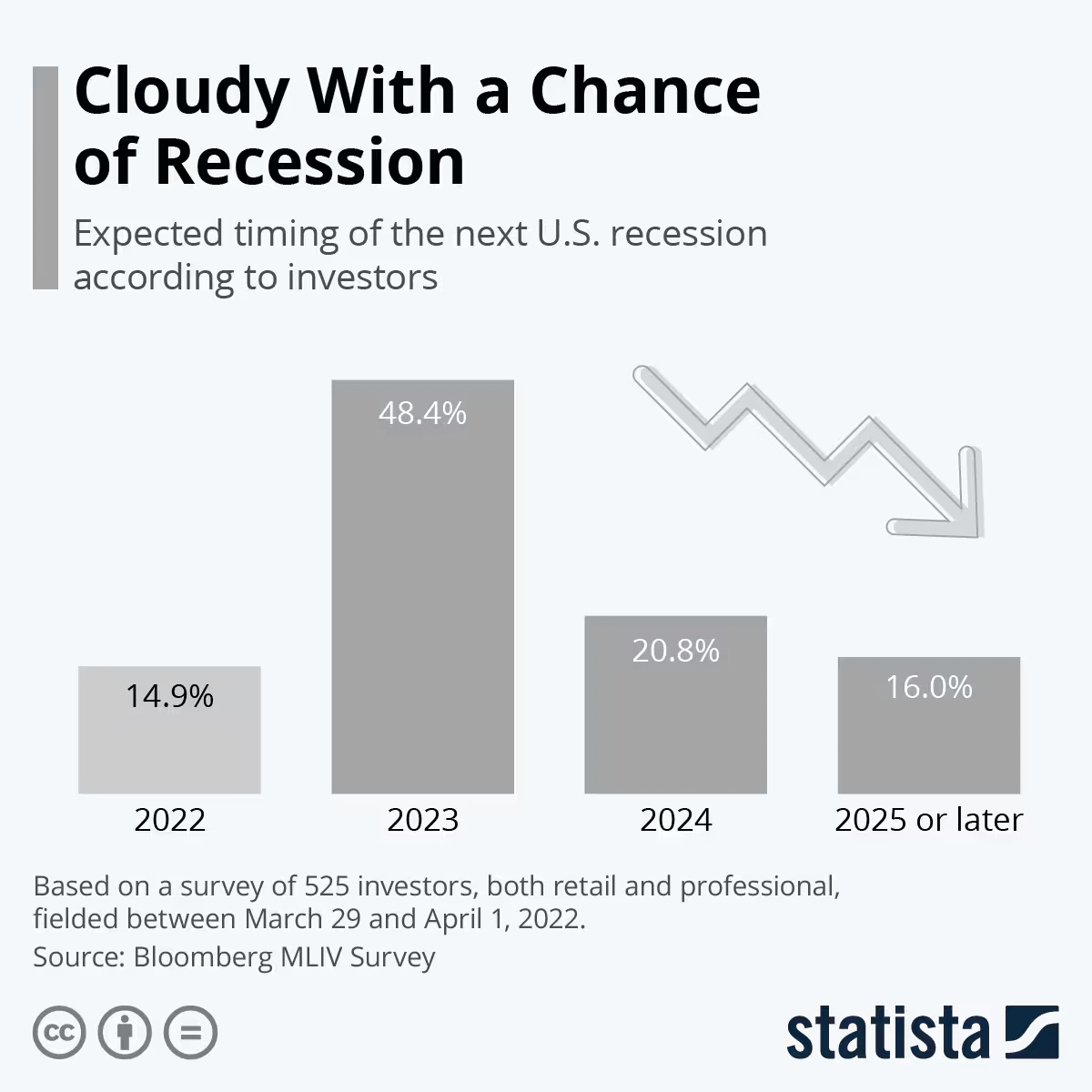

Diminished recession odds

Sure, the market looks bubbly, but this legislation meaningfully lowers the risk of a downturn

Increased cash flow boosts wages and fuels consumer demand

It’s a short-term win for Bitcoin and the broader crypto market

Ultimately, there are 2 possible outcomes:

In the short run, it’s a positive catalyst for $BTC

Over the long haul, the outlook turns negative

1) Short-term (1,5-2 years)

• Increased government spending boosts overall demand

• Accelerated GDP growth

• Reduced chance of recession

• Expansionary monetary policy

• Rising business confidence

• Job creation through new government contracts and infrastructure projects

Because of this, Bitcoin will probably hit new ATHs, and a global bull market will start

It will be similar to 2021, when they cut interest rates and pumped money into the markets

Now, they’re not printing money directly, but new money is still entering the economy

2) Long term (2-3 years)

• More national debt means bond yields will go up

• Businesses and people will face higher interest rates

• The government will spend more to pay interest on its debt

• Inflation could become bigger

• The economy might slow down under this pressure

In this period, expect a deep bear market

The Fed will probably raise rates again, which will be the turning point

Economic growth will slow a lot, causing people to pull money out of risky assets like $BTC, $ETH & $SOL

My plan hasn’t changed: hold for 6 more months, then exit

I’ll keep an eye on Trump’s next economic moves and adjust if needed

Stay strong, everyone - we’re on the edge of something big for $BTC

Here are 5 alts I expect will outperform $BTC during this cycle 👇

1/ @pudgypenguins - $PENGU

Pudgy Penguins NFT collection launched their token. Community-driven meme with massive brand recognition with billions impressions

Market cap: $983.6M

Price: $0.015

PENGU is a cultural item. When NFT communities unite behind tokens, magic happens

2/ @HyperliquidX - $HYPE

#1 no-kyc DEX with native token for trading. Built for professional traders demanding speed and low fees

Market cap: $13B

Price: $39

HYPE is what happens when you build a DEX that works better than CEXs

3/ @tao_net - $TAO

Decentralized AI network where machine intelligence meets blockchain. Miners rewarded for contributing computational power

Market cap: $2.8B

Price: $322

$TAO is Bitcoin mining for AI. As artificial intelligence explodes, holders control the infrastructure

4/ @Ripple - $XRP

Cross-border payment solution for banks. Enables fast, cheap international transfers without banking delays

Market cap: $130B

Price: $2.22

$XRP won the SEC battle and banks are taking notice. While crypto argues, Ripple moves trillions for institutions

5/ @OndoFinance - $ONDO

Real-world asset tokenization platform bringing traditional finance on-chain. Bridges TradFi and DeFi

Market cap: $2.45B

Price: $0.77

$ONDO is tokenizing the financial system. They bring REAL assets on-chain

32.11K

40

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.