The Bitcoin Halving: A Testament to the Resilience of Cryptocurrency

A message from OKX Chief Commercial Officer Lennix Lai. Opinions are that of the author and do not reflect OKX's official view. Not financial advice.

The halving is a significant event that underscores the technological strength and resiliency of Bitcoin. As a fundamental feature of Bitcoin's design, the halving mechanism means that the block reward will be cut in half, slowing the introduction of the remaining coins that can be mined and released into the market. The big picture is this: out of the maximum supply of 21 million, about 1.35 million bitcoin are left to be mined between now and the final halving in the year 2140.

Notably, this halving is set against the backdrop of a rapidly evolving market landscape. Since the previous halving event, we've seen significant developments including an influx of institutional investors, the development of more advanced trading infrastructure, and a growing mainstream acceptance of cryptocurrencies. These factors have collectively worked towards creating an optimistic environment for Bitcoin, and its price has appreciated significantly in recent months.

In theory, a reduction in the supply of new bitcoin should create a bullish sentiment in the market. Taking stock of the market landscape today, however, I think that it's likely that the halving has been priced-in for a few months. The BTC funding rate at OKX has flattened over the past week, implying that traders' sentiment has softened from bullish to more normalized expectations. The funding rate for altcoins has also recently trended negative, implying leveraged longs has been downsized or liquidated. Crypto traders appear to be reducing their risk exposure in light of geopolitical uncertainty and revised expectations on rate cuts from central banks. Short term volatility is likely.

Zooming out, though, events such as the halving, increased investor understanding of the asset through media coverage, and the introduction of ETFs and other mainstream crypto events have made Bitcoin's scarcity more apparent to investors. This understanding has been further facilitated by notable financial institutions like BlackRock, Fidelity and ARK Invest, which have provided easy access to Bitcoin, leading to substantial inflows over time.

Despite the potential short-term fluctuations, the Bitcoin halving serves as a reminder of the cryptocurrency's resilience. The halving mechanism, hard-coded into Bitcoin's protocol, ensures a predictable and transparent supply schedule, setting it apart from traditional fiat currencies.

As the crypto industry continues to mature, the significance of the Bitcoin halving extends beyond its immediate impact on price. It represents a testament to the robustness of the cryptocurrency's economic model and its ability to withstand the test of time.

While the halving may not be the sole driver of Bitcoin's price in the short term, it remains a crucial component of the cryptocurrency's long-term value proposition. As the industry continues to innovate and adapt, the Bitcoin halving will serve as a benchmark for the resilience and staying power of cryptocurrencies.

As we approach the 2024 halving, it is essential to view the event in the context of the broader cryptocurrency landscape. It is evident that regulators in many countries are beginning to develop frameworks for user protection and crypto technology access, which are key elements for the growth of regional crypto hubs. As regulations advance, Bitcoin and other cryptocurrencies' utility and adoption will continue to grow and accelerate, pointing to a bright future for the sector.

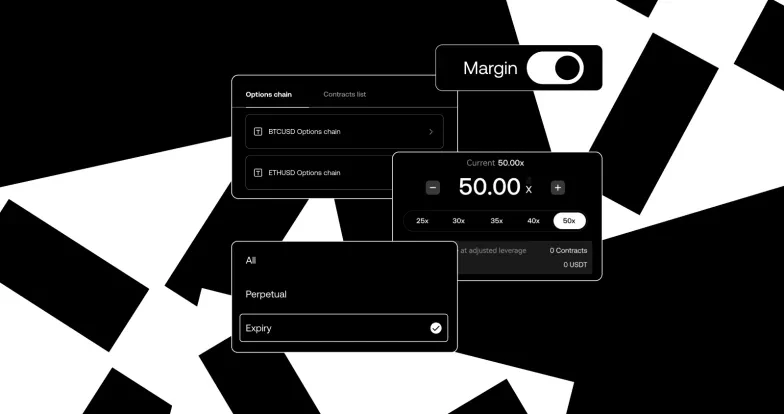

At OKX, our focus is on building useful products and infrastructure that will stand the test of time, rather than reacting to temporary market shifts. By focusing on the underlying technology, the growing adoption, and the increasing maturity of the market, we can appreciate the significance of the halving as a testament to the enduring nature of Bitcoin and the crypto industry as a whole.

Lennix Lai

OKX Global Chief Commercial Officer