💰 Part 2: Allora Fundraising - Tier 1 VC Extravaganza

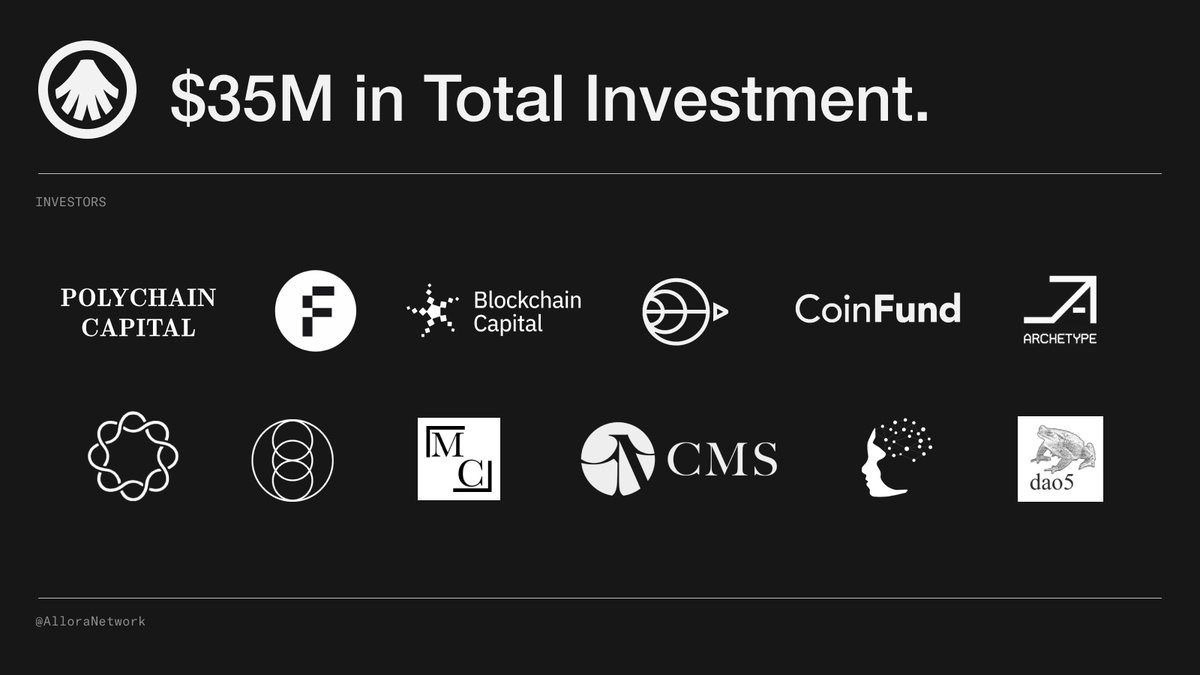

Part 2 of Allora Fundraising - Full of Tier 1 VCs! They have secured an investment of $35M. (For reference, today Sahara, which surpassed a FDV of $1.5B, received $50M. We can make some comparisons, right? 🤔)

The companies that received fundraising also have decent names. Just to highlight a few:

1. Polychain Capital (@polychaincap): A Tier 1 VC ranked 7th according to the VC ranking site Drobstab, showing a lot of interest in Bitcoin recently, and notable projects in the industry like Aeternity / Vera / IP / Movement / Babylon / Eigenlayer are definitely included.

2. Dao5 (@daofive): Was it since the end of last year? This VC started going viral in Korea as a somewhat problematic VC, and I heard their members are quite impressive. They also have some interest in Bitcoin, and there are many overlapping portfolios with Polychain. Additionally, they have a lot of investments in VeraChain dApps and DeFi portfolios.

3. Blockchain Capital (@blockchaincap): Similarly, a veteran in the Tier 1 market. These guys invest a lot in projects that don’t necessarily issue tokens and also invest heavily in infrastructure, and they seem to have a strong interest in cross-chain projects.

4. Delphi Digital (@Delphi_Digital): Also a Tier 1 according to Drobstab, with a higher investment ratio in AI and node-related projects compared to other VCs, such as Grass / 0G / Nucleus. They are also well invested in significant projects like Inicia, Eclipse, Cetria, and Aeternity.

In addition, there are many decent VCs like Framework Ventures, Mechanism Capital, and CMS that have come in, but what exactly about Allora captivated them? Next, we will explore the attractive points of Allora!

In conclusion: The mission of @AlloraNetwork is to create an abstraction layer for global machine intelligence to transform intelligence into digital products. It aims to enable widespread access to AI for people while respecting the contributions of everyone with useful data or algorithms.

Show original

503

6

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.